Posthaste: Is the Great Resignation back on? More workers planning to quit as pressures mount

The rising cost of living coupled with dissatisfaction at work are prompting more Canadians to consider quitting their jobs — threatening to usher in a fresh wave of the so-called Great Resignation.

A greater number of Canadians are eyeing the exits at work this year, says PricewaterhouseCoopers LLP’s latest hopes and fears survey for 2023. Close to a quarter of Canadian employees say they are very or extremely likely to quit their jobs and find new employment elsewhere within the next 12 months, compared to only 16 per cent who said the same last year.

A deep sense of unfulfillment seems to be driving some of those intentions, and among workers planning to quit, only 47 per cent say they find a sense of purpose in their jobs. That’s a big difference from those who don’t plan to quit, of which 57 per cent say their work is “fulfilling.”

In another sign of dissatisfaction, many of those considering new opportunities also feel they can’t show who they really are at work compared to those who plan to stay put, the survey said.

That comes as a higher cost of living squeezes paycheques, leaving fewer people with money left over at the end of the month and forcing some to take on multiple jobs. Globally, one in five people work more than one job and 69 per cent say they do so because they need the extra money, PwC said.

Canadians are feeling the pain, too. Forty-two per cent say they have nothing left to save after paying their bills each month, while 14 per cent have trouble paying those bills in the first place. But the stress doesn’t end there. Most Canadian employees complain they’re being overworked as well, and only 22 per cent said their workloads were “manageable” over the past year.

If that wasn’t enough to contend with, the rise of generative artificial intelligence is piling on a whole new set of pressures on employees, and many don’t seem to realize what they’re up against. Most Canadian workers aren’t considering the impact of AI on their jobs, and less than half are even thinking about the skills they’ll need as the technology takes hold in the next few years.

But PwC said AI will absolutely require employees to adapt and learn new skills — a difficult task if they’re worried about making ends meet. The survey said those struggling financially are less likely to seek out new skills at work or ask for feedback to improve their overall performance compared to those who aren’t worried about money.

That’s cause for concern for employers, PwC said, because CEOs are actively seeking ways to transform their businesses to succeed in the AI age. But that won’t be possible if employees are so stressed they can’t adapt to the new working environment. As a result, workers might find themselves out of a job completely as businesses are forced to shutter. Indeed, close to 40 per cent of executives think their companies may not be able to survive the next 10 years, a separate PwC survey of CEOs said.

Kathy Parker, partner and National Workforce of the Future consulting leader at PwC Canada said in a press release that executives will need to invest in workers if they want their organizations to be a going concern. Those investments include addressing employees’ feelings of overwork and stress over money so they are in the proper headspace to learn new skills, the survey said.

“We must be thoughtful in creating the right environment for employees,” Parker said. “It is crucial to offer meaningful work, ways for them to connect in meaningful ways, along with ways to build future-proof skills.”

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

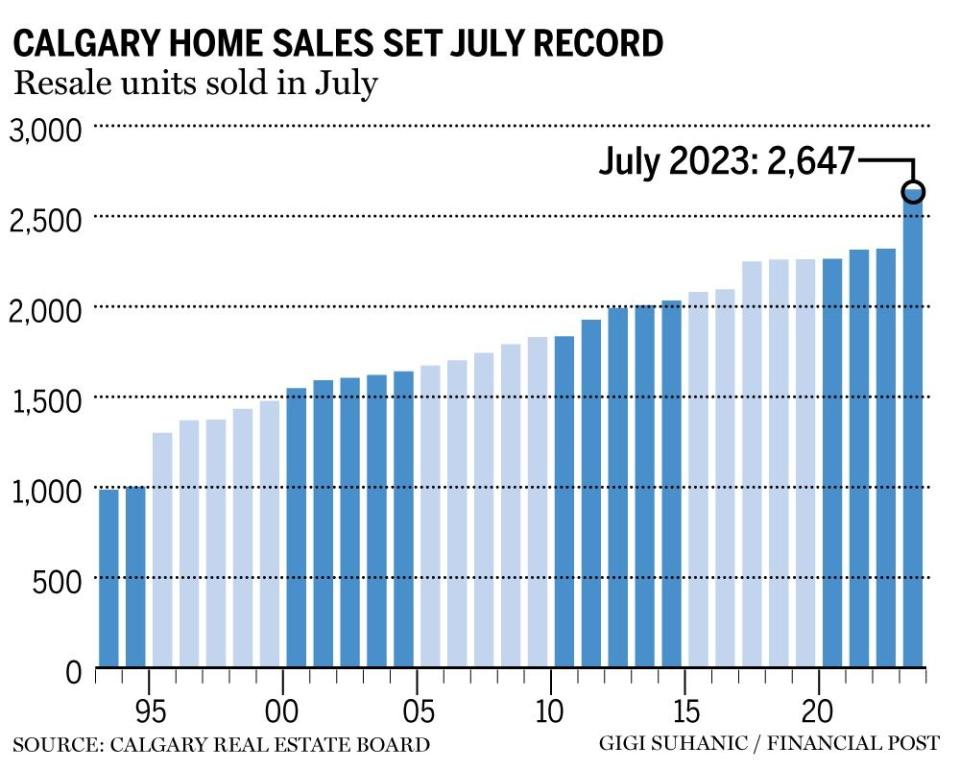

Calgary’s real estate market had its busiest July on record and benchmark prices increased for the seventh-straight month, the latest date from the Calgary Real Estate board showed.

CREB said year-over-year sales surged by 18 per cent to reach 2,647 total transactions in July.

The unadjusted benchmark price of a home jumped to $567,700 from $564,700 in June and is now more than four per cent above the previous peak recorded in May 2022.

Sales and higher prices are evident of stronger demand for housing, which is being fuelled by continued migration into the province as newcomers seek out affordable housing. However, a lack of supply is driving up prices, CREB said.

___________________________________________________

Today’s data: Real Estate Board of Greater Vancouver releases July home sales figures; U.S. ADP national employment report

Earnings: Shopify Inc., Thomson Reuters Corp., Nutrien Ltd., Intact Financial Corp., Tourmaline Oil Corp., Cameco Corp., Kinross Gold Corp.

___________________________________________________

_______________________________________________________

‘They want the $2 back’: Metro must reinstate pandemic hero pay to end strike, says union

What Canada is doing wrong in its world-leading immigration push

Strathcona to become fifth-largest Canadian oil producer after Pipestone takeover

Friendshoring offers Canada both risks and opportunities in new era of global trade

____________________________________________________

Broker downgrades, insider trading and new competition are all reasons why investors get out of a stock they clearly loved at one point. Financial Post columnist Peter Hodson says these are not valid reasons to sell and he has a couple of other points to make as well.

____________________________________________________

Today’s Posthaste was written by Victoria Wells (@vwells80), with additional reporting from Financial Post staff, The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Yahoo Finance

Yahoo Finance