Posthaste: These two cities are now the top-searched spots for real estate in Canada

Good morning,

When the housing market gets tough, homebuyers go west.

In new evidence that Alberta hosts some of the hottest real estate in the country, Royal LePage says Edmonton and Calgary are now the top-searched cities for home hunters in Canada.

Since the start of the pandemic, sky-high prices for Ontario properties and an increased ability to work remotely have sent a surge of home seekers to the province, said the national real estate company.

In 2020, Alberta’s capital and its largest city were in the top 20 of searches. By 2021, they were in the top 10. In the first six months of this year, Edmonton was the most searched city in Canada, followed by Calgary.

In the past it has always been the big cities in southern Ontario that dominated searches, said Royal LePage.

The proportion of searches on the Royal LePage website for properties in Edmonton have quadrupled since before the pandemic. Between January and June of 2023, unique searches for homes in Edmonton reached 2 per cent of total searches, compared with 0.5 per cent in 2019.

Searches for Calgary homes made up 1.9 per cent, more than double the percentage during the same period in 2019.

“Canadians are grappling with expensive home prices in a high-cost borrowing environment. These challenges are tempting homebuyers to migrate to communities where housing is more affordable,” said Tom Shearer, owner of Royal LePage Noralta Real Estate in Edmonton.

Cheaper real estate is part of the appeal. According to Royal LePage the aggregate price of a home in Edmonton was $434,400 in the second quarter of 2023, and $643,200 in Calgary, compared to a national aggregate price of $809,200.

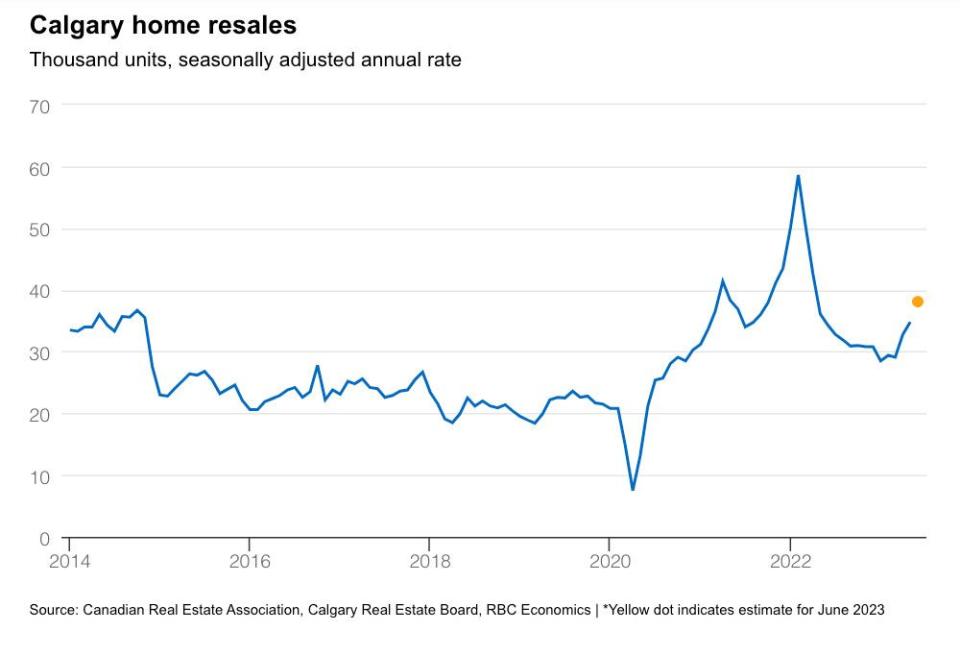

Prices, however, are rising. In June the average selling price of a home in Calgary was up almost 7 per cent from the year before, according to the Calgary Real Estate Board.

The city also set a record for home sales in June, up 11 per cent from the year before, with apartment sales up 48 per cent. The numbers for July come out today.

This bucks the national trend, where home sales have began to ease or even decline because of higher borrowing costs.

It has also ramped up competition.

Calgary real estate agent Matt Halladay told The Canadian Press that some homes are selling the same day they are listed, and sometimes sight unseen.

“It’s common to see anywhere from four to 17 offers (on one listing),” Halladay said.

“The most I’ve heard of, on one that we lost out on, was 26 offers.”

Significantly more homes have came up for sale in Calgary in recent months, said RBC assistant-chief economist Robert Hogue, but the increase in supply has still come up short, “leaving the market heavily tilted in favour of sellers.”

“Calgary’s impressive population growth and relatively affordable position (compared to other major Canadian cities) will likely keep this trend going over the back half of the year,” he said.

__________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

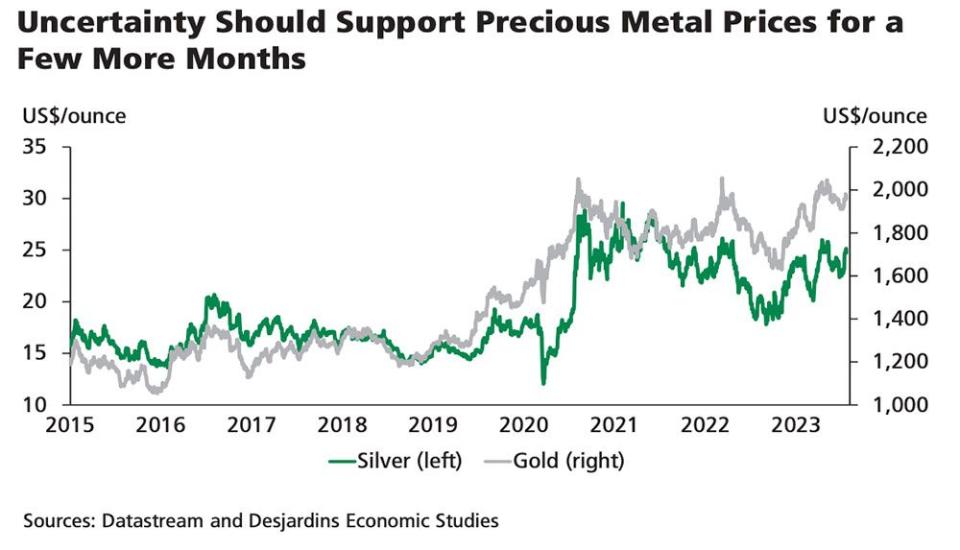

Gold has rallied about 15 per cent over the past 12 months and still has room to run, say analysts. Desjardins says economic and financial uncertainty should keep up the momentum for a few more quarters and JPMorgan Chase & Co. predicts gold will hit fresh records in late 2024 when the Federal Reserve starts to cut interest rates.

The bank has a price target of US$2,175 an ounce for bullion in the final quarter of 2024, which is about US$100 above the current record set in 2020.

“We’re in a very prime place where we think gold ownership and long allocation to gold and silver is something that acts as both a late cycle diversifier and something that will perform as we look to the next sort of 12, 18 months,” said Greg Shearer, JPMorgan’s executive director of global commodities research.

Today’s Data: Canadian auto sales

Earnings: First Capital, EQB, RioCan REIT, Dream Industrial REIT, Caterpillar, Pfizer, George Weston, Uber, Starbucks

_______________________________________________________

Sovereign debt defaults soar as governments feel pinch of higher rates, data show

David Rosenberg: My recession call has the haters out in force, but I’ve been here before

Manitoba aims to be Canada’s lithium hub with new critical minerals strategy

Like driving a car, your portfolio needs regular tune-ups to remain on course

Like your car, your investment portfolio needs to perform at its best to get you to your destination, especially when accelerating through those turns in the market. This means undertaking regular portfolio maintenance with reviews and adjustments to ensure it remains on track to meet your financial goals.

To help get you started, investing pro Martin Pelletier has three things you can do to ensure your portfolio runs smoothly. Find out more

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance