Posthaste: Unconscious spending habits eating into Canadians' wallets

Good morning!

Many Canadians are struggling to curb their unconscious spending habits amid the rising cost of living, according to a new consumer survey by FP Canada.

More than half of the 1,502 Canadians surveyed in October are concerned about their current financial situation, but most of them have not changed their unconscious spending habits compared to six months ago.

“With the rising cost of living, Canadians’ dollars simply aren’t going as far as they once did,” Tashia Batstone, chief executive of FP Canada, said in a press release. “Now more than ever, it’s critical for Canadians to be mindful of their spending habits.”

Inflation is currently running three times faster than the Bank of Canada‘s two-per-cent target, with the consumer price index increasing 6.9 per cent in October from a year earlier, matching September’s year-over-year gain.

Yet rather than spending money intentionally based on budgets or long-term financial plans, many purchases continue to be made because of convenience or habit. This includes using a credit card to make payments, picking up additional items at checkout, buying more than intended during sales and/or purchasing items through “buy now, pay later” plans.

Some types of unconscious spending have even increased over the past six months, such as using a credit card (28 per cent more frequently versus 13 per cent less frequently), charging monthly subscriptions directly to credit cards (21 per cent more frequently versus 14 per cent less frequently) and adding additional items to get perks such as free shipping (25 per cent more frequently versus 14 per cent less frequently).

Mindful spending tips from experts include using cash instead of credit or debit cards when going out for entertainment as well as putting any extra money in a jar to make the savings feel concrete.

Another way to regain control over your unconscious spending is to open a separate savings account, linked to your debit card, specifically for non-essential spending. Using a different financial institution for this account can also minimize the temptation to pay using others accounts.

But experts say the crucial first step is to create a budget to regularly track where your money is going.

“Clear budgets help us better identify what benefit we receive from our spending habits, whether emotional or practical, and can make an impact in navigating tough times,” Sucheta Rajagopal, a CFP professional at Research Capital Corp., said in the release.

A separate study by PayPal Canada, which polled 2,000 Canadians in October, found that more than half of Canadians are feeling anxious that the holidays will not be as good this year because of the cost-of-living crisis.

Sixty-six per cent reported feeling financial pressures in this year’s holiday snapshot survey. But a majority of them said they would be too embarrassed to ask for financial help with splitting the cost of celebrations.

“Sharing the load and splitting costs with friends and family can be a difficult conversation, especially for Canadians who want to be thoughtful about others and their financial situation,” Malini Mitra, communications director at PayPal Canada, said in a press release.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

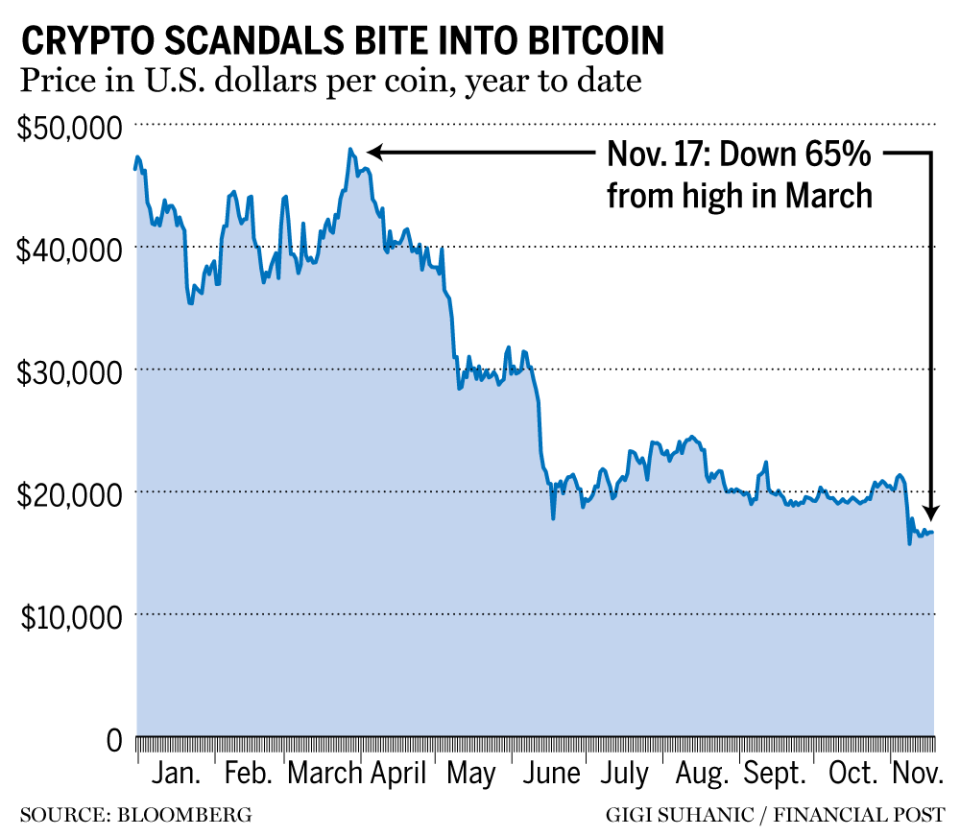

The full extent of the fallout on the crypto industry from the collapse of Sam Bankman-Fried’s FTX is yet to come out, Coinbase Global Inc. chief financial officer Alesia Haas told the Wall Street Journal on Wednesday. “What we are seeing now is a fallout of FTX is becoming much more like the 2008 financial crisis where it’s exposing poor credit practices and is exposing poor risk management,” Haas said. It will take a few days or weeks to understand the full contagion of the event, Haas added. But, the fallout could have been worse in Canada. The Financial Post’s Barbara Shecter explains how regulation slowed FTX’s growth and limited the toll of its collapse in Canada.

___________________________________________________

The 2022 Halifax International Security Forum is being held from Nov. 18-20

National Defence Minister Anita Anand will make a defence announcement. She will be joined by: Sean Fraser, minister of immigration, refugees and citizenship; Admiral Rob Bauer, chair of the military committee of NATO; Gen. Wayne Eyre, chief of the defence staff; and Andy Fillmore, Liberal MP for Halifax

Jean-Yves Duclos, minister of health and Liberal MP for Quebec, will make an announcement about funding for infrastructure projects to support the Quebec City Jean Lesage International Airport. Marc-Andre Bedard, vice president of business development and technology of the airport, will also be present

The parliamentary budget officer will post a report entitled “Supplementary Estimates (B) 2022-23” on the website at pbo-dpb.ca. This report presents a detailed analysis of the Government’s second supplementary estimates for the 2022-23 fiscal year, which outlines $25.8 billion in new spending

Marilyn Gladu, conservative shadow minister for civil liberties, joined by members of the NDP and Bloc Quebecois, will hold a press conference to discuss the Liberal government’s rejection of an amendment to prioritize workers’ severance in the case of bankruptcy

The standing committee on citizenship and immigration meet regarding conditions faced by asylum-seekers. Sean Fraser, minister of immigration, refugees and citizenship, will appear

The standing committee on Canadian heritage meets about Bill C-18, An Act respecting online communications platforms that make news content available to persons in Canada. A clause-by-clause consideration

Dan Vandal, Liberal MP for Saint Boniface — Saint Vital, and minister of Northern Affairs, PrairiesCan, and CanNor will announce federal funding for innovation and economic growth in Manitoba

The Calgary Chamber will host Premier Danielle Smith for her inaugural keynote address to the Calgary business community, during which she will outline her government’s vision for a strong and prosperous economy in Alberta

Prime Minister Justin Trudeau will participate in the APEC Leaders’ dialogue in Bangkok

Environment and Climate Change Minister Steven Guilbeault will hold a media availability to conclude his participation at COP27

Prime Minister Justin Trudeau will depart for Djerba, Tunisia where he will attend the Summit of la Francophonie

Today’s data: Canadian industrial products and raw materials price indices, international securities transactions, monthly credit aggregates; U.S. existing home sales, quarterly services survey, leading indicators

Earnings: Foot Locker Inc., Strikewell Energy Corp.

___________________________________________________

_______________________________________________________

Freedom would be less competitive after Rogers-Shaw merger, expert tells tribunal

Five investing lessons so you can be prepared for the next market event

Come from away: Ukrainian refugees help Newfoundland and Labrador companies soar

FP Answers: How do I use stock losses to lower my income taxes?

GM says deal to source nickel from Vale’s Quebec plant will help trigger U.S. tax credits

Backed by Airbus and Air Canada, company says it’s closer to pulling carbon from the sky

BMO debuts new technology funds that will be managed by Cathie Wood’s ARK

Lightspeed is ‘spending a fortune on hiring’ as tech sector cuts thousands

____________________________________________________

If you’ve ever been enticed by the siren call of day trading, you’re not alone — interest in this risky type of trading skyrocketed during the first year of the pandemic. Shay Huang first dipped her toes in trading in 2014. Now it’s her full-time job and she teaches others her methods under the name of The Humbled Trader. If you’re hoping to follow in Huang’s footsteps as a successful day trader, head over to our content partner MoneyWise to find out what you need to know.

____________________________________________________

Today’s Posthaste was written by Noella Ovid, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Yahoo Finance

Yahoo Finance