Posthaste: The engine of Canada's economy is losing power

Small business is often called the engine of Canada’s economy, and there’s a reason for that.

Small and medium-sized businesses made up 98 per cent of all employer businesses in Canada last year, according to Statistics Canada. They employed 10.7 million people which is almost 63 per cent of the country’s workforce.

Yet that engine may be losing power because the ranks of Canadian entrepreneurs are shrinking, says a recent report by RBC Economics.

“The uncertainty of the pandemic, strong labour markets, and soaring inflation have sped up a decades-long decline in the self-employment rate,” said Cynthia Leach, assistant chief economist at Royal Bank of Canada.

The ranks of the self-employed in this country were already declining before COVID-19, but this was mostly driven by industry factors and concentrated in the goods sector, said Leach. Since the pandemic that decline has become broad based.

The tight labour market and higher wages that rose out of the lockdowns likely contributed as Canadians were able to find ready employment at higher pay rather than taking the risk of striking out on their own. An employee working in professional, scientific and technical services, for example, now earns 20 per cent more per hour on average than a self-employed worker in the same fields, she said.

Since the pandemic, employers are also giving workers more flexibility, a benefit typically reserved for the self-employed.

Most of the decline is in small businesses with paid help. The share of the self-employed who have one or more employees has fallen from 34 per cent in 1998 to 27 per cent now, said Leach.

As baby boomers retire more of these businesses will exit the economy but who will take their place?

Self-employment rates among younger Canadians, aged 35 to 44, have always been lower, but that share has dropped from 3.3 per cent in 1998 to 2 per cent now.

Labour shortages are expected to continue to support wage and benefits growth in this decade, making paid employment more attractive.

And last but not least, these are challenging times to run a small business, and as the economy slows further, they will get more challenging.

“The bottom line,” writes Leach, “entrepreneurship is becoming less enticing for Canadians. With Canada’s aging population, as more small business owners exit, there will be fewer nascent businesses to take their place.”

__________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

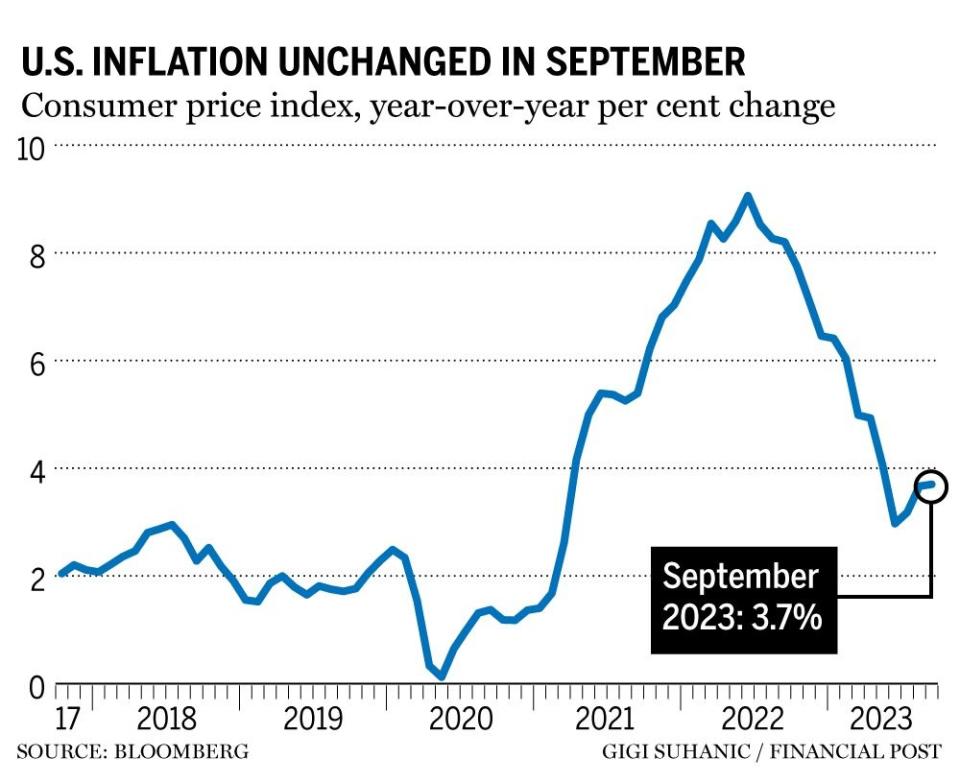

U.S. consumer prices for September were stronger than expected, data showed yesterday, supporting the Federal Reserve‘s intent to keep interest rates higher for longer.

The annual inflation rate held at 3.7 per cent, higher than it was in June and July. Core annual inflation rate was 4.1 per cent, still a long way from the Fed’s 2 per cent target.

“In short, the report reminded us that the path to 2 per cent inflation is unlikely to be smooth sailing and the Fed must continue to err on the side of doing too much rather than too little,” said BofA Global Research strategists in a note.

Canada gets the latest picture of its housing market when the Canadian Real Estate Association releases existing home sales for September and its updated quarterly forecast

The parliamentary budget officer will post a baseline projection of the economic and fiscal outlook for the federal government

Today’s data: U.S. import and export price index, University of Michigan consumer sentiment index

Get all today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

_______________________________________________________

More mergers expected in 2024 as need for capital ranks high on miners’ risk list

Royal Lepage cuts Canada’s home price forecast as market softens

Cineplex banks on concerts as Taylor Swift film breaks presale record

In dealings with the Canada Revenue Agency, you have the option to receive its notices by either regular mail or email, but either way, the taxman assumes you receive them unless you can prove otherwise, as one taxpayer has found out. Learn more about the case from tax expert Jamie Golombek

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance