Posthaste: Many Canadians are accessing food banks for the first time as they struggle to meet basic needs

An increasing number of Canadians are accessing food banks for the first time as they struggle to meet their basic needs amid the high cost of living, according to new research from The Salvation Army Canada.

The Canadian Poverty and Socioeconomic Analysis, which interviewed 1,515 Canadians in March, found that 61 per cent of those who recently accessed a food bank, food hamper or community meal program were first-time users, a sharp increase from 43 per cent in October 2023. The total number of Canadians who accessed one of these programs was also up slightly from six per cent last fall to seven per cent this spring.

“The increase in first-time users of food banks is an alarming indicator of the conditions that many Canadians are facing,” John Murray, territorial secretary for communications at The Salvation Army in Canada and Bermuda, said in a press release. “We often find that when people show up at a food bank it can be the tip of the iceberg for additional issues they may be facing.”

More than a quarter of those surveyed (26 per cent) indicated that they are “extremely concerned” about having enough income to cover their basic needs. The number of people who said they had skipped or reduced the size of a meal also increased to 26 per cent from 21 per cent previously.

More Canadians also admitted to buying less nutritious food and reducing their grocery bills to save money and pay for other necessities.

“Despite easing inflation numbers, life is still difficult for many Canadians,” Murray said. “Food insecurity is just one symptom facing people today.”

Canada’s annual rate of inflation fell to a three-year low of 2.7 per cent in April, down from 2.9 per cent the month prior, according to Statistics Canada.

Still, 72 per cent of respondents have had challenges managing limited financial resources in the past year. In fact, many of them have cut back on non-essential needs (59 per cent), changed habits to save money (52 per cent) and used savings or gone into debt to afford basic needs (36 per cent).

In the last year alone, more than three million visits were made to The Salvation Army in Canada and Bermuda for assistance. That included 2.1 million visits for food, clothing or practical help, 438,000 for Christmas food hampers and toys, and 3.2 million for community meals.

Sign up here to get Posthaste delivered straight to your inbox.

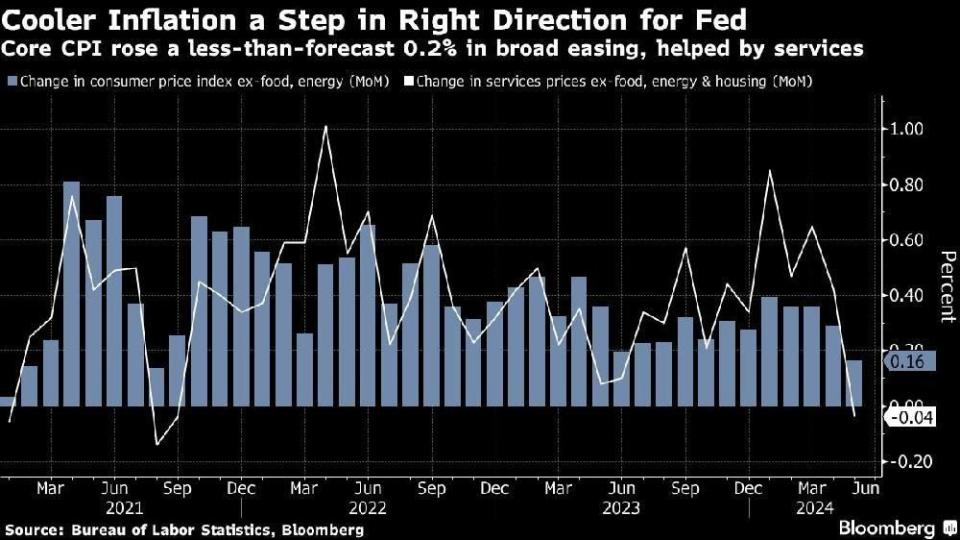

A key measure of underlying U.S. inflation stepped down for a second month in May. The so-called core consumer price index — which excludes food and energy costs — climbed 0.2 per cent from April, Bureau of Labor Statistics figures showed. The year-over-year measure rose 3.4 per cent, cooling to the slowest pace in more than three years, according to Wednesday’s data. — Bloomberg

G7 Summit in Fasano, Italy begins

9:50 a.m.: Bank of Canada deputy governor Sharon Kozicki speaks in Ottawa

Today’s Data: Canada national balance sheet accounts for the first quarter; U.S. initial claims, producer price index for May

Earnings: Adobe Inc.

National Bank’s bid to buy Canadian Western signals more consolidations in banking sector

Bank CEOs want AI ASAP, but workplace resistance persists: IBM survey

How to handle the two capital gains inclusion rates planned for this year

After much angst over inflation, the weaker economy in this country finally prompted the Bank of Canada to cut its interest rate by 0.25 per cent, but what now? What should investors do next now that a cut is finally official? Peter Hodson outlines five strategies to use in the new rate regime.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line with your contact info and the gist of your problem and we’ll try to find some experts to help you out, while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers, led by Julie Cazzin, can give it a shot.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Noella Ovid, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance