Posthaste: Canadian oil touted as best place for investors to ride out energy transition turmoil

Nobody said the energy transition would be easy.

In a recent report, Morgan Stanley strategists warn of turbulent times ahead as traditional energy sources decline and demand outstrips supply over the next decade.

“On the other side of energy transition lies a new, stable system, but the transition also entails risks that may be hedged with exposure to the energy sector,” said Stu Morrow, chief investment strategist of Morgan Stanley Wealth Management Canada.

One of the best places to ride out this turbulence, according to strategists, is Canadian oil and gas.

“We believe that Canada’s oil & gas industry can play a critical role in energy transition over the coming decades despite a less enthusiastic view from the market,” said Morrow.

Dividend yield and free cash flow for Canada’s energy sector is about two and a half times higher than those of U.S. peers and Canadian producers are less leveraged, says the report.

Yet the sector is trading at a discount to U.S. producers across most measures and in September was at its steepest discount to long-term average valuations compared with other sectors on the TSX.

The pessimistic outlook likely reflects uncertainty over the future of oil and gas, but Morgan Stanley believes it doesn’t take into account the potential for the gap between the price of Western Texas Intermediate crude and Western Canadian Select to narrow. Canadian oil prices have ranged between US$10 and US$28 lower than WTI this year.

One advantage of Canada’s energy sector is that producers don’t need high oil prices to be sustainable. Morgan Stanley analysis suggests that Canadian oil companies can maintain capital expenditures, meet dividend payments and net zero emission targets, and retire outstanding debt with WTI at US$65.

Though the cost of building an oilsands site is high, the operation costs are relatively low, with most projects able to generate positive cash flows when WTI is at US$40.

“While NZE [net zero emissions] implies major shifts in the energy sector, we believe that Canada’s energy sector may provide investors with sustained dividend and capital appreciation over the coming decade, assuming a reasonable outlook for the price of oil,” said Morrow.

Difficulties getting oil to market in the past have also hurt Canadian oil producers’ returns and widened the price gap between WTI and WCS. However, that differential should narrow when the Trans Mountain extension comes on line later this year, increasing pipeline capacity and providing access to Pacific Coast shipping terminals, he said.

The higher levels of emissions of oilsands production compared to its global peers has led to a wave of divestment from both international investors and producers in recent years.

However, when reviewing ESG scores across several countries, “Canadian oil may be considered as the preferred barrel globally,” said the report.

According to Morgan Stanley research, Canada is taking a proactive approach to cutting emissions and investing in clean energies.

Carbon taxes are headwinds to the industry, but the collaborative approach between industry and government is supportive of building new energy businesses, which strategists view as a competitive advantage to American peers.

Canada has also made strides on carbon capture and storage with dozens of projects underway, the largest by the Pathways Alliance, a group of the six major oilsands producers.

The Pathways Alliance is also working on 80 technologies that aim to reduce emissions in energy production, such as direct air capture technology and using renewable fuels to run operations, says the report.

Alternative energy will eventually grow big enough to compete with fossil fuels, but there are potential headwinds to supply and demand that could lengthen that transition, say strategists.

Investors can hedge against this volatility by exposure to Canadian energy.

“Canada’s energy sector has the potential to offset the risks associated with a turbulent transition to NZE by providing a secure and increasingly cleaner source of energy to trading partners,” said Morrow.

_____________________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

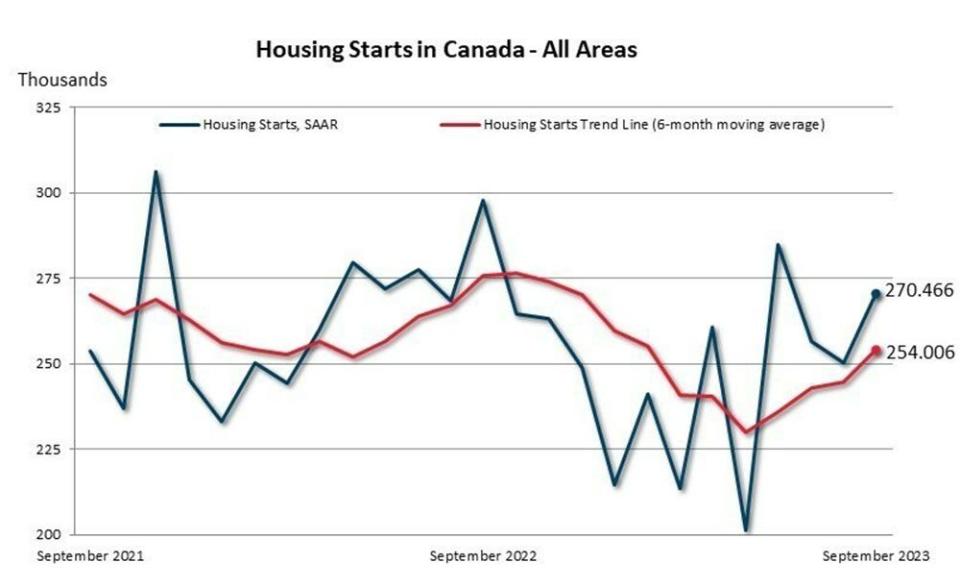

Builders are breaking ground on new homes in Canada at a “very strong pace” despite the challenges of higher interest rates and construction costs.

Canada Mortgage and Housing Corp. said the annual pace of housing starts in September rose eight per cent compared with August.

That leaves starts running more than 20 per cent above pre-pandemic levels on a trend basis, said Toronto-Dominion Bank economist Rishi Sondhi.

For the third quarter, housing starts increased four per cent, which Sondhi says will help support gross domestic product growth.

The annual pace of urban housing starts rose nine per cent in September with multi-unit urban starts gaining 10 per cent.

U.S. Federal Reserve chair Jerome Powell speaks at the Economic Club of New York

Small Business Minister Rechie Valdez will participate in a fireside chat at a Shopify Inc. townhall event in Toronto.

Today’s Data: Canada’s industrial product and raw materials price indices, U.S. Existing Home Sales, U.S. Leading Indicators

Earnings: AT&T, American Airlines Group, Blackstone Inc. and Nokia Corp.

Get all today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

_______________________________________________________

BHP chief calls Canada ‘really attractive’ market as he hopes to invest beyond potash

Arthur Irving out as chairman of Irving Oil in wake of strategic review

Luxury housing market resilient, but not bulletproof: Sotheby’s

There are all sorts of rules about how much you should withdraw from your retirement portfolio to make sure you don’t run out of funds. Investor Fraser Stark says the premise of these rules is that the opposite — not running out — constitutes success, but does it? Find out more

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance