Posthaste: How consumers, high home prices could complicate the Bank of Canada's inflation ambitions

From resilient Canadian consumers to rising housing prices, there are all kinds of factors gumming up the Bank of Canada’s goal of getting inflation back to its two per cent target, according to economists.

On one hand, consumers still have plenty of “juice” to cope with higher rates, suggests an analysis from CIBC Economics, which notes “the consumer is acting like nothing happened” despite 425 basis points of rate hikes in a 12-month period.

Benjamin Tal and Karyne Charbonneau examined a wide swath of metrics including credit-card purchases, excess cash, credit conditions and credit quality and found that “consumers send a clear message of assurance” that “could complicate the downward trajectory in inflation.”

For example, credit-card purchases have risen by more than 20 per cent over pre-pandemic levels since the summer, they said in a note released on April 19. But balances declined by approximately 13 per cent, suggesting Canadians want to and can afford to keep spending.

The Canadian economy has also been a jobs machine, allowing consumers to hang onto government transfer payments as excess deposits. Cash deposits have risen to $160 billion since the start of the pandemic. The CIBC economists acknowledged that wealthier people hold much of that extra cash, but the data as of December 2022 showed that even low-income people’s net worth has improved since the pandemic.

Canadians also appear to be managing the costs of servicing their debt.

In 2022, they spent about 15 per cent of their disposable income on servicing their debt, with about half going to interest payments. In 2023, CIBC estimates the cost of paying the interest on mortgages and lines of credit will rise by one per cent. But some homeowners with variable rate mortgages are, for the most part, only paying the interest, not chipping into the principal. However, consumers’ debt-servicing ratio remained below 2019 levels despite the Bank of Canada’s aggressive rate hikes.

On the housing front, global economics house Capital Economics said it expects more price gains to come because of the “collapse” in new listings, with prices ending the year higher than initially expected.

Housing prices edged up in March from February in various markets across the country. Real estate broker Royal LePage, in its latest quarterly housing report, said the average home price will end the year 4.5 per cent higher than at the end of 2022. Initially, it believed the average price would increase one per cent by the end of 2023.

“While the stabilization is good news for the near-term economic outlook, it nevertheless makes the Bank of Canada’s job harder,” said Stephen Brown, Canada economist for Capital Economics.

Housing prices also affect the consumer price index (CPI). Shelter accounted for almost 30 per cent of the CPI’s basket of goods in 2021, according to Statistics Canada. Brown said he expects inflation to moderate less because of those stronger housing prices, which could also feed into consumers’ expectations for inflation to remain higher for longer, and only gradually decline from their current elevated levels.

“All this could prompt the Bank of Canada to keep the policy unchanged longer than we expect,” Brown said.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

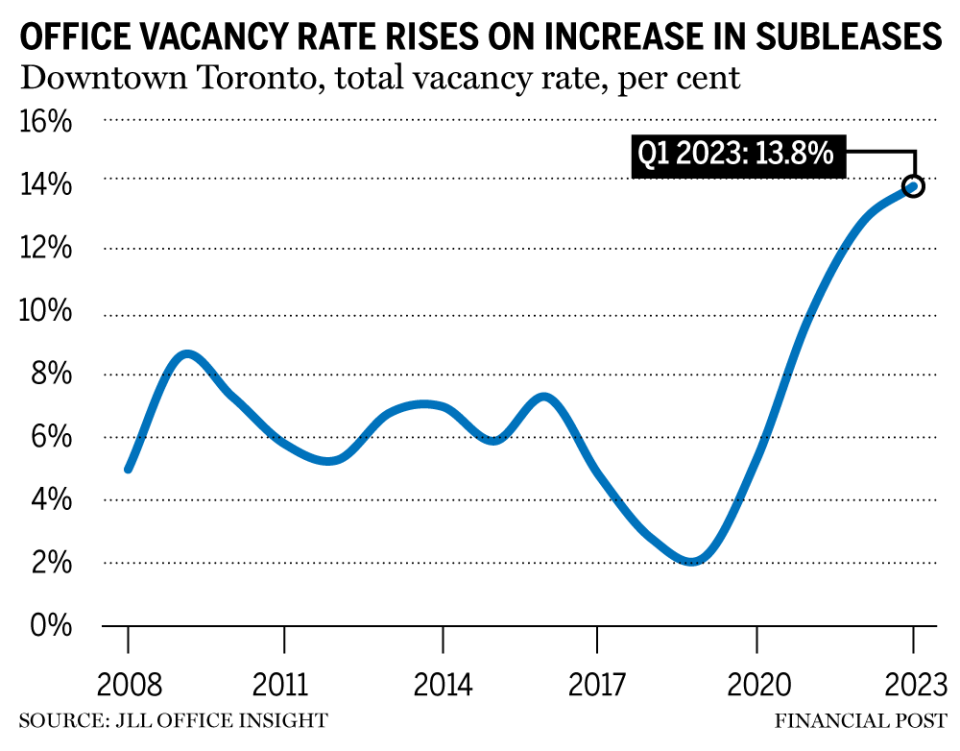

Subleased space in Toronto‘s downtown core surged in the first quarter as firms continue to right-size their work spaces following the pandemic work-from-home boom, with even the highest quality office buildings starting to feel the effects.

Downtown Toronto’s sublease availability jumped 13.5 per cent from the fourth quarter of 2022 to over 4.36 million square feet in the first three months of the year, according to data from real estate firm JLL Inc. While the increase wasn’t as high as the 20.8 per cent jump recorded in the fourth quarter of 2022, it marks the third consecutive quarterly rising of sublease space.

The total vacancy rate rose to 13.8 per cent, though rent rates held steady with a slight 0.3 per cent decrease. — Stephanie Hughes

Read the full story here.

___________________________________________________

The Canadian Federation of Independent Business releases its latest Business Barometer

Canada Mortgage and Housing Corporation will release its latest Housing Market Outlook

The Economic Club of Canada hosts a conversation with Peter Routledge, superintendent of financial institutions, where he will discuss the big issues facing OSFI in 2023, how these issues compared to those discussed in 2022 and how his organization is responding to these ever-changing issues

Prime Minister Justin Trudeau will be in New York for an international summit championing sustainable development and human rights

Today’s data: Statistics Canada survey of employment payroll hours; U.S. initial jobless and continuing claims, quarterly GDP annualized, pending home sales, Kansas City Fed manufacturing activity

Earnings: Agnico Eagle Mines Ltd., Amazon.com Inc., Johnson & Johnson, Eli Lilly and Co., MasterCard Inc., AstraZeneca PLC, Pfizer Inc., Total SA, Intel Corp., BP PLC, Newmont Mining Corp., Deutsche Bank AG, American Airlines Inc., Canadian Utilities Ltd., Toromont Industries Ltd., Bombardier Inc.

___________________________________________________

_______________________________________________________

Bank of Canada refrained from rate hike to collect more economic evidence, minutes show

Rogers partnering with SpaceX to offer satellite-to-phone coverage

TotalEnergies exits Canadian oilsands, selling stakes to Suncor for $4.1 billion

Teck cancels split, but prized copper assets will be in high demand

_______________________________________________________

You know you feel the fear. But sometimes you want to see your fear reflected back at you, especially when it comes to worrying about your investments. That’s where the Chicago Board Options Exchange’s volatility index comes into play. The VIX, as it’s more commonly known, is Wall Street’s go-to fear gauge for investors. But lately, even though markets have been flashing all kinds of worrying signals, the VIX hasn’t reacted as it has in the past. Enter the one-day VIX, which started operating on April 24. It was created to track movement among traders hedging against — or betting on — turmoil who are piling into options with zero-days-to-expiration. Read the full story here.

____________________________________________________

Today’s Posthaste was written by Gigi Suhanic, (@gsuhanic), with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance