Posthaste: Renter nation? Number of tenants in Canada hits unprecedented heights

Renters in Canada have climbed to 33 per cent of households — the highest percentage yet — as their numbers are swelled by the high cost of homeownership and aging demographics.

Depending on what city you live in the percentage could be even higher.

Twenty-eight of Canada’s 50 major cities have a share of renters higher than the national average, according to the study by real estate site Point2 based on the latest census data. Montreal leads the way with 63 per cent of households renting.

The share of renters in this country has grown steadily over the past decade, increasing at twice the pace of homeowners between 2016 and 2021. More than 40 per cent of homes built during that time are being rented out, the highest tenant rate in decades.

Young people still make up the bulk of renters, but baby boomers, the largest demographic group in the population up to 2023, are not far behind.

“Renting has become widespread across all age brackets,” said Alexander Ciunti, author of the Point2 study.

“With renters increasing at twice the rate of homeowners during this five-year period, it begs the question: Is renting becoming the go-to housing option for Canadians.”

Several forces are at work here. Canada’s aging population means growing numbers of baby boomers are selling the family home and moving into rented accommodation.

At the same time, Canada’s housing affordability crisis has barred many younger people of the millennial and gen Z generations from the property ladder.

“In a country where 18 out of 50 major cities have benchmark home prices above $1 million, a boost in rentership is bound to happen,” said Ciunti.

In fact, it has never been tougher to afford a home in Canada as higher mortgage rates outpace the decline in home prices, according to the latest Royal Bank of Canada housing affordability report.

A household at the end of 2023 needed to spend a “staggering” 63.5 per cent of the median income to cover the cost of owning a home at the average market price, up from 61.8 per cent in the third quarter, Robert Hogue, RBC’s assistant chief economist, said in the April report.

The high number of new immigrants, who tend to rent when they first arrive in the country, has also contributed to the “renter revolution.”

The pressure this has put on the country’s housing market is well known and rent prices have soared in recent years.

The average asking rent for a home in Canada hit a record $2,202 in May, up almost 10 per cent from a year ago, according to the latest report by Urbanation and Rentals.ca.

All provinces reported year-over-year increases for purpose-built apartments and condo rentals, but the prairie provinces bore the brunt of rent inflation.

Rents in Saskatchewan rose 21 per cent and 17.5 per cent in Alberta.

You might think pricey Vancouver or Toronto would have the highest share of renters, but in Canada, as mentioned above, that distinction goes to Montreal.

This Quebec hub also boasts some of the lowest average rent prices among major cities. Rents in the city centre are about $3,000, significantly lower than in downtown Toronto or Vancouver, said Point2.

More than half the households in Sherbrooke, Que. rent, likely for the same reason. Along with Trois Rivieres and Saguenay, rents in this city are less than $1,500, even in the city centre.

No mystery why 54 per cent of Vancouver households rent. The composite benchmark home price here in May was $1,212,000.

Toronto, where the benchmark price is $1,117,400, has the largest number of renting households in the country because of its larger population, but its 48 per cent share ranks only fifth in Canada.

Only one city among the 50 studied actually showed a decline in renters in recent years. Richmond Hill, north of Toronto, saw the share of tenants drop from almost 26 per cent to about 22 per cent, despite homes here going for $1.5 million.

Close to Toronto, Richmond Hill is known for its safe streets, good schools and high incomes. Seventy-eight per cent of households here own their own homes.

Sign up here to get Posthaste delivered straight to your inbox.

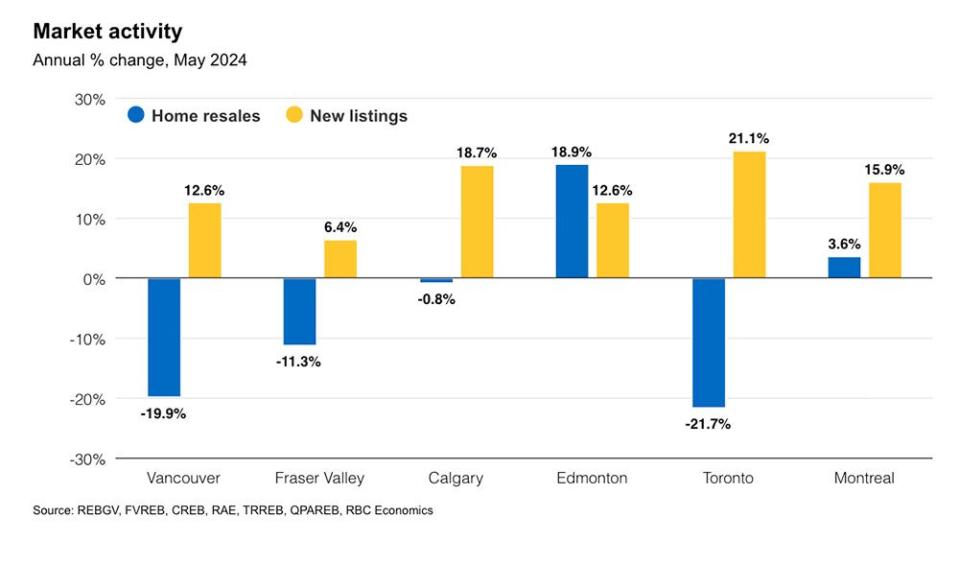

A look at today’s chart suggests buyers are gaining the upper hand in many Canadian housing markets. While aspiring homeowners wait out the Bank of Canada, sellers are back, causing inventories to climb, especially in Toronto and Vancouver, said RBC’s Hogue.

Active listings in Toronto rose 83 per cent year over year in May to a decade high of 21,800 units, led by condo listings which were up 95 per cent.

“Rising supply and softening demand are giving buyers more bargaining power,” said Hogue. “And last month they’ve leveraged that power to extract some price concessions from sellers.”

Toronto’s MLS Home Price Index fell 0.4 per cent, the first monthly decline since January.

The United States Federal Open Market Committee meeting begins

Today’s Data: Canada building permits for April

Earnings: Oracle Corp.

Canada's standard of living on track for worst decline in 40 years

Canadian dream of owning a home is fading for whole generation

Capital losses can only be applied to offset capital gains and not ordinary income, except in the year of death, but certified financial planner Andrew Dobson says there are several things to consider when deciding whether to sell or hold today, including the rising capital gains inclusion rate to two-thirds. Find out more

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line with your contact info and the gist of your problem and we’ll try to find some experts to help you out, while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers, led by Julie Cazzin, can give it a shot.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance