'Pokémon Go' could boost Apple sales by $3 billion

Nintendo (NTDOY) isn’t the only company cashing in on the “Pokémon Go” phenomenon.

According to Needham analyst Laura Martin, the mobile game could be responsible for adding $3 billion to Apple’s (AAPL) top line.

“Nintendo’s market cap has risen by $20B,” Martin said in a note to clients. “By contrast, AAPL’s market cap rose by only $2B between July 6-18 (above the S&P500’s move). We estimate that APPL could generate $3B of incremental high-margin revenue from ‘Pokémon Go’ over the next 12-24 months. As background, ‘Candy Crush’ generated more than $1B of revenue in … 2013 and 2014 and Pokémon Go’s ratio of paid users to total users is 10x higher.”

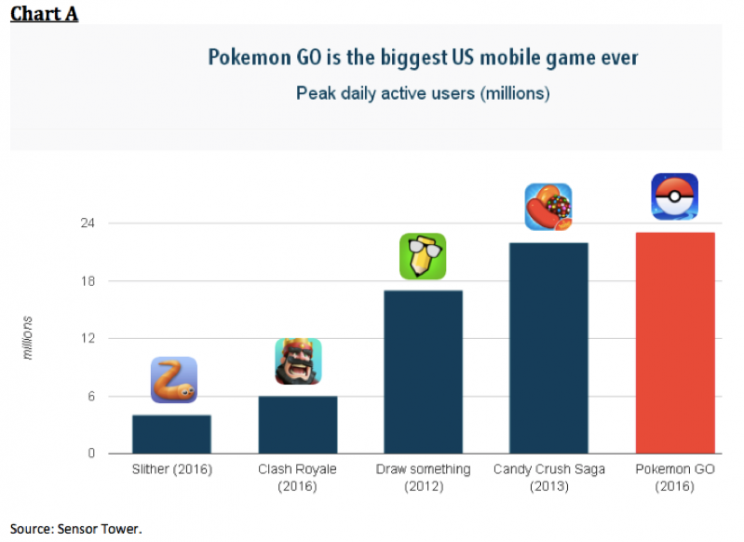

“Pokémon Go” is an augmented reality (AR) game. Specifically, it allows players to hunt virtual monsters in the real world. According to data cited by Martin, “Pokémon Go” is already the biggest mobile game to hit the US ever.

Furthermore, players spend more time playing “Pokémon Go” than they do using Facebook and Snapchat.

It’s worth noting that these are estimates, which means there is no guarantee they’ll come to fruition. Even the professional Nintendo analysts are having a tough time figuring out just what “Pokémon Go” means for the company.

Having said that, Martin presents an interesting case here. From her note: “We believe ‘Pokémon Go’ underscores 2 under-appreciated investment qualities of APPL: 1) AAPL is THE global distribution platform for mobile content winners (not just ‘Pokémon Go’), with the wealthiest consumers; and 2) for ‘Pokémon Go,’ we believe APPL keeps 30% of Pokémon Go’s revenue spent on iOS devices, suggesting upside to earnings, plus valuable options on future hits.”

Martin has a rating of Strong Buy on Apple with a $150 price target.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Pokemon GO may be the dawn of a new era for Nintendo

There’s something ‘animal’ about the stock market right now

Everyone complaining about P/E ratios is using them wrong

Stocks today are reminiscent of 2 of history’s most exciting buying opportunities – RBC

Yahoo Finance

Yahoo Finance