Pinnacle West's (PNW) Q2 Earnings & Revenues Beat Estimates

Pinnacle West Capital Corporation PNW posts earnings of $1.91 per share for the second quarter of 2021, outperforming the Zacks Consensus Estimate of $1.63 by 17.2%. Also, the bottom line improved 11.7% from the prior-year quarter’s earnings of $1.71 per share owing to improvement in sales amid the reopening of economy along with strong customer growth and warmer-than-normal temperatures in June.

Total Revenues

In the quarter under review, total revenues of $1 billion improved 7.6% on a year-over-year basis. Also, the top line beat the Zacks Consensus Estimate of $0.9 billion by 11.1%.

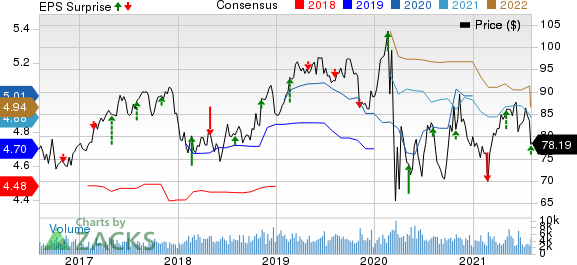

Pinnacle West Capital Corporation Price, Consensus and EPS Surprise

Pinnacle West Capital Corporation price-consensus-eps-surprise-chart | Pinnacle West Capital Corporation Quote

Operational Highlights

In the second quarter, total operating expenses were $721.9 million, up 8.1% from the year-ago quarter’s level.

Operating income improved 6.3% year over year to $278.4 million.

Interest expenses were $57.6 million, down 0.6% year over year.

The company recorded 2.3% year-over-year customer growth in second-quarter 2021.

Financial Highlights

Cash and cash equivalents were $14.1 million as of Jun 30, 2021 compared with $60 million on Dec 31, 2020.

Total long-term debt was $6,315.9 million as of Jun 30, 2021, higher than $6,314.3 million at 2020 end.

Net cash flow provided by operating activities in the first six months of 2021 was $312.4 million compared with $369 million in the comparable period of 2020. For the reported quarter, capital expenditure of the company was $681.1 million compared with $677 million in the prior-year quarter.

Guidance

During the 2021-2023 forecast period, the utility expects retail customer growth in the 1.5-2.5% range. The utility plans to invest $4,500 million during the same time period.

It expects rate base to grow annually at nearly 6% in the long term.

Zacks Rank

Pinnacle West Capital currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Utility Releases

NextEra Energy, Inc. NEE reported second-quarter 2021 adjusted earnings of 71 cents per share, which beat the Zacks Consensus Estimate of 67 cents by 5.6%.

FirstEnergy Corporation FE delivered second-quarter 2021 operating earnings of 59 cents per share, in line with the Zacks Consensus Estimate.

DTE Energy Company DTE reported second-quarter 2021 operating earnings per share of $1.70, which beat the Zacks Consensus Estimate of $1.44 by 18.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance