Posthaste: Bank of Canada may pause rate hikes when it sees this big data

Good morning,

The big news in the economic world this week comes out Friday with the latest reading of Canada’s gross domestic product.

The last major economic data release before the Sept. 6 interest rate decision, the Bank of Canada will be watching this data closely.

“We think this print is very important for the BoC’s (September) decision,” Carlos Capistran, head of Canada and Mexico economics at Bank of America Merrill Lynch told Reuters. “The BoC is in a data-dependent mode and has not closed the door to further hikes.”

Economists expect to see a slowdown in the economy in the second quarter that could persuade the central bank to pause its interest rate hiking despite a recent inflation reading that came in hotter than expected.

Earlier this month bets on another hike in September rose after July’s consumer price index surged to 3.3 per cent, moving beyond the Bank of Canada’s target range of between one and three per cent.

After growing 3.1 per cent in the first quarter, the preliminary estimate for GDP in the second is 1 per cent, said Royal Bank of Canada economists, but they see it coming in even lower at 0.5 per cent. Both are below the Bank of Canada’s estimate of 1.5 per cent.

“Policy makers clearly are willing to respond with additional interest rate hikes if momentum in the economy isn’t softening enough to ensure inflation pressures will trend lower,” said RBC economists Nathan Janzen and Claire Fan.

“But we expect there will be enough signs of cooling demand to-date for the BoC to forego another increase in the overnight rate in September.”

Some of the drags on the economy in recent months are transitory, economists say, such as the wildfires still raging in Canada.

Stephen Brown, deputy chief North America economist at Capital Economics, said the worst Canadian wildfires on record appear to be behind much of the recent weakness in GDP and as more areas are evacuated, growth will likely remain weak in coming months.

Wildfires so far have burned more than double the hectares of forest than during the previous worst year in 1989, he said.

Oil and gas extraction fell 3.6 per cent month over month in May as some producers stopped operations as a precaution against the fires. The impact also showed up in June in a fall in manufacturing and wholesale sales, with large declines in Alberta and Saskatchewan, which were heavily affected by wildfires at the time, he said.

“The wildfires will make the Bank’s job harder as it will be tricky to determine the exact extent to which any weakness in the data is due to the wildfire disruption rather than the impact of high interest rates,” said Brown.

Statistics Canada will also release a preliminary estimate for July on Friday and early data suggest weakness continued in the third quarter, said RBC. Labour markets have shown signs of cooling, with the unemployment rate rising 0.5 percentage points in the three months to July. Job vacancies out next week should show further declines, said the economists.

A dock workers strike last month in British Columbia will also have had an impact.

Money markets see a 70 per cent chance that the Bank will hold in September, but that doesn’t mean we are done with interest rate hikes. Investors are still betting on another before the end of the year, with rates peaking at 5.25 per cent.

__________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

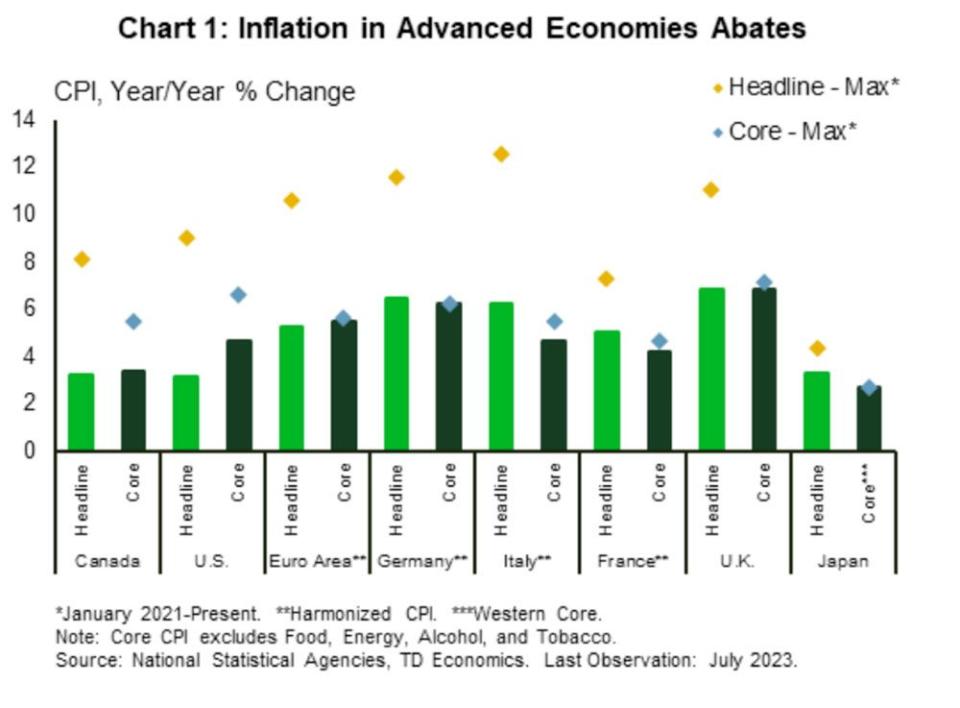

Inflation is easing in advanced economies, now that the energy price surge of last year has receded, says TD Economics.

“Compared to last year’s eye-watering levels today’s above-trend price gains look quaint,” writes TD senior economist Andrew Hencic.

In Italy the consumer price index which peaked at over 12 per cent has dropped back to 6.3 per cent. Canada and United States, which escaped the extremes of the natural gas price shock in 2022, have managed to bring price growth much closer to the 2 per cent target.

Earnings: Bank of Montreal, Bank of Nova Scotia, Best Buy, HP Inc.

_______________________________________________________

Canada needs to boost charging infrastructure to encourage more people to buy EVs, study says

Canadian autoworkers approve strike mandate at the Big Three

Investing lately has been the most challenging it’s been in the past three years, says investing pro Martin Pelletier. It’s included one of the worst-performing periods for balanced portfolios, with bonds selling off and investors herding into the megacaps while ignoring the rest of the equity market, which remains well below its 2021 highs. Pelletier says there is no better time for self-reflection than periods of uncertainty and structural shifts and investors need to challenge their thinking to see what tactics really work. Find out how here

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance