Posthaste: In Canada, the whiff of recession is in the air

Good morning,

When the Bank of Canada first began hiking interest rates back in 2022 we were told it could take 18 months to two years for the effects to work through the economy.

Well, here we are.

Eighteen months on and we have now entered the period of “peak tightening effects,” said Desjardins chief economist Jimmy Jean.

So how does it look?

Economists say signs that the economy is weakening are now undeniable.

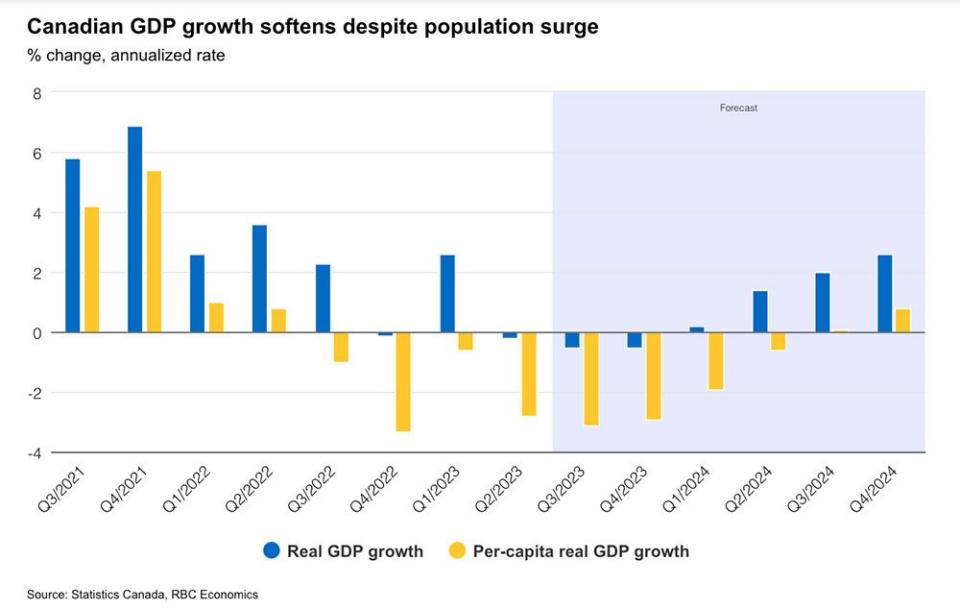

The second-quarter GDP reading was a big tipoff. Not only did it miss the Bank of Canada’s forecast, it also shrank, the second contraction in the past three quarters.

A flat estimate for July suggests momentum going into the third quarter was just as weak.

On the labour front, the 0.5 percentage point increase in Canada’s jobless rate over the past four months is the largest outside of the pandemic since the 2008/09 recession, said RBC Economics.

“Since the 1970s, there have been just six periods when the jobless rate rose by that much in such a short timeframe prior to this year — and four of them were during recessions,” RBC economists wrote in a report entitled “Canada’s economic engine is gearing down.”

Nor is economic data the only warning sign. Bank earnings last month were lacklustre and not just because lenders are putting away more money for bad loans, said Jean.

Banks are getting more careful about their spending and job vacancies in finance jobs dipped below their pre-pandemic averages in June, he said.

Some say the recession is already here.

The weak second-quarter GDP left Oxford Economics more convinced that the economy has slipped into a moderate recession that will last until early 2024. They have lowered their growth forecasts for Canada to 0.7 per cent in 2023 and a contraction of -0.5 per cent in 2024.

They also see the unemployment rate climbing as high as 7.2 per cent (it’s 5.5 per cent now) by mid-2024 as hiring slows and job losses rise.

Other forecasters expect less damage. Desjardins sees real GDP at 1.1 per cent for 2023 and flat for 2024 and RBC’s forecast is 1 per cent for 2023 and 0.6 per cent for 2024.

What does this mean for Canadians?

The mild recession that Desjardins expects at the turn of the year means that interest rates won’t be higher for too much longer, says Jean.

“By next March, we anticipate the Bank of Canada will deem the supply-demand rebalancing process well entrenched enough to warrant some monetary policy relief,” he said.

However, with inflation expected to persist until the end of next year, the Bank won’t be injecting as much stimulus into the economy as it has in past downturns.

That means while the recession might not be extremely painful, the recovery could be painfully slow, he said.

__________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

Homebuilding slowed further in Canada with the pace of housing starts dropping one per cent to an annual rate of 252,787 in August.

The latest numbers leave building 6 per cent below last year’s levels and well below the 290,000 annualized pace needed to keep up with population growth, said CIBC economist Katherine Judge.

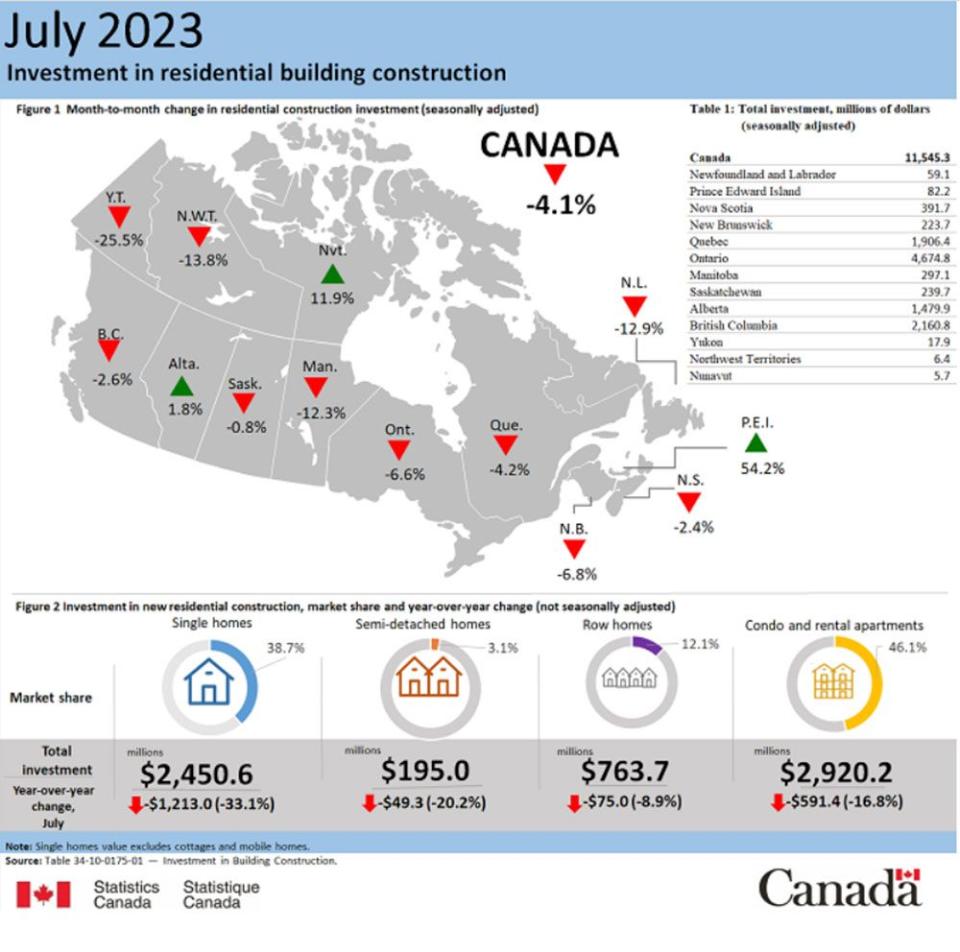

Investment in homebuilding also slumped in July, falling 4.1 per cent to $11.5 billion, with declines in eight provinces, Statistics Canada reported the same day.

Single-family home construction investment dropped 5.5 per cent to $5.8 billion, the lowest level since August 2020, said StatsCan, with Ontario accounting for most of the fall.

Bank of Canada deputy governor Kozicki speaks at the University of Regina

The Canadian Club hosts an event with Isabelle Hudon, CEO of Business Development Bank of Canada

The 24th World Petroleum Congress continues in Calgary

Today’s Data: Canada’s Consumer Price Index for August, U.S. housing starts and building permits for August

Get all today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

_______________________________________________________

Why Canada’s pension plan is standing by its $52-billion bet on China while other investors flee

Structured notes are growing so rapidly it’s fascinating to watch — here’s why

The structured notes market is now worth more than $91 billion in Canada, and is expected to grow much bigger. Investing pro Martin Pelletier explains why this investment segment has taken off and how it can serve as another tool to manage risk in your portfolio. Read more

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance