Posthaste: Bank of Canada expected to pause, but limping loonie could spur hikes in months to come

Good Morning!

It’s the Bank of Canada’s decision day on Wednesday and the pundits see little chance of anything but a hold on interest rates.

In fact, markets have priced in the probability of the central bank making a ninth hike this week at effectively zero.

When the Bank last raised rates in January it said if the economy unfolds as expected it would hold the rate while it assesses the impact of hikes so far.

Since then there have been signs the economy has slowed even more than the Bank expected. January’s inflation rate came in at 5.9 per cent, a significant decline from 6.3 per cent the month before, and the economy recorded no growth in the fourth quarter.

So a hold this week looks almost certain, but some economists argue that it is too soon to say interest rates in this country have hit their peak.

One big concern is divergence with the United States Federal Reserve.

The Bank of Canada is limited in how much its interest rate increases can lag the Fed’s, as the gap could weaken the Canadian dollar and fuel inflation, said Derek Holt, head of Scotiabank’s capital markets economics, in a note.

Money markets are betting that chairman Jerome Powell will raise the Fed funds rate to between 5.25 per cent and 5.5 per cent, and that would test the Bank of Canada’s resolve, said economists in a Bloomberg survey.

And traders in overnight swaps are betting the Canadian central bank will eventually deliver another quarter-percentage-point hike at some point this year, says Bloomberg.

“Canada does not need more hikes to cool inflation, although they may be forced to hike if the gap in policy rates starts to cause major currency weakness,” said BofA global economist Ethan Harris.

Capital Economics’ Stephen Brown thinks the Bank of Canada, while holding on March 8, will continue to stress its readiness to resume hikes if needed.

“If the Bank were to send a dovish message [this] week, it would risk a sharper exchange rate depreciation that would increase the upside risks to imported goods inflation,” wrote Brown.

The loonie was trading at 73.42 this morning.

While acknowledging that a growing policy rate differential would not be supportive of the Canadian dollar, National Bank economists disagree that this will force governor Tiff Macklem’s hand.

The Bank of Canada last May expressed concerns about the currency, but back then prices pressures were at their peak, they said.

Since then the Bank has downplayed those fears, with deputy-governor Paul Beaudry saying in a speech last month: “We shouldn’t be too concerned if Canada follows a slightly different path to normalization than our counterparts.”

A wide interest rate gap “might not be good news for the C$ but, as long as inflation moderation continues we think the Bank will (rightly) prioritize not crushing the Canadian economy under the weight of even higher rates,” said National.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

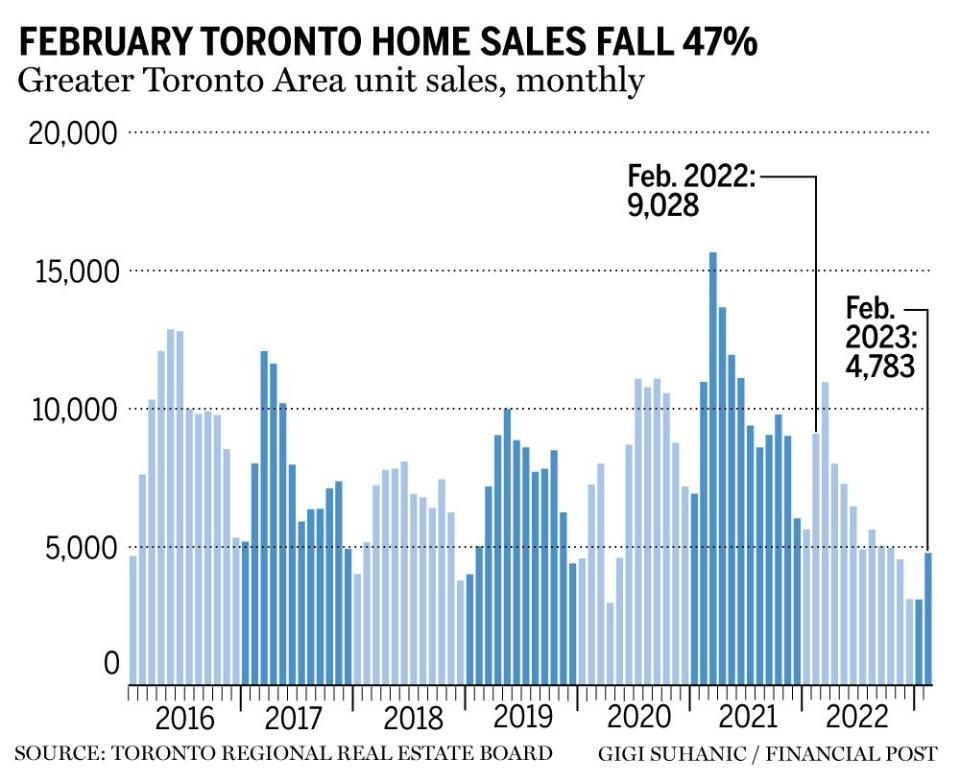

Toronto home sales rose 8.5 per cent in February from the month before, the second increase in three months. So is this good news for the housing market of Canada’s biggest city? Not necessarily, points out Daren King, an economist with National Bank of Canada.

Sales were down 47 per cent from the same month a year ago and are near the low reached during the 2008 global financial crisis, he said.

Moreover, the monthly upturn could prove short-lived given a rally in long-term Treasury yields could signal a rise in fixed mortgage rates in coming weeks.

National economists expect the Bank of Canada to hold its rate at 4.5 per cent for most of 2023, but still the “outlook for a recovery in the housing market remains limited,” said King.

“As a result, sales are expected to remain below their historical average in the coming months.”

Prospectors & Developers Association Of Canada (PDAC) Conference in Toronto

The Canadian Federation of Agriculture hosts its annual general meeting

The standing committee on agriculture and agri-food meet on food price inflation

Today’s Data: U.S. factory orders, Global Supply Chain Pressure Index

Earnings: Cargojet, Birchcliff Energy, Resolute Forest Products, Element Fleet Management

___________________________________________________

_______________________________________________________

Private mortgage risk flagged by regulators amid growth in shadow banking

Mining guru Ken Hoffman says U.S. Inflation Reduction Act has ‘changed everything’ for industry

3 factors affecting our currency that will hurt Canadians for years to come

Nordstrom joins the exodus of U.S. retailers from Canada: What you need to know

Family Finance, the Financial Post column that helps readers solve their money issues, is back. In this instalment a couple in Ottawa is investing heavily in real estate to fund an early retirement, so much so that they’re focused on paying down payments rather than contributing to registered investment accounts that could add to their government pensions. Family Finance asked two financial planners to help them come up with a better plan. Read their solution here.

Need help to solve your money issues? Drop us a line at aholloway@postmedia.com with the general gist of your problem and we’ll try to find some experts to help you out.

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance