Posthaste: Most Canadians are missing out on ways to save money on their insurance bills

Canadians are finding savvy ways to cut down on monthly expenses to combat the rising cost of living, but most of them are missing out on additional savings through their home and auto insurance, according to a new report by TD Insurance.

The study, which interviewed 1,372 Canadians with home, renters or vehicle insurance, found that three-quarters are more aware of how to save money on their phone bill than their insurance bill.

What’s more is that despite it being a necessity for most (86 per cent own home or auto insurance), more than a quarter (26 per cent) take a set-it-and-forget-it approach to purchasing and managing their home or auto insurance policy.

A big reason is that only 40 per cent of insured Canadians feel confident that they understand their insurance policy. In fact, most of them feel more knowledgeable about what’s in their phone plan (79 per cent) or what’s on sale at the grocery store (75 per cent) than they do about their insurance premiums (37 per cent).

Their reasons include finding it overwhelming (22 per cent), complicated (20 per cent) or believing that it’s a fixed cost that won’t change (18 per cent).

“The best way for Canadians to help protect what they own and also see if they can save money on their insurance is to take a more active role in understanding their insurance policies and how premiums are calculated,” Bruno Jauernig, vice-president and executive journey product owner at TD Insurance, said in a press release. “Being more informed about insurance can help Canadians be more financially resilient, better safeguard the things they’ve worked so hard for and discover more ways to save money.”

Only 38 per cent of those surveyed take the time to search for possible ways to save on their home and auto insurance. By comparison, 70 per cent dedicate time to reduce their grocery costs, 46 to decrease their internet bill and 42 per cent to lowering spending or finding deals on clothing.

“Insurance can protect the things we cherish most — from the couple who forfeited trips and nights out for a home to call their own, to the teen who worked two jobs to buy their first car — we want to protect our valuable belongings because life can be unpredictable,” Jauernig said.

Sign up here to get Posthaste delivered straight to your inbox.

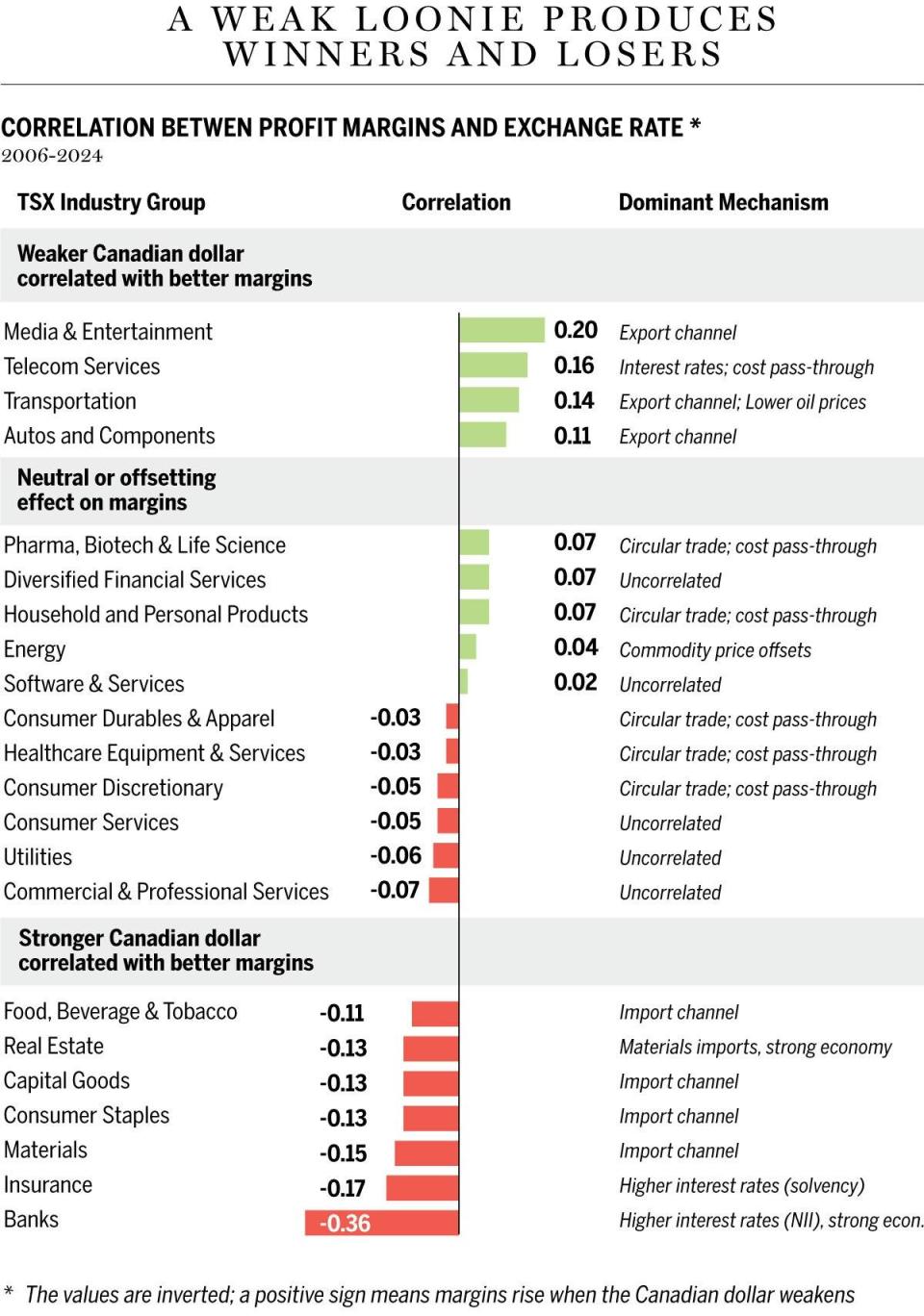

There are good trades beyond the bond market to help make portfolios robust to the challenge of a global interest rate divergence. In Canada, different sections of the S&P/TSX composite have different exposures to a low-for-long loonie. Other factors matter, but this macro theme suggests favouring media and manufacturing and ditching banks and consumer staples, writes Dylan Smith. Read on for more details.

Today’s Data: Canada employment report for May, capacity utilization for the first quarter; U.S. employment report for May, wholesale trade for April, flow of funds for the first quarter and consumer credit for April

Property rich, cash poor: How churches can help solve Canada’s housing crisis

Variable rate mortgages are the best bet to save you money after Bank of Canada cut

Taxpayer who flipped a property eight years ago gets a CRA call

Prospective homeowners still want to buy despite rising prices

Women are paid less even in retirement, pension gap study finds

John is a single father of a young daughter and is thinking about how he can support her through post-secondary education while retiring or at least shifting to part-time consulting work in five or six years’ time. The 55-year-old is a health-care professional and earns about $210,000 annually before tax. Here’s what the expert had to say.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line with your contact info and the gist of your problem and we’ll try to find some experts to help you out, while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers, led by Julie Cazzin, can give it a shot.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Noella Ovid, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance