Posthaste: Bank of Canada fumbled its mid-pandemic policy response, economists say

Good morning!

The Bank of Canada fumbled its handling of policy during the middle of the pandemic, earning it a passing grade instead of top marks for its response, according to a report card from economists at Desjardins Group.

Though the central bank’s policy decisions helped stop a recession and facilitated the recovery, the bank could have done better, economists Royce Mendes and Tiago Figueiredo wrote in a note.

They said the Bank of Canada started off strong as COVID-19 hit, jumping into action as markets plunged and the economy ground to a halt amid initial lockdowns. But even though they “performed admirably,” policymakers missed the mark.

“Central bankers could have acted sooner,” Mendes and Figueiredo wrote, pointing out that Canada’s central bank dragged their heels compared to the U.S. Federal Reserve and waited two weeks to drop interest rates after the pandemic was declared. It took another two weeks for the bank to implement its bond buying program. The economists awarded the bank an A- for its initial response.

But its performance at the mid-point of the pandemic is what really dragged down the central bank’s grade, they said.

The bank failed to rein in its bond purchasing quickly enough, and was left holding a huge percentage of outstanding debt in the market — owning up to 60 per cent of some bond issues. That spawned “market functioning issues,” Desjardins said, without doing anything good for monetary stimulus.

Policymakers also shot themselves in the foot by pledging to hold interest rates for as long as there was slack in the economy. That was a serious miscalculation, as the bank assumed it was dealing with a demand problem, but both supply and demand were getting hammered by pandemic pressures. And then came inflation.

“As consumer prices began increasing more rapidly in 2021, the Bank of Canada’s pledge to keep rates on hold until ‘slack’ was completely absorbed looked more and more out of touch,” the economists wrote.

The bank went so far as to cite its forward guidance for continuing to hold rates in January, though rising inflation made a hike appear necessary. In hindsight, that decision was a mistake, Desjardins said. Added all together, policymakers’ overly large quantitive easing program and its steadfast commitment to keeping rates on hold made rising prices and a red-hot housing market worse.

“While it’s true that a firefighter can’t be criticized for using too much water when the fire is blazing, keeping the taps open and soaking reconstruction crews doesn’t do anyone any good,” the economists wrote, slapping the central bank with a C-.

At this stage of the pandemic, the central bank could also be doing better, Desjardins said. For example, the bank should have hiked rates by 75 basis points sooner to get inflation under control. It also hasn’t sold any of its bond holdings, which is seen as “too timid a response” to tackle soaring inflation, the economists said.

That has put the bank in a tricky position as a recession looms, with policymakers scrambling to figure out how best to tailor its tools to address soaring inflation as the economy slows.

Plus, with interest rates still fairly low and a sizable balance sheet, the Bank of Canada will find itself on less solid footing in case of a future shock. That earns the bank a B for its response at this stage, Desjardins said.

In the end, it would be wise for the central bank to spend some time assessing its pandemic response, the economists said.

“The Bank of Canada deserves a passing grade. The policies it put in place helped the economy avoid a much longer recession or even a depression. But there is always room for improvement.”

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

BYE-BYE BORIS Britain’s Prime Minister Boris Johnson announced his resignation on Thursday after more than 50 of his ministers quit in his latest political scandal. His announcement deepens the uncertainty facing the U.K. economy, already suffering under an inflation rate heading for double digits, the risk of a recession and Brexit. Reuters summarizes the key issues you need to know as the economy navigates political chaos. Photo by Henry Nicholls/Reuters

___________________________________________________

Jonathan Wilkinson, federal minister of natural resources, and Andrew Parsons, minister of industry, energy and technology for Newfoundland and Labrador, will hold a media availability at the end of the Energy and Mines Ministers’ Conference.

Minister of International Trade, Export Promotion, Small Business and Economic Development, Mary Ng, joins United States Trade Representative Katherine Tai and Mexico’s Secretary of Economy, Tatiana Clouthier Carrillo for a news conference at the conclusion of trilateral discussions at the Free Trade Commission meeting. The news conference will also mark the second anniversary of the Canada-United States-Mexico Agreement.

Today’s data: Canadian employment report, U.S. employment report, U.S. wholesale trade

Earnings: MTY Food Group Inc.

___________________________________________________

_______________________________________________________

Canada to fall into ‘moderate and short-lived’ recession next year, RBC warns

The great normalization has crushed investor sentiment — and that may be a sign the worst is over

‘Massive wealth’ Canadians stockpiled during pandemic being chipped away, study says

Rising recession fears strip some of the lift from loonie’s outlook

Howard Levitt: Cautionary tale shows risks of both sides ‘going for the jugular’ in court

_____________________________________________

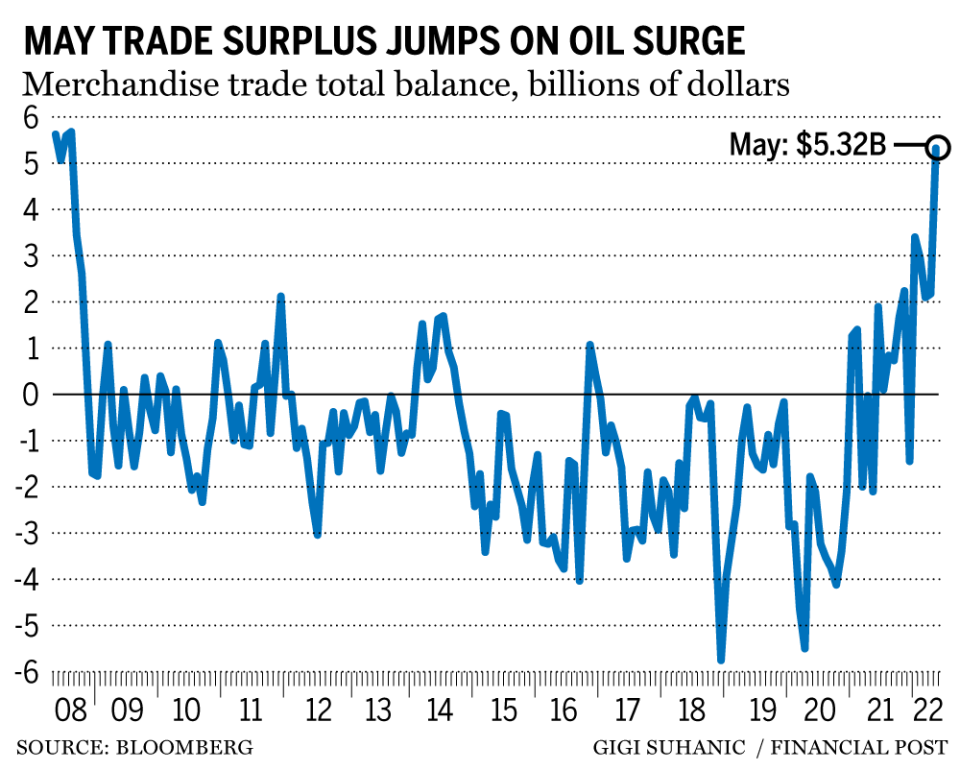

Canada’s merchandise trade surplus expanded to the largest in 14 years in May, as oil exports surged amid higher energy prices, Statistics Canada reported Thursday.

Exports rose 4.1 per cent from April and imports decreased 2.1 per cent. That brought the trade surplus from $2.2 billion in April to $5.3 billion in May, its biggest gain since August 2008.

Crude oil exports rose 9.2 per cent thanks to higher prices. Energy exports as a whole grew 5.8 per cent in May to $20.4 billion, and made up 29.8 per cent of all exports, a new high.

____________________________________________________

The Canadian housing market is slowing down. During April, figures from the Canadian Real Estate Association showed that home sales declined by 12.6 per cent one month after the Bank of Canada announced its first post-pandemic rate hike of 25 basis points, or 0.25 per cent.

The trend has continued downwards, with a recent Toronto Real Estate Board report confirming that Toronto home sales were down 41 per cent in June, compared to the same time last year.

What does falling home prices mean for Canadians, whether they are hoping to buy, sell or invest? Our content partner MoneyWise Canada has some insights into the market.

____________________________________________________

Today’s Posthaste was written by Victoria Wells (@vwells80), with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Yahoo Finance

Yahoo Finance