Posthaste: Rising food costs forcing some Canadians to overhaul Thanksgiving menus

Good morning!

Don’t be surprised if your Thanksgiving dinner is missing a turkey this year. Nearly a quarter (22 per cent) of Canadians are planning on changing their menus this weekend due to the rising cost of food, according to a new report.

The Agri-Food Analytics Lab at Dalhousie University in Halifax, in partnership with Angus Reid, found that higher food prices are making a big impact on dinner tables this year, especially in lower-income households. Those who earn less than $50,000 a year make up 30 per cent of those changing their menus.

“Higher food prices are clearly changing plans for many people this year,” Sylvain Charlebois, director of the Agri-Food Analytics Lab, said in the report. “This is our first time measuring intent of Canadians for Thanksgiving, but you can sense that food inflation is putting some pressure on dinner tables these days.”

The report estimated that the per-kilogram price of turkey has increased by an average of more than 15 per cent since last year. Turkey is a Thanksgiving staple, with 62 per cent of Canadians ranking it as the most important food for the holiday, and 77 per cent ranking it among the top three.

“Turkey clearly remains the food of choice in Canada, but a more fragmented, diverse food market is making things more interesting,” Janet Music, research associate at the Agri-Food Analytics Lab, said in the report. “Even though turkey is popular, we were expecting higher numbers.”

Stuffing and potatoes, respectively, came in as the second- and third-most important dishes, both of which have also skyrocketed in price. The cost of potatoes has increased by 22 per cent from a year ago, while the price of bread to make that stuffing is up 13 per cent.

The report said that people living in British Columbia (29 per cent) and Alberta (25 per cent) are the most likely to change their menus this year, while 70 per cent of those in Saskatchewan and Manitoba said they will be eating the same foods they normally do.

The survey interviewed 1,244 Canadians on Sept. 30.

Another recent survey also indicated Canadians are having trouble with the rising cost of living. Roughly half (52 per cent) of those surveyed for insolvency firm MNP Ltd.’s quarterly Consumer Debt Index said they are finding it less affordable to feed themselves and their families.

“Canadians are putting more of their paycheques towards paying for basic necessities as the cost of living rises, which in turn is leaving less of a financial buffer to manage the impacts of current and potential future interest rate hikes,” Grant Bazian, president of MNP, said in a press release.

The index found that the average Canadian has less money left to spend at the end of the month — down $37 from the previous quarter to $654 — because they are paying much more for necessities.

“With less overall room in their budgets, any future increases to interest rates or the prices of everyday items could push individuals closer to insolvency,” Bazian said.

The index interviewed 2,000 Canadian adults in September.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

‘CANADA WILL GET LEFT BEHIND’ Canada was first with significant incentives for systems that would keep carbon from entering the atmosphere, but the United States now has the size advantage, and oilpatch leaders with capital to invest in green technology have noticed. The Biden administration’s new climate package has been celebrated around the world as a game-changer in the fight to reverse climate change. “We will take our capital and we will invest in projects with a strong bias towards the United States,” said Michael Belenkie, the head of Entropy Inc., the Calgary-based carbon capture and storage subsidiary of Advantage Energy Ltd. Read the full story by Meghan Potkins. Photo by Handout/MEG Energy

___________________________________________________

Sean Fraser, minister of immigration, refugees and citizenship, will make an announcement regarding international students and addressing Canada’s labour shortage

Dan Vandal, minister for PrairiesCan, will announce an investment in agri-food and biomanufacturing research, development and sustainability

Today’s data: Canadian employment report; U.S. employment report, wholesale trade, consumer credit

Earnings: Tilray Brands Inc., MTY Food Group Inc.

___________________________________________________

_______________________________________________________

Fragility of Canada’s supply chains on display as burning Alberta bridge stalls grain shipments

Rocket man: It could take a long, long time, but startup has lit the fuse for a NASA north

TFSA rules land two more taxpayers in hot water with the CRA

Canadian Tire permanently cuts ties with Hockey Canada over sexual assault allegations

Not enough workers to build homes needed to address housing affordability: CMHC

‘There is more to be done’: Rate hikes still needed to tame inflation, Bank of Canada’s Macklem says

Work-from-home or return to the office? A rift is emerging among workers

Are you having an ideal, disengaged or toxic day at work? It matters

FP Answers: What should I do with a $275,000 payout from my critical illness insurance policy?

_____________________________________________

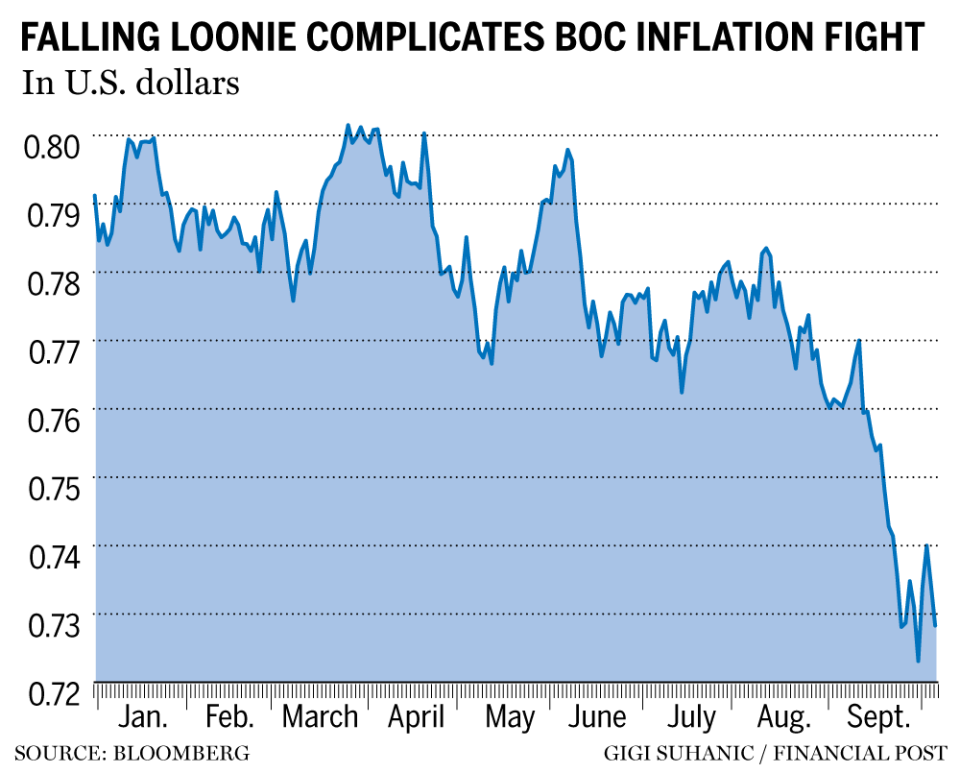

If battling decades-high inflation wasn’t hard enough, the Bank of Canada is now facing the added burden posed by a struggling loonie, which has plunged in recent weeks. The Canadian dollar fell to a two-year low below 73 U.S. cents at the end of September. Though it has clawed its way back above the 73-cent mark in recent days, the drop from the 77-cent range in which it was trading earlier last month may add to the country’s inflation woes by making imports — especially those from the United States, Canada’s biggest trading partner — more expensive. Stephanie Hughes reports.

____________________________________________________

Although many investors suffered painful losses in 2022 — the S&P 500 had its worst first half of the year since 1970 — billionaire investor Carl Icahn is not one of them. At his company Icahn Enterprises, the net asset value went up about 30 per cent in the first six months of this year. Looking ahead, his outlook isn’t exactly optimistic, but he suggests that you should not bail on stocks completely. Our content partner MoneyWise has details on where he sees opportunity right now.

____________________________________________________

Today’s Posthaste was written by Noella Ovid, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Yahoo Finance

Yahoo Finance