Plymouth Industrial REIT Inc. (PLYM) Q1 2024 Earnings: Misses Analyst Revenue and Earnings Estimates

Revenue: Reported revenue for the quarter, actual figures not provided in the text, comparison with the estimated $51.53 million not possible.

Net Income: Specific net income for the quarter not disclosed, unable to compare against the estimated net loss of $1.65 million.

Earnings Per Share (EPS): EPS details not mentioned, preventing comparison with the estimated EPS of -$0.04.

Balance Sheet and Liquidity: Maintained strong with over 90% of debt at fixed rates, operating within the 6x range throughout 2024.

Investment and Growth Strategy: Focused on accretive growth translating into FFO growth, planning to fund new opportunities through asset sales and credit facilities.

Market Activity: Transaction market unlocking earlier than anticipated, indicating a proactive approach to growth and investment.

Leasing Dynamics: Observed changes in tenant behavior with some taking longer to finalize lease agreements, suggesting a cautious market sentiment.

Plymouth Industrial REIT Inc. (NYSE:PLYM) released its 8-K filing on May 3, 2024, revealing the financial outcomes for the first quarter of 2024. The company, a self-administered and self-managed Maryland corporation, focuses on acquiring and managing Class B industrial properties across the United States.

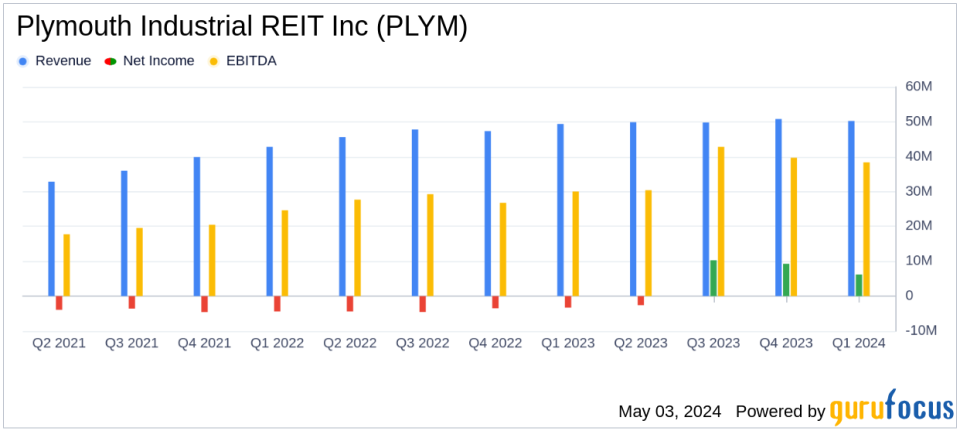

For Q1 2024, Plymouth reported a revenue of $51.53 million, aligning with analyst estimates. However, the earnings per share (EPS) and net income fell short of expectations, with an EPS of -$0.04 and a net loss of $1.65 million, reflecting challenges in achieving profitable growth.

Company Overview and Portfolio Insights

Plymouth Industrial REIT's portfolio predominantly consists of distribution centers, warehouses, and light industrial properties, strategically located in key markets like Florida, Ohio, Indiana, Tennessee, Illinois, and Georgia. The company's revenue primarily stems from rental income, with a focus on maintaining a diversified tenant base to stabilize cash flows.

Strategic Developments and Market Positioning

During the earnings call, CEO Jeff Witherell highlighted several strategic initiatives, including new investments in the Golden Triangle area, driven by significant commitments from major corporations like Toyota and Honda. The company's strong balance sheet and liquidity position, with over 90% of debt at fixed rates, supports its strategic growth initiatives aimed at enhancing shareholder value through accretive acquisitions and effective capital management.

Operational Challenges and Opportunities

The company faces challenges in the transaction market, which has shown signs of activity earlier than anticipated. Management's focus remains on growth that translates into funds from operations (FFO) growth, funded through asset sales and credit facilities. Additionally, the leasing landscape presents both challenges and opportunities, with significant tenant negotiations underway that could influence future revenue streams.

Financial Health and Future Outlook

Plymouth's financial position is solid, with strategic efforts to manage debt and leverage effectively. The company's approach to match funding acquisitions with asset sales and credit usage demonstrates prudent financial management. Looking ahead, Plymouth aims to capitalize on market opportunities, particularly in regions experiencing industrial growth due to reshoring and infrastructural developments.

Conclusion

While Plymouth Industrial REIT Inc. aligns with revenue estimates, the EPS and net income shortfall highlight ongoing challenges. However, strategic investments, a robust balance sheet, and active market engagement position the company to navigate the dynamic industrial real estate environment effectively. Investors and stakeholders will likely watch for improvements in profitability and strategic execution in upcoming quarters.

Explore the complete 8-K earnings release (here) from Plymouth Industrial REIT Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance