Posthaste: Canada at 'critical turning point' as poverty worsens, warns report

Canada has reached “a critical turning point” as the high cost of living and housing in this country push more people below the poverty line, says a report out today from Food Banks Canada.

According to the 2024 Poverty Report Cards, almost half of people nationally feel financially worse off than last year and one in four are suffering from food insecurity.

“Food Bank Canada’s 2024 Report Cards show that people in Canada, from coast to coast, are struggling to keep up with the rising cost of living, said Food Banks Canada chief executive Kirstin Beardsley.

“Though deeply concerning, these results are sadly unsurprising to the thousands of food banks across the country who have seen a 50 per cent increase in visits since 2021.”

One in 10 Canadians now live in poverty by the latest data, up substantially from just a few years ago, said the report.

It wasn’t always so. Between 2015 and 2020, Canada saw the most dramatic decline in poverty on record, with the rate dropping from over 14 per cent to 6.4 per cent, the report said.

But in 2022 poverty rates began to climb as the economy was buffeted by a series of challenges. Rising interest rates, though aimed at taming inflation, hit lower-income households the hardest, rapid population growth put pressure on social services and rents soared, increasing the share of income households needed to dedicate to housing.

Between February and April of this year, 25 per cent of people aged 18 to 24 went to a food charity because of lack of money.

The report lays out policy recommendations for Canada and each province designed to alleviate poverty, ranging from rent controls to youth employment programs to ramping up social assistance.

But so far governments aren’t rising to the challenge, said Food Banks Canada.

The report downgrades Canada from a D to D-, signalling that people are struggling more in 2024 with poverty and the cost of living than they did in 2023.

The country also received failing grades for housing affordability, access to health care and adequacy of government supports.

The study found that across Canada 47 per cent of people had difficulty navigating the tax system and didn’t know what tax benefits they were eligible for.

A quarter of Canadians said they struggle to access the social services they need.

Sign up here to get Posthaste delivered straight to your inbox.

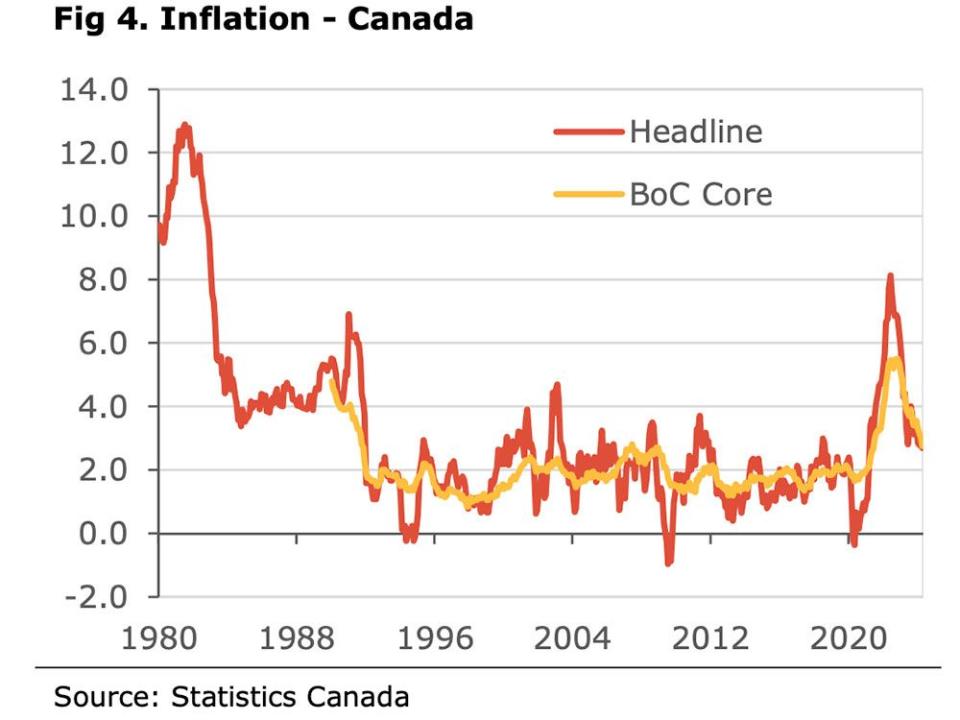

Canada’s inflation eased again in April, bolstering the case for an interest rate cut in June, say economists. Core inflation measures, which the Bank of Canada looks at, cooled for the fourth straight month and are now all below 3 per cent, falling within the central bank’s target range.

“There is nothing in today’s report that would prevent the BoC to cut June,” said Alberta Central chief economist Charles St-Arnaud.

“If the BoC doesn’t cut, it would be a matter of extreme caution in our view, rather than suggesting that upside risks to inflation remain a concern.”

AI4Canada Summit in Ottawa, the conference brings together leaders in government, industry, and academia to discuss critical topics to accelerate responsible AI adoption.

Federal Reserve minutes from the Federal Open Market Committee meeting

Today’s Data: United States existing home sales

Earnings: Target Corp, TJX Cos Inc, NVIDIA Corp

Short-term gains can leave you open to the hawks circling above

Good taxation policies don’t need slick videos to make a case for them

The banking crisis south of the border last year led many investors to shy away from the financials sector. But market strategist Marius Jongstra says there are pockets of value to be found if investors can cut through the noise and look at the fundamentals. Find out more

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at aholloway@postmedia.com with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

McLister on Mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance