Posthaste: Canadians fear more interest rate hikes as pessimism over debt grows

Canadians are sinking to new depths of despair over their mounting debt loads as high interest rates squeeze finances and leave them worrying they won’t be able to pay their bills.

People haven’t been this pessimistic about their debt in five years of tracking, according to insolvency firm MNP Ltd.’s latest consumer debt index. More Canadians rate their debt situation as much worse than a year ago, a two-point increase from last quarter to 20 per cent. Still more say it’s deteriorated compared to five years ago, up three points to 25 per cent.

Many also aren’t hopeful they’ll see relief any time soon. Compared to last quarter, there’s been an increase in the number of people who expect to be in worse shape financially by this time next year and in five years’ time, up three points and two points, respectively. The index also noted a two-point drop in the number of people who think their debt levels will improve.

High interest rates and a rising cost of living are at the root of the pessimism, MNP said.

“There is no mystery as to what is causing Canadians’ bleak debt outlook: it’s getting increasingly difficult to make ends meet,” Grant Bazian, president of MNP Ltd., said in a release. “Facing a combination of rising debt carrying costs, living expenses and concern over the potential for continued interest rate and price hikes, many Canadians are stretched uncomfortably close to broke.”

Indeed, just over half say they are $200 away from not being able to cover their bills and debt payments, the survey said. Another 31 per cent said they already don’t make enough to pay for everything.

The escalating cost of living is also leaving people with less money left over to put into savings. The average amount people said they had after paying bills dropped to $674 this quarter — a significant $97 less than in the last survey.

Many people also aren’t sure their finances can withstand any more interest rate hikes from the Bank of Canada. Twenty-eight per cent said they’d have a harder time managing a one percentage point rate increase, up five points from the last survey. Another four in 10 said their ability to absorb an extra $130 in interest on debt payments has got worse, a five-point increase.

Still, there are some signs of optimism amid all that gloom. The index showed fewer Canadians are worried about never being able to pay off their debt and less fear they’re headed for bankruptcy. And though 40 per cent are concerned about their debt loads, there’s been a seven-point drop in the number of people who express regrets and a three-point decline in those who say they are concerned.

A continued strong labour market and low unemployment rate may be helping to ease some people’s financial anxiety, MNP said. But the firm warned that job losses could be looming for many.

“The uncomfortable truth is that higher interest rates slowing the economy will inevitably come with consequences, like increased unemployment,” Bazian said.

In the event of a lost job, MNP advises consumers minimize credit card use, contact lenders to set up payment plans and also seek professional advice on budgeting and debt consolidation.

Sign up here to get Posthaste delivered straight to your inbox.

Inflation is decelerating again, leaving room for the Bank of Canada to hold interest rates steady next week.

The consumer price index rose 3.8 per cent in September from a year ago, Statistics Canada reported yesterday, slower than the median estimate of four per cent in a Bloomberg survey of economists. It’s a reversal that comes at the right time for Bank of Canada policymakers, who will soon begin their deliberations for a rate decision on Oct. 25.

On a monthly basis, the consumer price index fell 0.1 per cent in September, versus expectations for an increase of 0.1 per cent.

Two key yearly inflation measures that are tracked closely by the Bank of Canada and filter out components with more volatile price fluctuations — the so-called trim and median core rates — also eased, averaging 3.8 per cent, from four per cent a month earlier.

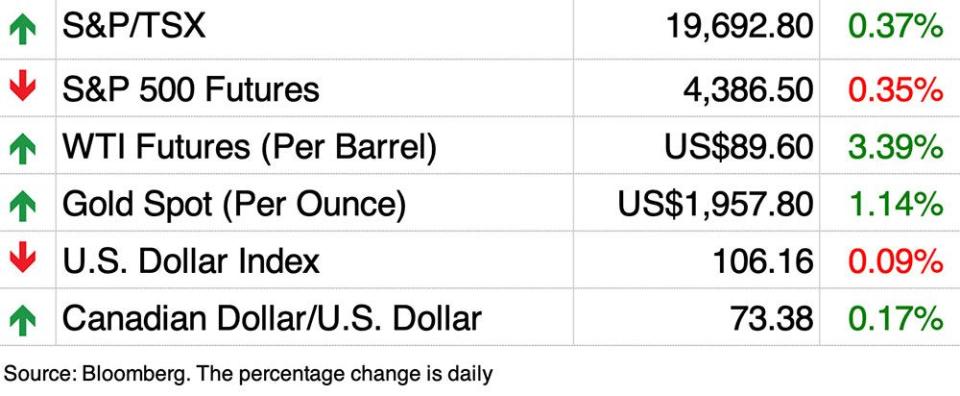

Bloomberg

Goldy Hyder, chief executive of the Business Council of Canada, and Annette Verschuren, chair and CEO of NRStor Inc., speak at the Canadian Club on economic growth in Toronto.

The United States Federal Reserve will release its Beige Book economic survey at 2 p.m.

Today’s data: U.S. housing starts, building permits

Earnings: Tesla Inc., Netflix Inc., Morgan Stanley, Kinder Morgan Inc., Volvo AB

Get all of today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

‘Next move likely an interest-rate cut’ — What economists say about the latest inflation reading

Outreach to Albertans on fate of pension plan biased in favour of exit, say CPP fund managers

Holiday spending plans hit new low point in Deloitte retail study

Work-from-home rates drop to lowest levels since pandemic in U.S.

There are all sorts of rules about how much you should withdraw from your retirement portfolio to make sure you don’t run out of funds. Investor Fraser Stark says the premise of these rules is that the opposite — not running out — constitutes success, but does it?

Today’s Posthaste was written by Victoria Wells, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance