Posthaste: If you think you're worse off than before the pandemic you're probably right

Canada has a productivity problem.

This isn’t news, points out BMO chief economist Douglas Porter. Canada has lagged the United States for decades, but in recent years this underperformance has reached the point where productivity in this country is actually declining — and it’s dragging real GDP per capita down with it.

This is not just some obscure statistic.

“GDP per hour worked is the very fundamental building block of living standards, said Porter in a recent report. “Thus, the recent fall in productivity is stark evidence that Canadians on average are worse off than prior to the pandemic — it’s not just perception.”

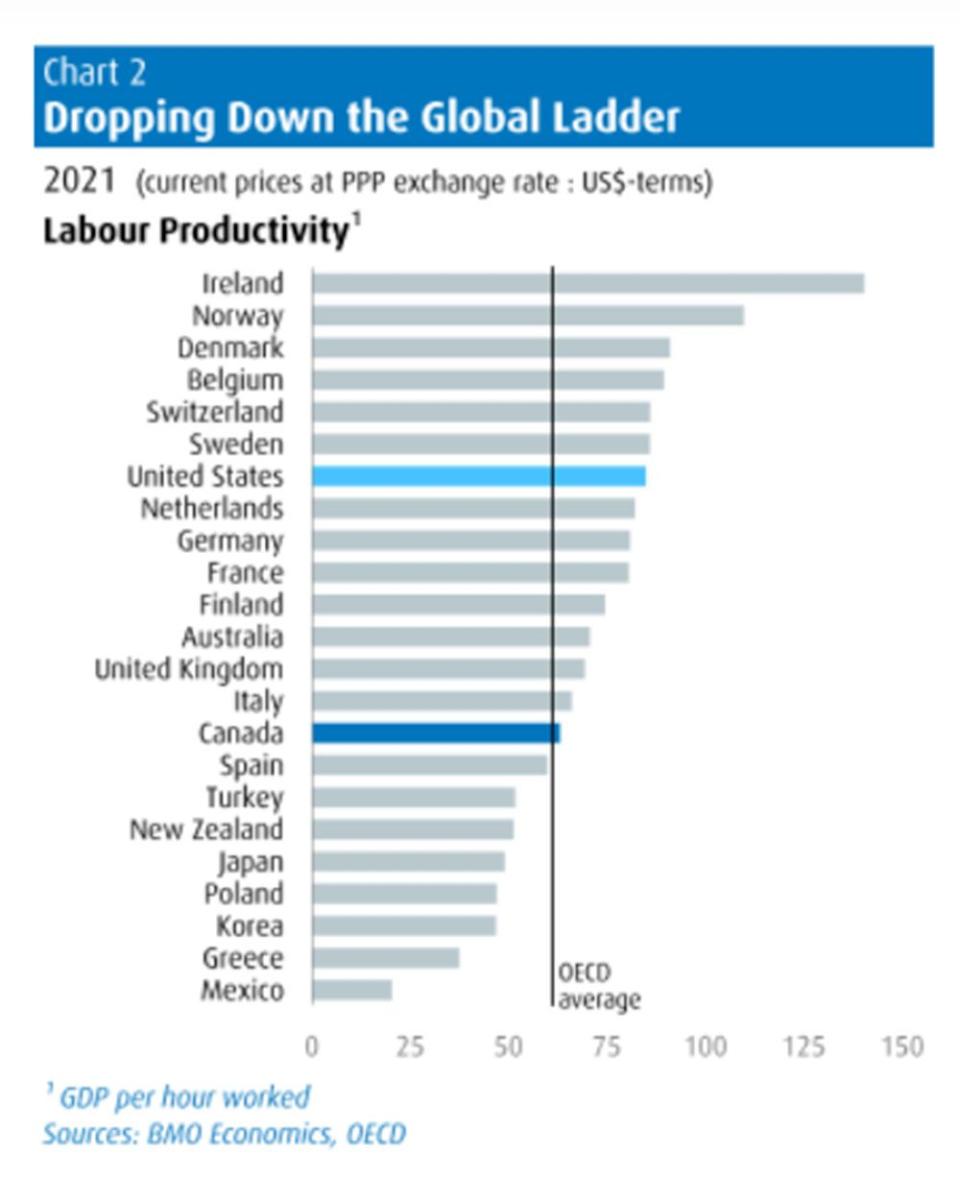

Canada has fallen below, not only the United States, but also most of Western Europe and Australia on the Organisation for Economic Co-operation and Development ranking for productivity. And OECD data only go up until 2021, said Porter. Canadian productivity has fallen since then.

“The sustained decline in recent years is without precedent in the post-war era,” he said.

Over the past five years, productivity in Canada’s business sector has fallen 0.3 per cent, while it has grown 1.7 per cent in the U.S.

This divergence has slowed real GDP growth despite a fairly robust job market. GDP per capita has actually dropped and is now no higher than it was in 2017.

There are some short-term reasons for this. Higher interest rates, the population surge, and lingering effects of the pandemic have all made productivity more challenging, said Porter.

Then there are the perennial problems. Canada’s vast size and harsh winters make transportation of goods difficult and businesses, markets and the tech sector are all smaller here than in the United States.

The resource sector looms large in Canada, and “windfalls from resources can lead to a lack of urgency in other sectors,” said Porter. For example, manufacturing in this country has dropped from 16 per cent of GDP in 2000 to less than 10 per cent now.

Still Australia has these issues too, but its output per hour is more than 10 per cent higher than Canada’s. Norway, another resource-rich country, is second highest in productivity on the OECD scale.

Other causes cited over the years include a lack of competition and risk-taking, the relatively large public sector, low business investment and interprovincial barriers to trade, said BMO’s report.

There is also Canadians’ fixation on housing, leading to an “over-emphasis on residential construction.”

Policy makers have been struggling with Canada’s productivity problem for at least 40 years, and there is no easy solution, Porter said.

But he does offer some suggestions. An inefficient tax system, with relatively high marginal tax rates, is one drag on productivity that could be examined. When marginal tax rates were substantially reduced in 2000 a period of solid productivity growth followed, he said.

“It’s no silver bullet,” but a broader re-examination of the tax system is overdue, he said.

Policy could also be reworked. The focus in recent years has been on dividing up resources rather than expanding them, and supporting short-term consumption rather than long-term investment, said Porter.

“Finally, rather than force-feeding capital spending through heavy-duty subsidies, policymakers should address a fundamental question: Why are businesses so reluctant to invest in Canada?,” he said.

_____________________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

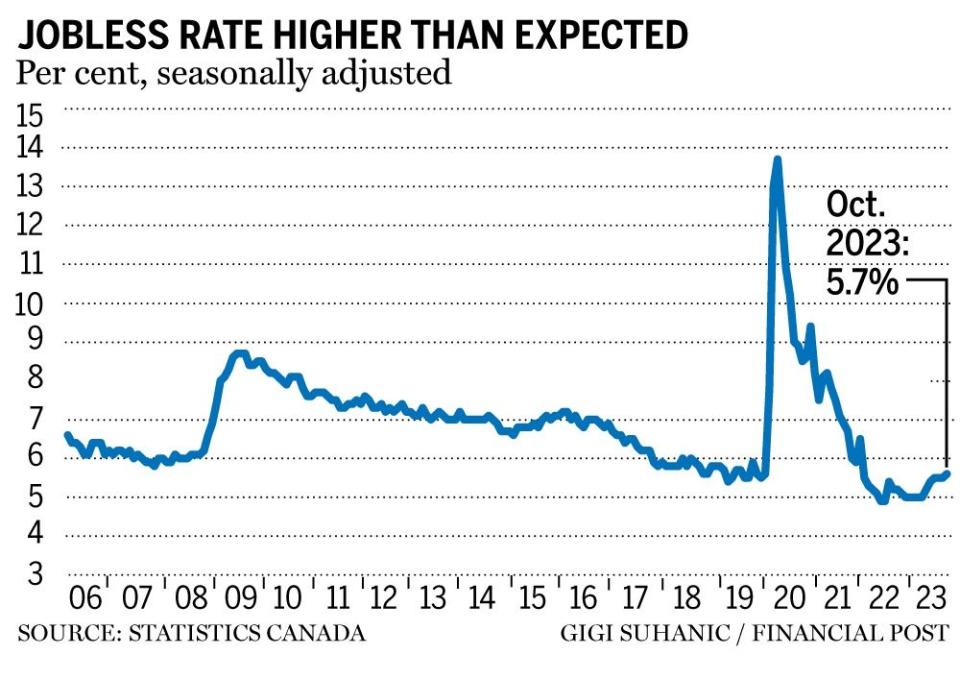

Canada’s unemployment rate rose to 5.7 per cent and the economy gained fewer jobs than expected, Statistics Canada’s Labour Force Survey showed Friday.

Over the past six months the jobless rate has risen 0.7 per cent from 5 per cent in April.

“The rate itself is still low, but an increase of that magnitude over that period is relatively rare historically (it has happened 6 times prior to this year dating back to the 1980s by our count, and four of those times were during a recession),” said Nathan Janzen, assistant chief economist at RBC Economics.

The Canadian Telecom Summit begins in Toronto. Leading executives from across the industry will meet to discuss collaboration and digital innovation.

Bank of Canada releases its Market Participants Survey

Today’s Data: Global Supply Chain Pressure Index

Earnings: Ivanhoe Mines, Brookfield Asset Management, Finning International, MEG Energy, Element Fleet Management

Get all today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

_______________________________________________________

Barrick CEO questions worth of Teck Resource’s key copper project as costs mount

Showdown brews between cafés, remote workers as owners say coffee shops aren’t offices

Canadians reported a collective loss of more than $283 million due to scams in the first half of 2023, with modern fraudsters using artificial intelligence and machine learning to deceive unsuspecting individuals. Portfolio manager and investment adviser Andy Zylstra offers some tips on how to spot and report scams.

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance