How to Play FedEx (FDX) Stock Ahead of Its Q4 Earnings?

FedEx Corporation FDX is set to release its fourth-quarter fiscal 2024 (ended May 31, 2024) results on Jun 25, after market close.

Some investors may be deliberating whether to purchase the stock of this transportation heavyweight before Jun 25 or wait for a better entry point.

The Zacks Consensus Estimate for revenues is pegged at $22.12 billion, suggesting growth of 0.85% from the year-ago quarter’s reported figure. The consensus mark for earnings is pegged at $5.34 per share, indicating an 8.1% rise from the year-earlier actuals. The estimates for earnings have improved 0.19% over the past 60 days.

Demand Erosion Likely to Dent FDX’s Q4 Results

FDX continues to struggle due to the normalization of volume and pricing trends in the post-COVID scenario. Geopolitical uncertainty and higher inflation continue to hurt consumer sentiment and growth expectations, particularly in Asia and Europe. The resultant weakness in package volumes is likely to have hurt FedEx's revenues in the to-be-reported quarter.

The performance of the Express unit, FDX's largest segment, is likely to have been hurt due to demand-induced volume weakness. We anticipate revenues from the Express unit to inch down 0.2% from fourth-quarter fiscal 2023 actuals.

Cost-Cuts Likely to Aid Results

Given the post-COVID adjustments in business, FedEx is realigning its costs under a companywide initiative called DRIVE. FDX’s cost-cutting efforts are likely to have aided its bottom-line performance in the quarter under discussion.

These cost-reduction initiatives include reducing flight frequencies, parking aircraft and cutting staff. We are impressed by FDX's efforts to control costs in the face of persistent revenue weakness. We anticipate expenses from salaries and benefits in fourth-quarter fiscal 2024 to inch down 0.2% from fourth-quarter fiscal 2023 actuals.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for FDX this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here, as FedEx has an Earnings ESP of -1.54% (the Most Accurate Estimate is currently pegged at $5.26 per share, eight cents below the Zacks Consensus Estimate) and carries a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Impressive Price Performance

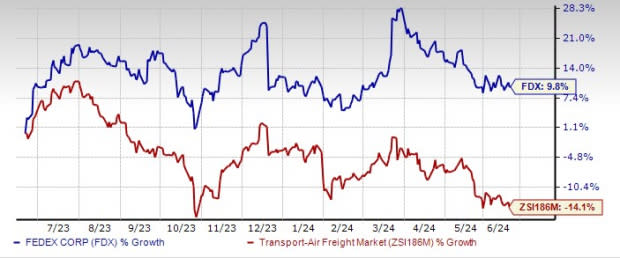

Despite demand weakness, shares of FDX gained 9.8% in a year’s time against its industry’s 14.1% decline.

Image Source: Zacks Investment Research

Fundamental Strength

For long-term investors a single quarter’s results are not so important. They would rather base their investment decision on the underlying fundamentals.

The comprehensive DRIVE program is aimed at improving the company’s long-term profitability. Driven by the technology-focused consolidation and improved efficiencies, the DRIVE program is expected to result in $1.8 billion in permanent savings this fiscal year and another $2.2 billion in fiscal 2025.

Management continues paying dividends and buying back shares highlighting financial bliss. The company announced a 10% increase in its quarterly dividend to $1.38 per share in June 2024.

FDX is also active on the buyback front. It expects to repurchase $2.5 billion of common stock and pay $1.3 billion in dividends during fiscal 2024 despite the fact that revenues are expected to decline in the low single digits.

Strong Growth Prospects

The Zacks Consensus Estimate for fiscal 2024 earnings per share are currently pegged at $17.76, indicating 18.7% growth from 2023 levels. Fiscal 2025 EPS is expected to grow 14.5% from fiscal 2024 actuals to $20.34. The company’s long-term (three-to-five years) earnings growth rate is pegged at 13.6%, higher than its industry’s 11.7%.

Wait for a Better Entry Point

While FDX has strong long-term potential, the current market conditions and specific challenges suggest that now may not be the best time to purchase additional shares. The industry is experiencing a period of uncertainty with supply-chain concerns and fluctuating demand.

Given all the above factors, we believe investors should refrain from rushing to buy FDX before Jun 25. Instead, they should monitor the stock closely for a more appropriate entry point.

Recent Results of Industry Peers

Below, we present the latest quarterly results of United Parcel Service UPS and Air Transport Services ATSG, which belong to the same industry as FedEx.

UPS’ first-quarter 2024 earnings per share of $1.43 beat the Zacks Consensus Estimate of $1.33 but declined 35% year over year. Revenues of $21.7 billion fell short of the Zacks Consensus Estimate of $21.9 billion and decreased 5.3% year over year.

UPS generated $3.31 billion of net cash from operating activities in the first quarter. Capital expenditures were $1.03 billion. Free cash flow was $2.28 billion. U.S. Domestic Package revenues decreased 5% year over year to $14.23 billion, caused by a 3.2% decrease in average daily volume.

Air Transport Services’ first-quarter 2024 earnings (excluding 3 cents from non-recurring items) of 16 cents per share surpassed the Zacks Consensus Estimate of 13 cents but plunged 55.6% year over year. Customer revenues (derived after eliminating internal revenues from total revenues) of $485.5 million edged past the Zacks Consensus Estimate of $484.2 million but fell 3.1% year over year.

Adjusted EBITDA fell 7.7% year over year to $127.3 million. Operating cash flow declined to $126.4 million from $216.4 million a year ago. Adjusted free cash flow was $96 million compared with $162.1 million in the prior year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

Air Transport Services Group, Inc (ATSG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance