Posthaste: 90% of small businesses have yet to repay COVID loans as deadline looms

Mental health issues, working significantly more than the average employee and ongoing money troubles: Canada’s entrepreneurs are suffering from all of these things, and there’s no sign of the pressure letting up, according to a number of surveys.

The latest one, released May 10 by the Canadian Federation of Independent Business (CFIB), said that almost three-quarters of small business owners want an extension to the deadline to repay federal COVID-19 era loans, as the trials associated with the pandemic have turned into a difficult period of high inflation, labour shortages and slowing growth.

The CFIB found that 72 per cent of the 5,996 members it surveyed wanted the repayment deadline for the Canada Emergency Business Account (CEBA) extended, with 30 per cent seeking a deferral of one year and 42 per cent calling for two years.

Seventy-eight per cent of respondents said their business would stand a better chance of surviving if they had more time to repay their COVID loans.

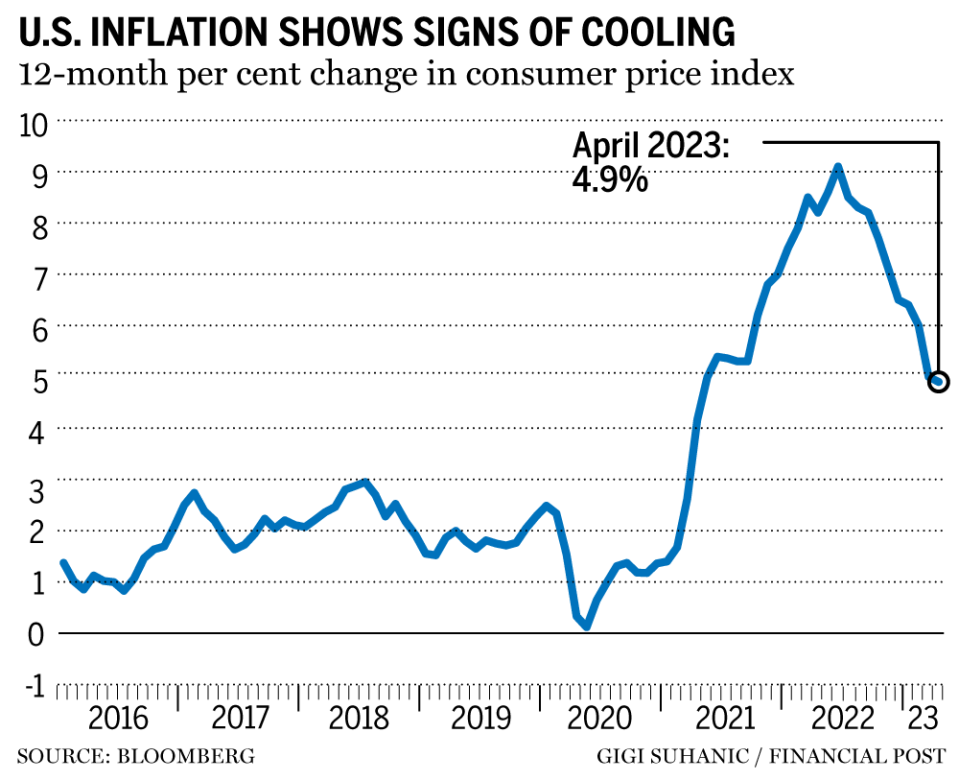

“Many small businesses are trying to repay their COVID-related debt, while facing an onslaught of additional challenges,” said Dan Kelly, CFIB president. “High interest rates, inflation and labour costs are all making it hard for small businesses to keep their head above water, let alone make any dent in the debt they were forced to take on to survive pandemic restrictions.”

Ten per cent of CFIB respondents said they had repaid their CEBA loans as of March, when the survey was conducted, and an additional 47 per cent said they expected to repay the government by the December 2023 deadline.

Of those who said they will repay, a significant majority were doing so in order to claim the forgivable portion of the loan. Nonetheless, they “will be really struggling,” the CFIB said in an email.

The CEBA program was started by Ottawa to help small businesses that lost revenue due to pandemic closures. The maximum amount available under CEBA was $60,000, and up to 20 per cent will be forgiven if repaid on time. After the deadline, interest of five per cent will accrue on the unpaid CEBA amount.

Ottawa already extended the deadline once, moving it to Dec. 31, 2023 from Dec. 31, 2022.

CEBA isn’t the only loan small businesses accessed during the pandemic.

“Our research shows 58 per cent of small businesses are still carrying pandemic debt, at an average of $105,000,” the CFIB said. “In our survey question, pandemic debt includes provincial and/or federal government loans (such as CEBA or HASCAP — another federal loan program), credit cards, lines of credit, and private borrowing/debt.”

Entrepreneurs are often described as the backbone of the Canadian economy because smaller businesses — those with one to 99 workers — account for 68 per cent of employment in the private sector.

Finances aren’t the only area of struggle for entrepreneurs.

The Business Development Bank of Canada (BDC) said this week that it is readying a therapy program for its clients after it uncovered that half of entrepreneurs are experiencing mental health challenges.

Forty-five cent of business owners told BDC that they “had felt mental health challenges/needs,” and 48 per cent said they “felt depressed and less accomplished” than they would have liked in the past two weeks.

“We were really hoping this year that the situation would have improved because last year it was already quite concerning, but it actually is worse,” said Annie Marsolais, chief marketing officer at BDC, which has a mandate from the federal government to lend to small businesses and entrepreneurs.

Another study, conducted in September 2022 by the CFIB, found that owners were working an average of 54 hours a week to compensate for a shortage of workers.

Full-time employees work an average of about 40 hours per week, according Statistics Canada.

—With additional reporting from Bianca Bharti

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

___________________________________________________

International Trade Minister Mary Ng will host a virtual media availability following the visit of Piyush Goyal, India’s minister of commerce and industry, consumer affairs and food, and public distribution and textiles

The David Suzuki Foundation; Canadian Associations of Physicians for the Environment; and Elizabeth May, leader of the Green Party of Canada and MP for Saanich-Gulf Islands, will address how the federal government must go further in addressing methane emissions reductions, in Ottawa

Today’s data: U.S. initial and continuing jobless claims, producer prices index

Earnings: Brookfield Corp., Sun Life Financial Inc., Fairfax Financial Holdings Ltd., Canadian Tire Corp. Ltd., Quebecor Inc., Maple Leaf Foods Inc., Aurora Cannabis Inc.

___________________________________________________

_______________________________________________________

Canadian banks hit with downgrades as economic storm clouds gather

Concern about TD’s anti-money laundering controls? The new twist in the failed First Horizon deal

_______________________________________________________

The real estate market is a roller coaster. When it comes time to renew your mortgage, you might be asking yourself whether you want to stay on the ride or hop off. Depending on how tight your budget is, an extra few hundred dollars can make a big impact. If you’re looking to renew your mortgage, here are some steps you can take to help make the process smoother and potentially save you money. Get the tips here.

The high cost of playing it safe when retired with teenage kids

Small business owners' poor mental health has gotten even worse

____________________________________________________

Today’s Posthaste was written by Gigi Suhanic, (@gsuhanic), with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance