Posthaste: Poll finds a lot of Canadians want to sell their homes within 3 years

Most Canadian homeowners are not looking to sell in the next three years, but if all those who are planning to sell follow through, there could be a historic number of properties hitting the market, according to a new report by personal finance company NerdWallet Inc.

The study, which interviewed 1,099 Canadian adults, 749 of them homeowners, found that 20 per cent are planning to sell their primary residence within the next three years. Another 41 per cent would like to sell more than five years from now and 31 per cent are not interested in selling at all.

The study used Statistics Canada data on Canada’s current population and home ownership rate to estimate the number of homes that could be listed in the next three years if 20 per cent of homeowners were to sell and found that it would result in approximately 5.4 million new listings — an average of 1.8 million per year — between 2024 and 2026. The report notes that the greatest number of listings Canada has seen in the past decade was in 2015, when just over one million homes were listed for sale.

But the likelihood that all would follow through is extremely low, report author Clary Jarvis wrote, in part because of the various obstacles homeowners face when deciding to sell.

The biggest obstacles preventing homeowners from selling their primary residence in the next three years are the stress of moving (22 per cent), higher mortgage rates potentially affecting homebuyers’ budgets (17 per cent) and having to buy a new home when mortgage rates are high (17 per cent).

Homeowners who plan to sell share the same top concerns: the stress of moving (41 per cent) and higher mortgage rates potentially affecting homebuyers’ budgets (37 per cent), followed by the possibility of having to sell their home for less than they believe it is worth (27 per cent).

Some of those worries, such as those related to high mortgage rates and lower home prices, could eventually diminish if interest rates drop or home sales rise. But the stress of moving, finding a good real estate agent and disruptions caused by major life events will always be challenges.

Canadians also seem keener than usual to sell other kinds of properties, when compared with recent averages, Jarvis wrote. The study found that nine per cent of homeowners are looking to sell a vacation home and 12 per cent are planning to sell an investment property within the next three years.

“Anything that prevents homeowners from listing their properties is going to put more pressure on buyers,” Shannon Terrell, personal finance expert at NerdWallet Canada, said in a press release. “But when you’re buying a home, you have to focus on what you can control — your down payment, debt levels and credit score — and be as ready as you can when the right property finally hits the market.”

Sign up here to get Posthaste delivered straight to your inbox.

Rising incomes and a slower housing market helped Canada’s households modestly repair their balance sheets in the second quarter, even as economic growth stalled. Combined, rising incomes and slower debt accumulation drove households’ ratio of credit market debt to income down to 180.5 per cent from 184.2 per cent in the previous quarter. That’s the biggest decrease in that measure in more than a year. — Bloomberg

Ontario Securities Commission (OSC) will host a roundtable on diversity, beyond gender. Panellists will discuss views on and approaches to diversity that will work for Canadian investors and public companies.

Follow along with the Financial Post’s live news blog to get breaking news as it happens, all day long.

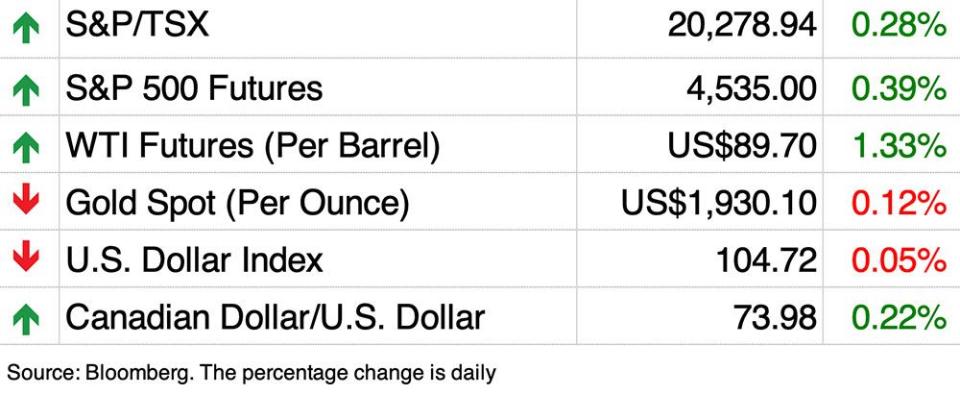

Today’s data: Wholesale trade; U.S. initial claims, retail sales, producer price index, business inventories

Earnings: Empire Co. Ltd., Transat A.T. Inc., Reitmans Canada Ltd.

Canada still needs 3.5 million more homes to close affordability gap, CMHC says

7 years not enough to build millions of extra homes needed to fix affordability: economist

Average rent now costs $2,117 a month in Canada — a record high

David Rosenberg: Why now’s the time for investors to buy Canada

Marianna, 50, is among the growing shift away from the traditional nuclear family. She is single, has no dependants and lives with her parents, who are in their 80s, in a home they jointly own and which she will inherit. She is also already enjoying retirement. If she continues on her current savings path, she could have $50 million at age 92. Marianna wants to figure out what to do with her money and wants some guidance on how to enjoy a comfortable retirement without risking outliving her savings. Here’s what the experts had to say.

____________________________________________________

Today’s Posthaste was written by Noella Ovid, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Yahoo Finance

Yahoo Finance