Posthaste: This Canadian housing market just had its worst year since 2000

2023 was a rough year for real estate, but some Canadian housing markets fared worse than others, according to early data.

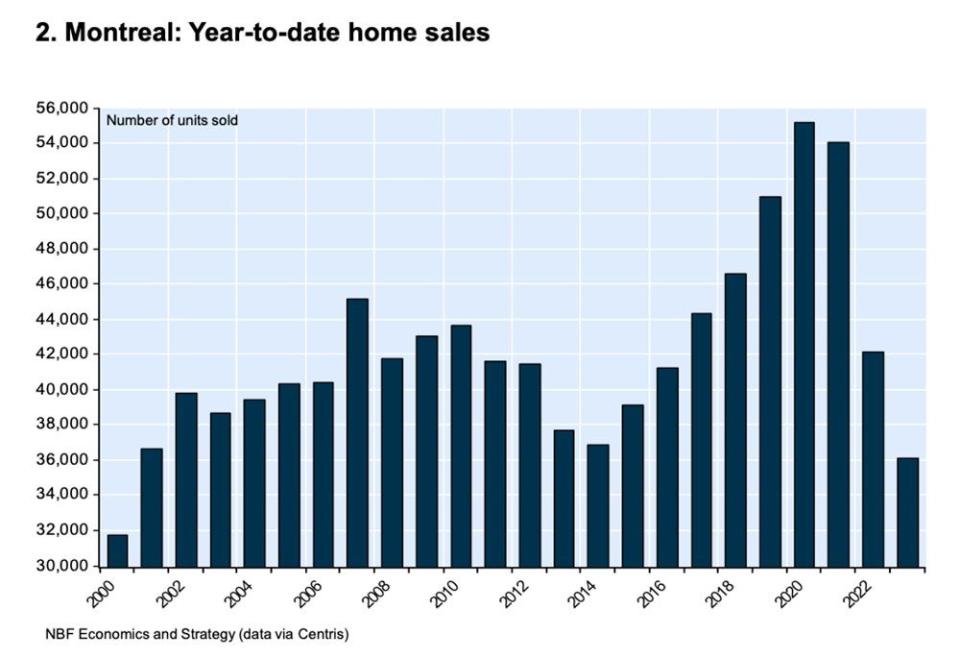

Take Montreal. Cumulative sales here for the year were down 14.3 per cent from 2022, making it the worst year for the Montreal housing market since 2000, said National Bank economist Daren King.

Seasonally adjusted home sales fell by 4.2 per cent from November to December. “As a result, sales are at a level so low that it has only been seen during the last two recessions (2008-2009 financial crisis and pandemic) in the last 20 years,” said King.

Other major markets also suffered double-digit declines for the year, but improved in December, managing a rebound in sales that some observers say could signal a turning point.

While Toronto home sales were down 12 per cent in 2023 from the year before, December sales bounced up 11.5 per cent over the same month last year.

Calgary sales performed even better, up 13.8 per cent in December from the same month last year. Sales for the year were down eight per cent from 2022.

The warm December weather may have played a role, but a recent fall in mortgage rates suggests housing markets will continue to improve, said Stephen Brown, deputy chief North America economist at Capital Economics.

Mortgage rates fell at the end of year, with the lowest available five-year fixed rate now at 5.4 per cent, 60 basis points lower than a recent peak in October.

Brown said even with the slight rebound in bond yields recently, it is feasible that fixed rates will continue to drop closer to 5 per cent.

December also brought a big improvement in sales-to-new listing ratios, he said. “Our assumption is that house prices will stabilize by March.”

There are risks, however, and a big one is the labour market. Jobs data out last week showed that the economy gained a mere 100 jobs in December and business surveys suggest that companies are cutting back on staff, Brown said.

“If the labour market were to weaken by more than we forecast in the coming months, it would raise the risk of forced home sales,” he said.

A big concern for the Bank of Canada is wage growth that came in hotter than expected. Inflation here is a clear risk to Capital’s forecast that the central bank will cut interest rates in March, said Brown.

_____________________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

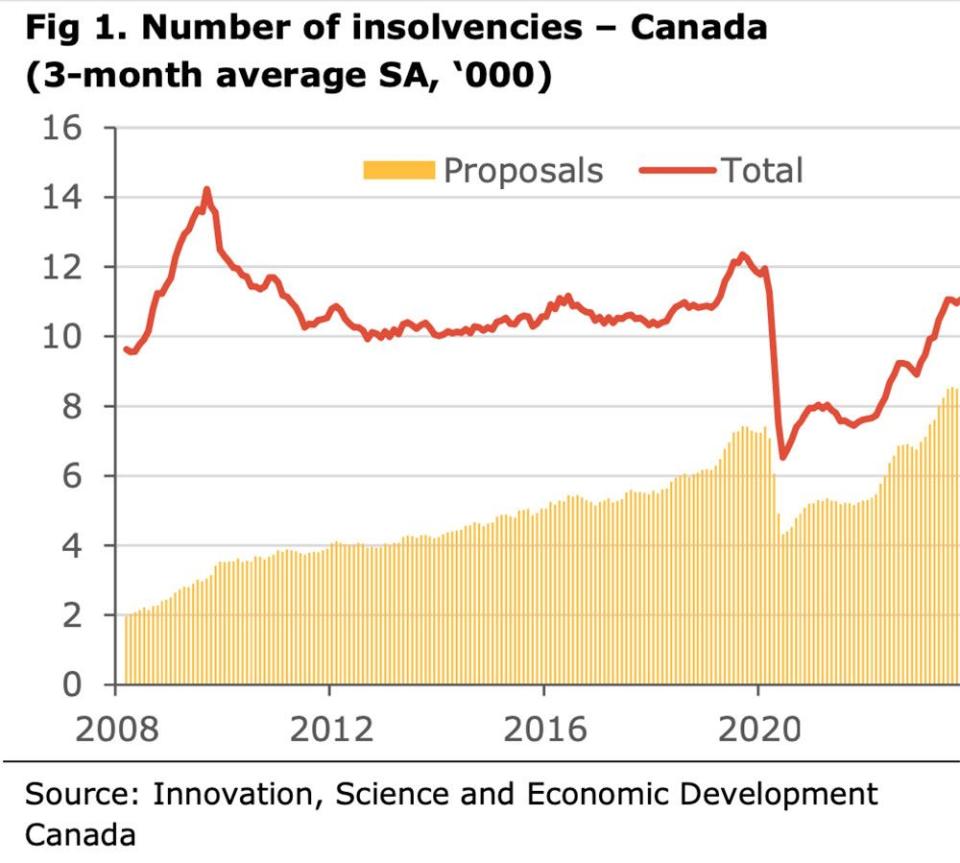

Insolvencies continue to climb in Canada, reaching the highest level since the start of the pandemic in November. Proposals, a renegotiation of debt terms, are about 25 per cent higher than their pre-pandemic levels nationwide, and significantly higher in almost every province, said Alberta Central chief economist Charles St-Arnaud, who brings us today’s chart.

In Ontario, British Columbia, Alberta, Saskatchewan and Manitoba — provinces that all have higher than average levels of debt-to-disposable income — the total level of insolvencies is above its pre-pandemic level, he said.

“Record levels of household debt, declining purchasing power due to rising inflation, and the sharp rise in interest rates are putting pressure on households’ finances,” said St-Arnaud.

Top executives at Canada’s big banks will speak at RBC Capital Markets’ Canadian bank CEO conference today.

Today’s Data: Canadian merchandise trade balance, building permits, U.S. goods and services trade balance, NFIB Small Business Economic Trends Survey

Earnings: Aritzia Inc, Tilray Brands Inc

Get all of today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

Geopolitical uncertainty buoys the case for hedging markets with oil

What to expect from the Canadian economy, housing market, stocks and more in 2024

Activist investors mount record number of attacks against companies

Global geopolitical risks are escalating, yet the market is shrugging it off, observes investing pro Martin Pelletier. The unrest and conflict threatens a resurgence of inflation from supply disruptions, but there is a way to hedge against these risks. Find out more from FP Investing

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance