Posthaste: Canadians are taking on debt and reducing grocery expenses to travel

Travel is becoming a key expense for Canadians in spite of high inflation as many of them prioritize a holiday at the expense of essential spending, according to a new study by FlightHub Group Inc., an online travel agency.

The survey, which interviewed 2,000 Canadians, found that nearly half (about 48 per cent) have made cuts to their budget in order to afford a trip.

“Even amidst challenging economic times, the desire to explore and connect with the world remains a fundamental aspect of the human spirit,” FlightHub chief executive Chris Dave said in a press release.

Among those who have travelled by plane within the last two years, 57 per cent have reduced non-essential expenses to be able to pay for a trip this year. That number jumps to 77 per cent in New Brunswick, the highest among the Canadian provinces.

Many of those who have cut spending to afford a trip have even reduced essential expenses and 41 per cent have decreased daily grocery expenses.

Those who still can’t afford to travel are looking to other financing methods, with over a quarter (28 per cent) resorting to using credit cards to finance trips.

“Travel is an investment in oneself,” Dave said. “Travel has the remarkable ability to transcend financial concerns, providing a unique and enriching experience.”

Younger Canadians are also compromising and making concessions to make their travel dreams come true. Among millennials, 57 per cent have reduced outings to restaurants, theatres and concerts. Meanwhile, 69 per cent of generation Z said they are willing to work extra hours for the sake of travel.

“This year, we are seeing a number of changes in travel behaviour among our customers,” FlightHub chief financial officer Marc Ghobriel said in the release. “Generation Z, for example, is booking more flights than boomers, and is more attracted to international destinations such as Manila, London and Paris.”

Interest in business travel has seen a similar uptake. A separate study by SAP Concur, which provides travel and expense management services to businesses, found that almost three-quarters (73 per cent) of the 250 Canadians surveyed are eager to travel for business in the next 12 months — up from 63 per cent last year.

Most (94 per cent) believe the future of their career depends on successful business travel in the coming year. Nearly half (48 per cent) feel travel is critical for keeping up on the latest trends, technology and advancements and establishing relationships with new clients (47 per cent).

Still, 96 per cent recognize there are threats to business travel, with inflation (44 per cent) among the biggest. Economic uncertainty has already affected travel for 91 per cent of Canadian businesspeople, forcing reduced travel budgets for 47 per cent, the survey said.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

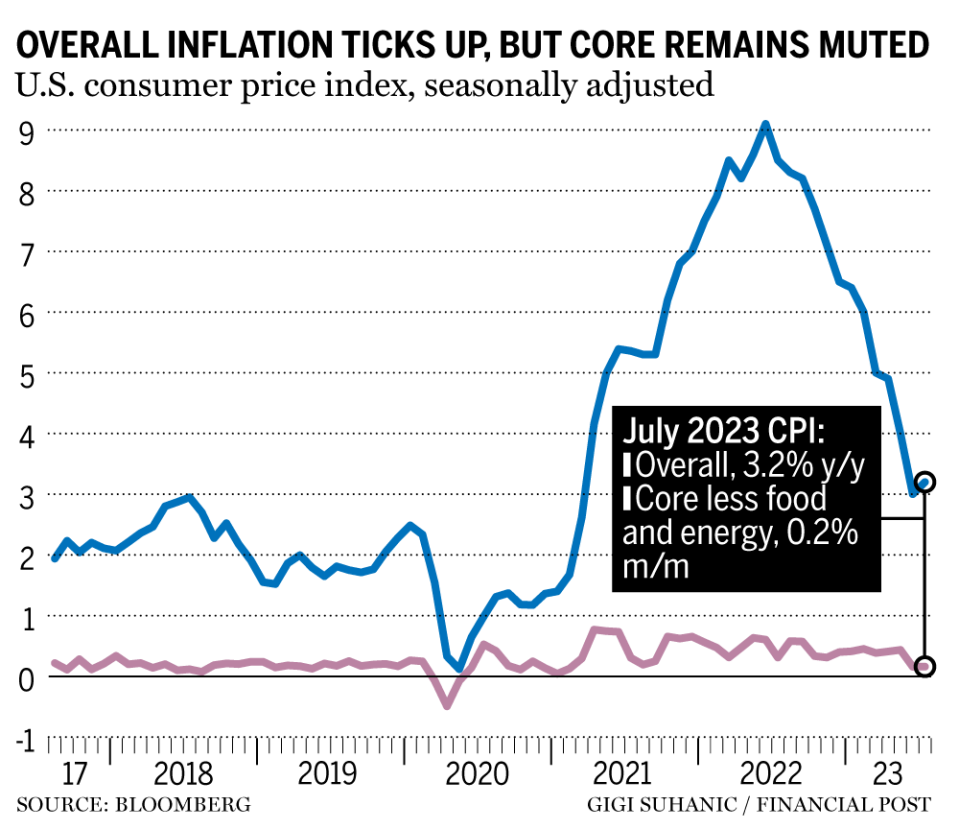

United States Federal Reserve policymakers are increasingly likely to leave interest rates unchanged at their next meeting in September after fresh data showed further signs of cooling inflation. The core consumer price index (CPI), which excludes often-volatile food and energy costs, rose 0.2 per cent for a second month, Bureau of Labor Statistics data showed Aug. 10. That marked the smallest back-to-back gain in more than two years. The overall CPI also increased 0.2 per cent in July and 3.2 per cent from a year earlier. — Bloomberg

___________________________________________________

Today’s data: U.S. producer price index, University of Michigan consumer sentiment index

Earnings: Air Canada, Power Corp. of Canada, Constellation Software Inc.

___________________________________________________

_______________________________________________________

Rio Tinto to build largest solar power plant in Canada’s North

Quebecor revenue, earnings surge after Freedom Mobile takeover

Montreal biotech with ‘promising’ weight-loss drug acquired by Ozempic maker

Stronger loonie pushes CPPIB to narrow first quarter investing loss

____________________________________________________

Canada’s tax system is not built to keep up with inflation — and it’s hurting some more than others. Tax expert Jamie Golombek examines a recent C.D. Howe report that says not all taxes are indexed, creating distortions that magnify the effects of rising prices.

____________________________________________________

Today’s Posthaste was written by Noella Ovid, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Yahoo Finance

Yahoo Finance