Posthaste: Three things to watch as the world teeters on the edge of a banking crisis

Good Morning,

Banking turmoil that started with the collapse of Silicon Valley Bank just over a week ago has now spread to the rescue of a major European bank and a joint operation by the world’s central banks that brings back uncomfortable memories of the great financial crisis.

Over the weekend, Swiss regulators engineered a rescue deal in which UBS Group AG will pay US$3.23 billion for its troubled rival Credit Suisse Group AG and assume up to US$5.4 billion in losses. The Federal Reserve, the Bank of Canada and four other central banks also announced a joint action to boost liquidity in the global financial system. It was all done to stem a crisis of confidence threatening to spread across financial markets.

But relief over these measures appears to have been short-lived. Banks stocks plunged today, with Credit Suisse falling 62 per cent in pre-market trade; UBS lost 7.1 per cent. This followed a day of heavy selling in Asian markets.

“It should be clear that after more than a week into the banking panic, and two interventions organized by the authorities, this problem is not going away. Quite the contrary, it has gone global,” Mike O’Rourke, chief market strategist, Jones Trading, told Reuters.

Whether this develops into a global financial crisis depends on the answers to three questions, wrote Neil Shearing, Capital Economics chief economist this morning.

Have policymakers done enough?

How markets interpret the forced takeover of Credit Suisse by its Swiss rival UBS will be key. On the surface it looks like the best way to end doubts about the bank’s viability, said Shearing, but …

There’s that fire-sale price. The US$3.23 billion UBS is paying is only about 13 per cent of Credit Suisse’s market value at the start of the year, suggesting that a large part of the bank’s US$570 billion assets are either impaired or perceived to be impaired, writes Shearing. “This could set in train renewed jitters about the health of banks.”

The reported decision to write off the subordinated “Additional Tier 1” bonds could also dent confidence in that asset class, especially if other institutions get into trouble, he said.

“Only time will tell how this shotgun wedding is received,” said Shearing.

On the pro side, the global banking system remains well capitalized, he said. New tools are in place to provide liquidity, such as the currency swap lines between central banks that the Federal Bank, Bank of Canada and other central banks bolstered yesterday.

“A full-blown repeat of the Global Financial Crisis of 2007-08 therefore looks unlikely,” said Shearing.

However, “containing crises is a bit like a game of whack-a-mole – with new fires starting as existing ones are extinguished. A key issue over the next week will be whether problems arise in other institutions or parts of the financial system.”

Where do the dangers lie?

There are three areas to watch, says Shearing. First, more financial institutions could struggle with unrealized losses, which totalled US$620 billion for all U.S. banks and financial institutions at the end of 2022, according to the U.S. Federal Deposit Insurance Corporation.

If the institutions failed to hedge this risk a loss in confidence and run on deposits could force more of them to dump assets and realize losses.

Capital believes the U.S. banking system is in good enough shape that unrealized losses on bond portfolios won’t spark a system-wide crisis. Moreover, if an institution does need to raise cash, it should be able to use Fed facilities to do so.

Still if more smaller banks go the way of SVB it will add to market anxiety and possibly trigger another market sell-off.

Second, banks could get in trouble for other reasons.

“While it’s tempting to dismiss the problems at SVB, Signature Bank and Credit Suisse as idiosyncratic, they have revealed that problems are lurking in the financial system as interest rates rise,” Shearing said, adding that smaller European banks and shadow banks could be vulnerable.

Lastly, though many of the recent problems relate to bad management of interest rate risks, a more serious crisis could emerge if you add credit risk to the mix. Banks are likely to tighten lending conditions after the events of the past week, which could develop into a “vicious circle” in which tighter credit leads to a slower economy which leads to rising defaults. Shearing says economies with overvalued housing markets face the biggest threat of this (Canada take note).

What does it mean for monetary policy?

While there’s been speculation that the Fed will pause rate hikes this week in light of the banking turmoil, Capital expects it and the Bank of England to stay the course and raise rates.

The Bank of England’s response to the pension scheme crisis last fall — when the central bank curbed financial strains by providing liquidity at the same time as raising rates to battle inflation — could be a template for any trouble to come, said Shearing.

The European Central Bank followed suit last week by raising its rate 50 basis points as planned while committing to be the lender of last resort.

“But this is a perilously difficult path for central banks to tread,” said Shearing.

What will be key in the days ahead will be how much these crises cause banks to reduce credit availability. While Capital economists think we’ll avoid the vicious circle, they also believe that interest rates will likely end up lower than the markets thought a few weeks ago.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

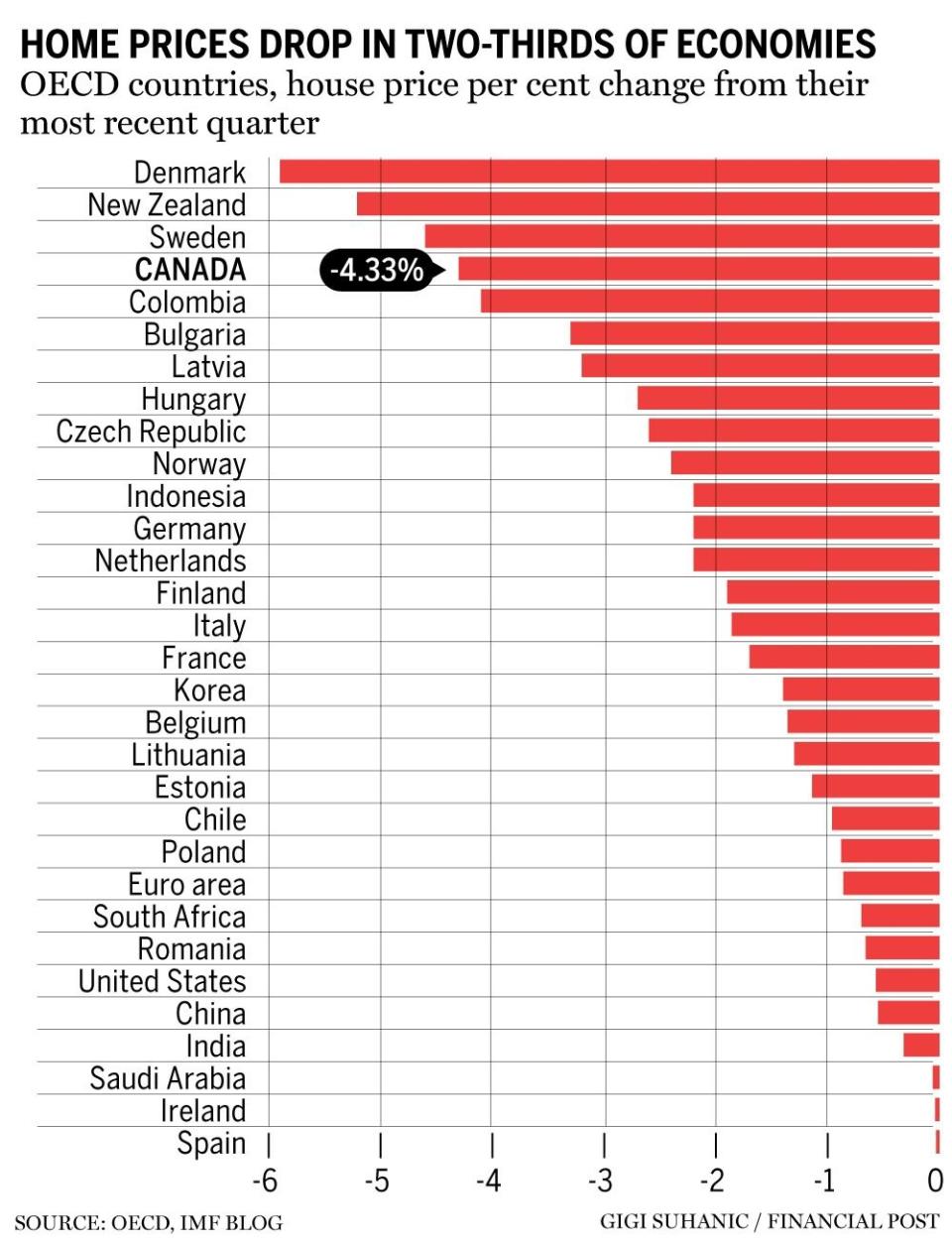

Just in case you wondered how our housing correction was stacking up against other countries’, the International Monetary Fund brings us their chart of the week. Note that Canada has suffered the fourth largest decline in the most recent quarter of data.

The IMF says the moves underscore the impact of rising interest rates on housing markets and estimates that for every one percentage point increase in real interest rates, home price growth slows by about two percentage points.

Canada’s housing downturn is historic, data out March 17 confirmed. The cumulative decline in prices since the peak in May 2022 hit a record 11.2 per cent in February on the Teranet-National Bank House Price Index. That’s an even bigger decline than the 9.2 per cent loss in the 2008 financial crisis, the business benchmark of everything bad.

Nordstrom Canada is expected to seek approval of a liquidation sale in court today as it prepares to close its 13 locations by late June. The retailer says customers can expect to find discounted items on its racks the day after approval is received.

Background: Nordstrom joins the exodus of U.S. retailers from Canada: What you need to know

Earnings: Foot Locker, Resolute Forest Products

___________________________________________________

_______________________________________________________

Central banks scramble to calm markets as UBS saves Credit Suisse from collapse

Silicon Valley Bank shook up Canadian tech lending. Will the big banks fill the void?

Canada’s carbon capture subsidies already on par with U.S., think tanks say

Howard Levitt: Ontario’s latest labour law update gives remote and hybrid workers their due

The you-only-live-once mindset that is causing some significant and persistent inflationary pressures has lasted well past its expiry date, but it’s still here and posing problems for investors. Portfolio manager Martin Pelletier says we should examine how much of our portfolio’s performance depends on interest rates falling back down again and adjust accordingly.

Centre yourself as interest rates stay sticky

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance