PNC Financial (PNC) Announces a 3% Hike in Quarterly Dividend

The PNC Financial Services Group, Inc. PNC has announced a hike in its quarterly common stock dividend. The company declared a quarterly cash dividend of $1.60 per share, marking an increase of 3% from the prior quarter. This dividend will be paid on Aug 5 to shareholders of record as of Jul 15, 2024.

Before the recent hike, PNC raised its dividend by 3.3% to $1.55 per share in July 2023. Also, the company has a five-year annualized dividend growth of 8.84%. At present, its payout ratio is 46% of earnings. This indicates that it retains adequate earnings for reinvestment and future growth initiatives while delivering lucrative returns to its shareholders.

Considering yesterday’s closing price of $158.84, PNC’s dividend yield is currently pegged at 4.03%, which is above the industry average of 3.73%.

Apart from regular dividend hikes, the company also has a share repurchase program. In the second quarter of 2022, a 100 million share repurchase plan was authorized. In the first quarter of 2024, the company repurchased 0.9 million shares for $0.1 billion. As of Mar 31, 2024, nearly 44% of shares were available for repurchase under the authorization. The company expects to maintain a similar level of share repurchase activities in the upcoming quarters of 2024.

Earlier this week, PNC announced that the 2024 Fed’s stress test results determined a preliminary Stress Capital Buffer (SCB) of 2.2% for the four quarters beginning Oct 1, 2024. However, since this is below the regulatory minimum, the SCB is set at 2.5%, which is consistent with the SCB in effect through Sep 30, 2024. As of Mar 31, 2024, PNC reported a CET1 ratio of 10.1%, which is more than 7%, reflecting strong capital levels.

Some other participants from the test that are enhancing capital distribution plan post stress test results are Wells Fargo & Company WFC and Bank of America Corporation BAC. WFC plans to raise its third-quarter 2024 common stock dividend to 40 cents per share, marking an increase of 14%. BAC intends to increase the quarterly cash dividend on common stock by 8.3% to 26 cents per share in the third quarter of 2024.

PNC Financial benefits from a strong balance sheet position. The total loan and deposit balances have been witnessing an uptrend over the last few years. As of Mar 31, 2024, total deposits and loans were $425.6 million and $319.8 million, respectively. The increasing loan balances and a well-diversified deposit base are likely to offer support to its financials.

Moreover, the company maintains a solid liquidity position, with $59.5 billion in total cash due from banks and interest-earning deposits in banks. Given the company’s strength in balance sheet and decent liquidity position, its capital-distribution activities seem sustainable and are likely to stoke investors’ confidence in the stock.

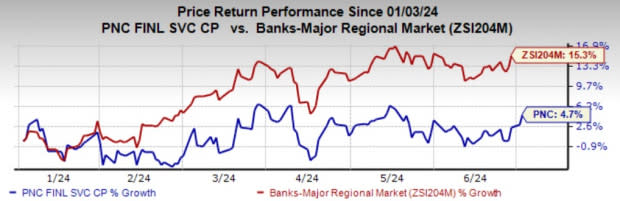

Shares of PNC have gained 4.7% in the past six months compared with the industry’s growth of 15.3%.

Image Source: Zacks Investment Research

At present, PNC carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance