Posthaste: What closing door to temporary residents could do to Canada's economy — it's not good

Canada now boasts one of the fastest growing populations in the world, but that growth has also brought concerns.

The nation has looked to immigration to boost the economy, replace aging workers and fill labour gaps, but there has also been criticism that this surge of newcomers is straining resources and exacerbating Canada’s housing crisis.

Ottawa has acknowledged these concerns and last November decided against hiking immigration targets and in December, increased the cost-of-living requirement for foreign students.

But a new report by Desjardins cautions that there could be economic repercussions if the arrival of newcomers is cut off too quickly.

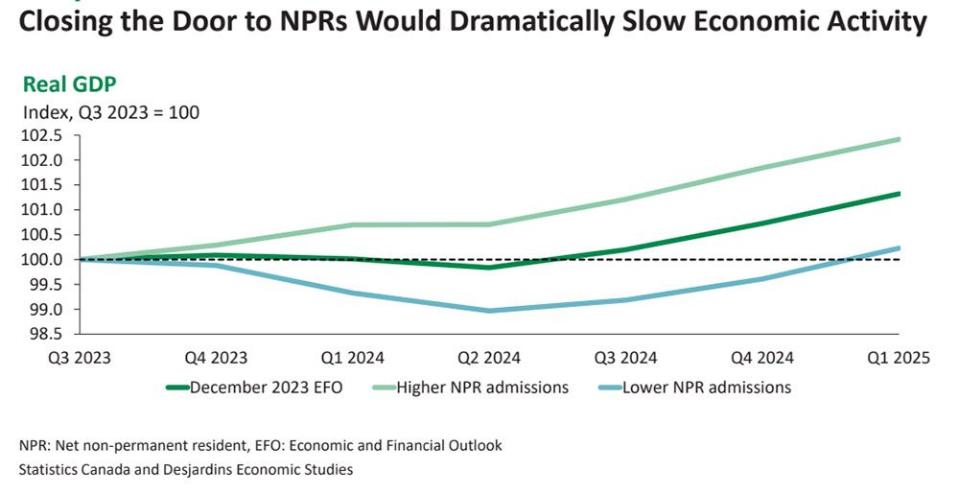

“Closing the door to temporary newcomers would deepen the recession expected in 2024 and blunt the subsequent recovery,” Randall Bartlett, senior director of Canadian economics, wrote in the report.

Much of Canada’s population growth comes from non-permanent residents, temporary foreign workers and students. In 2022 their numbers outpaced permanent residents for the first time, said Bartlett.

Desjardins’ baseline case assumes there will be half as many non-permanent residents in 2024 as last year, and half as many again in 2025. The numbers begin to gradually rise in 2026.

The working-age population will grow an average of 1.8 per cent a year from 2023 to 2028 with real GDP growth averaging 1.5 per cent a year.

While the slowing economy will naturally lead to a decrease in temporary residents, the numbers could also change abruptly due to government policy, said Bartlett.

“Some of this is playing out in real time now, with new restrictions on foreign student admissions and work permits announced recently,” he said.

With this in mind Desjardins calculated two alternative scenarios: one in which non-permanent residents fall to zero in each year of the projection and one in which they arrive at double the pace.

In the first scenario, population growth slows to 1.5 per cent between 2023 and 2028, and real GDP falls “considerably” below the baseline. The short and shallow recession that Desjardins expects in the first half of 2024 is doubled in length.

In the second scenario, population growth averages 2.1 per cent a year and real GDP rises above the baseline, leading to a milder downturn and possibly avoiding a recession altogether.

One downside would be elevated inflation, which could keep the Bank of Canada holding interest rates higher for longer.

The wildcard in Canada’s population growth is non-permanent residents, said Bartlett.

“While we anticipate the flow of these newcomers to slow, how much it slows will have material impacts for Canada’s economic growth, both in the near and long term,” he said.

“Caution is warranted on the part of policymakers to minimize the economic downside of slowing the pace of newcomer arrivals too quickly.”

However, Bartlett acknowledges that it is a difficult balance to achieve and provincial and municipal governments carry the brunt of the burden because of their direct role in delivering services to the growing population.

“Maintaining the current pace of newcomer arrivals will erode housing affordability further in the absence of a monumental increase in the supply of homes,” he said.

_____________________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

It’s no secret psychology plays a big role in real estate, and today’s chart from BMO maps Canadians’ moods over some turbulent times.

Surveys show expectations of home price gains have ebbed and flowed along with the Bank of Canada since the pandemic, says BMO senior economist Robert Kavcic — from the euphoria of “rates will remain low for a long time” in 2020 to the crushing onset of interest rates hikes in 2022.

The Bank’s hiking cycle is widely seen as over now, which Kavcic says is an important milestone because buyers know the worst case scenario on rates and can plan accordingly.

Market psychology will also get a boost from markets and pundits predicting rate cuts this year.

“If the job market holds up, we could see housing activity firm up notably this spring,” said Kavcic.

The Economic Club of Canada hosts its annual economic outlook breakfast with chief economists from TD Bank, Scotiabank, BMO, CIBC, National Bank and RBC.

Get all of today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

America is headed for a debt crisis like Canada’s in the ’90s, warn veteran politicians

Ultra-low interest rates are likely over and investors will need to adjust

Industrial real estate remains tight despite record-breaking increase in new space

There will be some changes to Canadians’ personal finance this year, ranging from a recently introduced investment account to a new tax filing obligation to a reversal of past thinking about debt. Jason Heath takes a look at three of these as well as re-examining a timeless resolution about registered retirement savings plans (RRSPs). Read more

Dissatisfaction with provincial governments is 'stark and growing'

This Canadian housing market just had its worst year since 2000

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance