The Pluralsight (NASDAQ:PS) Share Price Is Down 59% So Some Shareholders Are Wishing They Sold

Pluralsight, Inc. (NASDAQ:PS) shareholders will doubtless be very grateful to see the share price up 52% in the last month. But that isn't much consolation to those who have suffered through the declines of the last year. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 59% in that time. Some might say the recent bounce is to be expected after such a bad drop. It may be that the fall was an overreaction.

View our latest analysis for Pluralsight

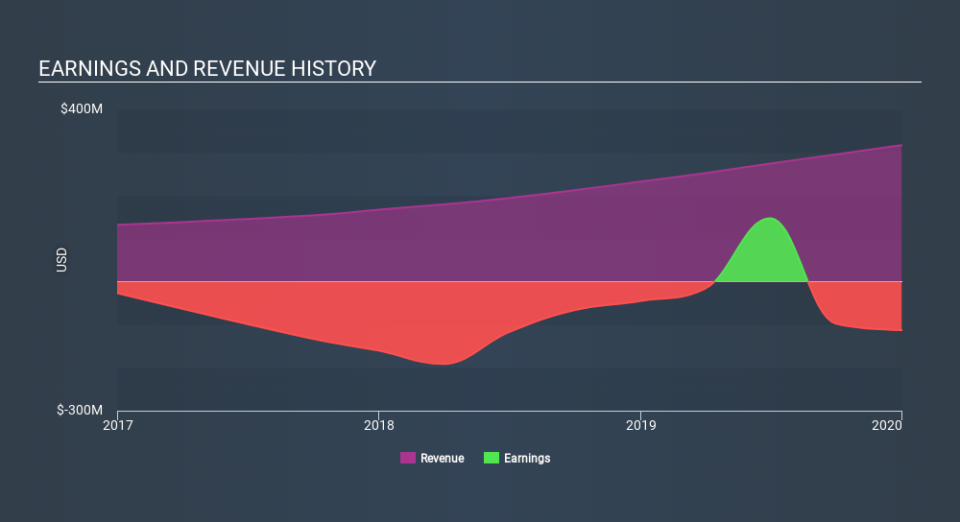

Pluralsight isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Pluralsight increased its revenue by 37%. We think that is pretty nice growth. Unfortunately it seems investors wanted more, because the share price is down 59% in that time. It is of course possible that the business will still deliver strong growth, it will just take longer than expected to do it. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Pluralsight shareholders are down 59% for the year, even worse than the market loss of 0.8%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 29%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Pluralsight has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

Pluralsight is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance