Posthaste: Bank of Canada could cut interest rates earlier than expected — if it goes by this data

Good morning,

When is enough, enough?

That has become the burning question as the Bank of Canada and other central banks near the end of what has been an extraordinary interest rate-hiking cycle.

To answer that you need to understand what the Bank is looking at to make its inflation forecasts, say CIBC economists Avery Shenfeld and Ali Jaffery in a new report.

And those signposts have changed.

There was a time when it was self-evident, said the economists. The Bank would look at whether real gross domestic product would run above or below its estimate for Canada’s non-inflationary potential — something known as the “output gap.”

But that reading became much more challenging during the labour shortages, supply chain disruptions and productivity lags of the COVID-19 pandemic.

“The reality is that the output gap hasn’t been a useful tool, or a guide to forecasting BoC rate decisions, since the fall of 2021,” said Shenfeld and Jaffery. “Understanding what has replaced it is therefore key for financial market participants.”

The labour market — unemployment, job vacancies and wages — has become a much more reliable indicator of excess demand or supply than the “ever-vacillating measure of the output gap,” they argue.

As evidence that these measures were gaining importance, the Bank began including labour market indicators in its monetary policy reports.

On this front there have been definite signs of improvement, at least from the perspective of the inflationary battle.

In July the unemployment rate rose to 5.5 per cent, nearing the 5.7 per cent which CIBC calculates is the sweet spot or NAIRU, the non-accelerating inflation rate of unemployment.

“A couple more quarters of soft job gains and an upward creep in unemployment rate should do the trick, or perhaps even less if job vacancies further ease and help wage pressures,” said the economists.

CIBC forecasts that Canada’s jobless rate will hit 6 per cent by early 2024, and economic models suggest that could mean no more rate hikes this year and rate cuts in the first quarter of 2024.

“If the Bank hikes in September, it would be doing so in the face of a job market outlook that suggests it’s not necessary,” said Shenfeld and Jaffery.

Their forecast is more dovish than the markets which are betting on another 25 basis-point hike by the end of this year, and no rate cuts in the first half of 2024.

__________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

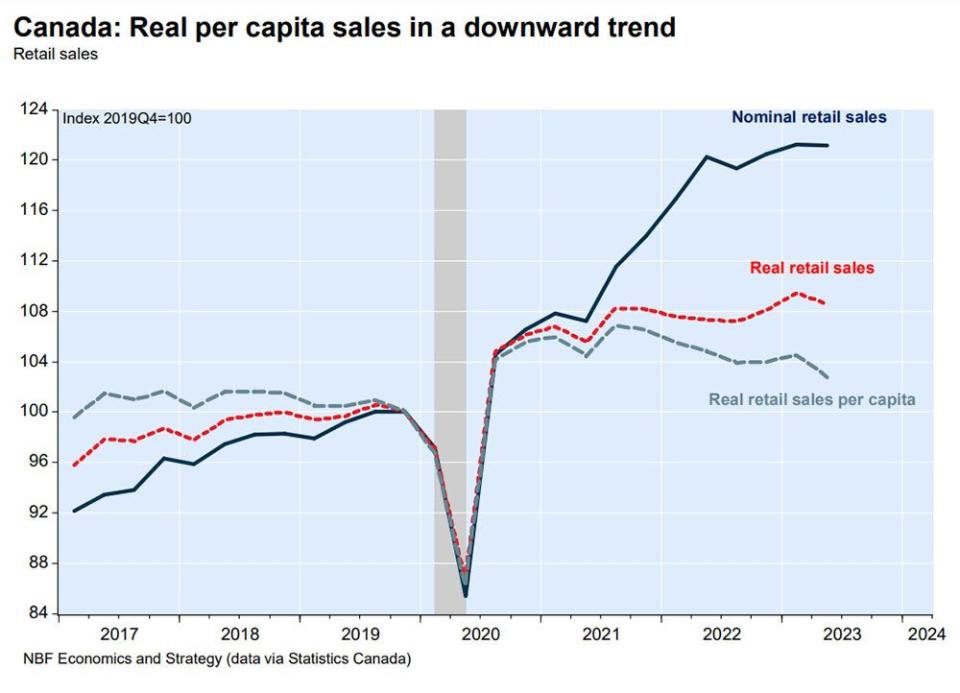

Retail sales are helping to build a case for the Bank of Canada to hold next month, say some economists.

Sales increased 0.1 per cent in June, mostly driven by auto and parts dealers. You take those out of the equation and core retail sales decreased 0.9 per cent.

Especially hard hit were sales related to housing — everything from building materials to gardening equipment to furniture and appliance dealers. Combined sales of these goods hit a two-year low, said National Bank economist Kyle Dahms.

Stripping out inflation, real retail spending dropped 3.2 per cent in the second quarter, said Dahms. When you factor in population growth — retail spending per capita — the drop gets even deeper.

Jackson Hole Economic Symposium begins in Wyoming

Today’s Data: U.S. Initial Jobless Claims, U.S. Durable Goods,

Earnings: Royal Bank of Canada, TD Bank, Dollar Tree, The Gap Inc., Intuit, Nordstrom

_______________________________________________________

Unifor blocks Metro’s Ontario warehouses, demands ‘serious goddamn offer’ to end strike

Ottawa needs to be ‘careful’ with placing caps on international students, businesses say

Slumping retail sales could keep Bank of Canada interest rate on hold

Pensions may seem similar at first glance, but there are significant variations that can impact retirement income, estate planning, control and costs. Wealth adviser Chris Warner dives into the unique features of both the multi-employer pension plan (MEPP) and the individual pension plan (IPP) to help you make an informed decision. Read more

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance