Posthaste: More Canadians improving financial wellness as costs climb

As Canada’s high cost of living has added stress to the lives of many Canadians, the vast majority have taken steps to make things easier.

FP Canada’s 2024 Financial Stress Index, released last week, found that most Canadians are now prioritizing their financial health and feeling more confident about the future.

The survey found that financial well being is the top stressor among 44 per cent of respondents, which has steadily climbed every year since 2021.

When it comes to what drives their financial stress, 69 per cent of respondents highlighted food prices, while 60 per cent pointed to inflation and 52 per cent blamed housing costs.

“There’s no denying that persistent affordability concerns can cause significant financial strain, so it’s no surprise that Canadians are continuing to feel the impact of these difficult conditions,” Meghan MacPherson, a qualified associate financial planner at Impact Financial Group Inc., said in a news release.

Despite the challenges, many Canadians are taking action. Ninety-one per cent of respondents have taken at least one measure to improve their financial well-being, with 45 per cent of Canadians tracking their expenses and 38 per cent tackling their debt.

Canadians are increasingly making better decisions with their money as well, as 24 per cent of respondents plan on paying off credit card debt in the next year, while just 19 per cent intend to spend money on a vacation.

Ravi Chhabra, a CFP professional, said in the release that paying off debt should be a top concern among Canadians.

“Canadians are adopting a fiscal-responsibility mindset, which is at the heart of financial empowerment and long-term financial stability,” he said.

“Prioritizing debt repayment while also budgeting for the things that bring us joy will do more than help us lessen immediate financial burdens. It will also lay the groundwork for a future where we can prioritize life’s pleasures without compromising our financial health.”

To Chhabra’s point, with more Canadians making sensible money decisions, more are also feeling optimistic about their financial situation.

The survey found 50 per cent of respondents are optimistic about their financial future, compared to 47 per cent a year ago.

Even as more Canadians are feeling optimistic about their finances, another study found more are relying on credit.

A new report from TransUnion found 31.8 million Canadians are holding at least one credit product, a new high for the research. New Canadians and Gen Z Canadians have driven the growth, with Gen Z credit balances spiking 30 per cent this year.

“Inflationary pressures may lead consumers to turn to bankcards or personal loans to help make ends meet, and Millennials and Gen Z consumers are no exception,” Matthew Fabian, director of financial services research and consulting at TransUnion Canada, said in a news release.

“Lenders need to carefully monitor credit performance in the coming year, particularly among younger consumers.”

Sign up here to get Posthaste delivered straight to your inbox.

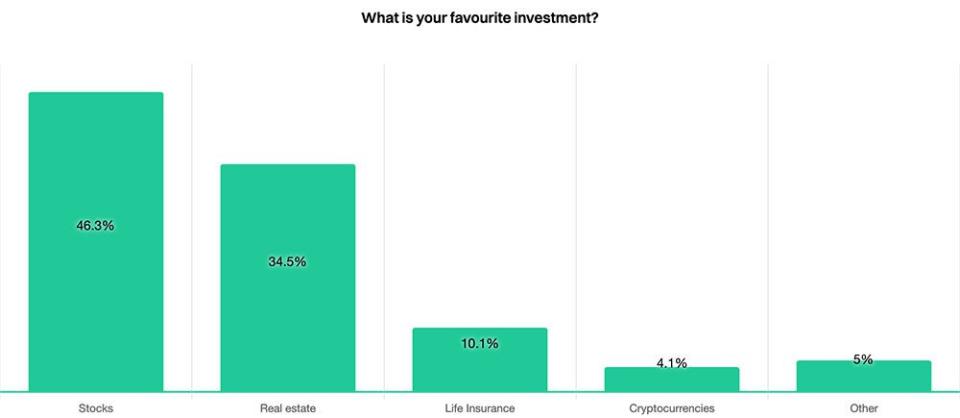

The stock market is still the place to be for Canadian investors, according to financial comparison site HelloSafe.

More than 45 per cent of Canadians in the HelloSafe survey ranked stocks as their top investment choice, with real estate the next most popular at almost 35 per cent.

Cryptocurrencies, at 4.1 per cent, is still a marginal investment for Canadians, except among the younger generations, said HelloSafe. About 28 per cent of people aged 16 to 35 put digital currencies as their top investment choice.

The 37th Canadian Conference on Artificial Intelligence, hosted by Guelph University in Ontario

Governor General Mary Simon will attend the Canadian Council for Aboriginal Business’ celebration of its 40th Anniversary in Toronto

Today’s data: United States Federal Reserve Beige Book, Royal LePage most affordable Canadian cities report

Earnings: Bank of Montreal, National Bank, EQB Inc., HP Inc.

Canadians need more time to digest new capital gains inclusion rules

Joe Oliver: The Trudeau Liberals have eroded all five pillars of prosperity

AI are the world's hottest jobs, but Canada’s been slow to adapt

Canada's standard of living on track for worst decline in 40 years

Roaring Kitty, GameStop Corp. and meme stocks are back in vogue, but portfolio manager Martin Pelletier says he’s happy with a slow-and-steady approach that uses tactics such as structured notes that consistently generate high-single-digit-yielding monthly coupons. Find out more.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line with your contact info and the gist of your problem and we’ll try to find some experts to help you out, while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers, led by Julie Cazzin, can give it a shot.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Ben Cousins, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance