Pokemon GO may be the dawn of a new era for Nintendo

Nintendo (NTDOY) has figured out how to turn a 90’s era game into one of the hottest apps in the world. And investors are going bonkers.

Last Wednesday, Nintendo launched Pokemon GO and it rocketed to become the No.1 free app in Apple’s (AAPL) US iTunes store. Shares of Nintendo jumped over 20% on Monday in Japan as buzz over a mobile game called Pokemon GO went parabolic.

Of course, one game isn’t going to be responsible for such a large price move in a multi-billion company, which has its legacy in gaming consoles.

“Despite the substantial success of Pokémon Go in the initial few days since its launch into only three countries, we still view Pokémon Go as a ‘leadoff hitter’ for Nintendo’s foray into mobile gaming,” Deutsche Bank’s Han Joon Kim said on Sunday. “We view Animal Crossing and Fire Emblem, slated for fall 2016, and Zelda for mobile possibly coming in spring 2017, as the real big hitters to drive Nintendo to score high in mobile.”Kim has a Buy rating on the stock with a price target of 23,600 yen, which is 45% above Friday’s closing price.

Pokemon GO has its problems.

The game involves users physically going to landmarks where they can see and interact with objects like Pokeballs and Pokemon. Pokemon GO effectively turns the real world into the setting for the game. This has already led to numerous accidents.

In addition to the physical injuries, users have experienced slow loading times and other technical glitches that may occur from heavy usage.

“To us this suggests the game is being overloaded by demand, which is a good thing longer term, assuming it is solved quickly,” Macquarie analyst David Gibson said in a note to clients on Thursday.

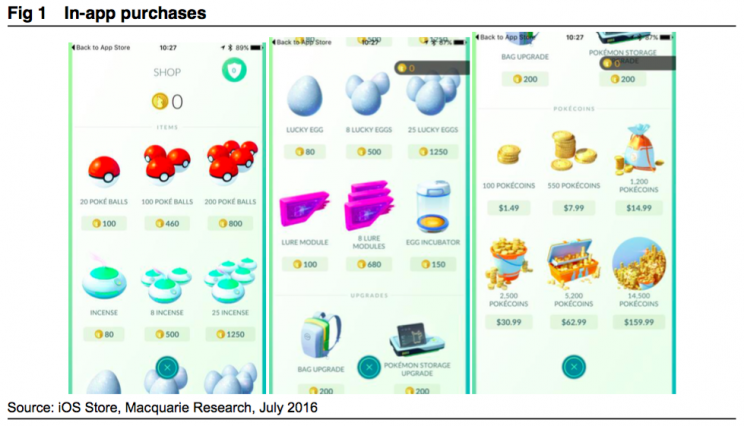

While Pokemon GO is free to download and play, there are lots of monetization opportunities for Nintendo.

“We had thought the title as per its beta would have little monetization,” Gibson said. “Instead, it has more than we expected; as users build their Pokémon inventory, spending money becomes needed to store, train, hatch and battle. The most popular item in Australia is $0.99 of coin, which we think is a positive, as it means its #2 gross ranking is being driven not by big spenders but by a large number of users.”

For Nintendo, is this for real?

“We highlight three components to enduring mobile success: 1) maximizing downloads; 2) retaining as many as possible of these users with good content; and 3) ensuring longevity through smooth operations,” Kim said. “With regard to the first point, Pokémon Go has gone beyond success to become a phenomenon, topping the revenue grossing charts in the three regions into which it has been launched: the US, Australia and New Zealand. The company has stopped rolling out to new countries, as demand is overloading its server capacity. How Niantic deals with issues in the coming weeks will determine the longer-term financial success of Pokémon Go, in our view.”

For investors, it is worth reiterating that this is just one game. The risk is that future games don’t pan out as well.

“While Pokémon Go is unlikely to materially impact on Nintendo’s financials (as a minority investment into Niantic, the studio behind Pokémon Go), we are confident that Nintendo’s future mobile pipeline will,” Kim said.

“If nothing else, Pokémon Go has shown that there are “dormant” Nintendo fans eager to trial its content for smartphones.”

Sam Ro is managing editor at Yahoo Finance.

Read more:

Citi analyst warns Brexit is bad news for Apple iPhone sales

Best Buy is almost out of crummy competitors to make it look good

The not-so-secret way millionaire investors get way richer

Wall Street: It’s not just Amazon — ‘There is no clear replacement for the skinny jean’

Yahoo Finance

Yahoo Finance