Pinduoduo (NASDAQ:PDD investor one-year losses grow to 49% as the stock sheds CN¥14b this past week

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Pinduoduo Inc. (NASDAQ:PDD) shareholders over the last year, as the share price declined 49%. That's disappointing when you consider the market declined 21%. The silver lining (for longer term investors) is that the stock is still 17% higher than it was three years ago. Even worse, it's down 21% in about a month, which isn't fun at all.

If the past week is anything to go by, investor sentiment for Pinduoduo isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Pinduoduo

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

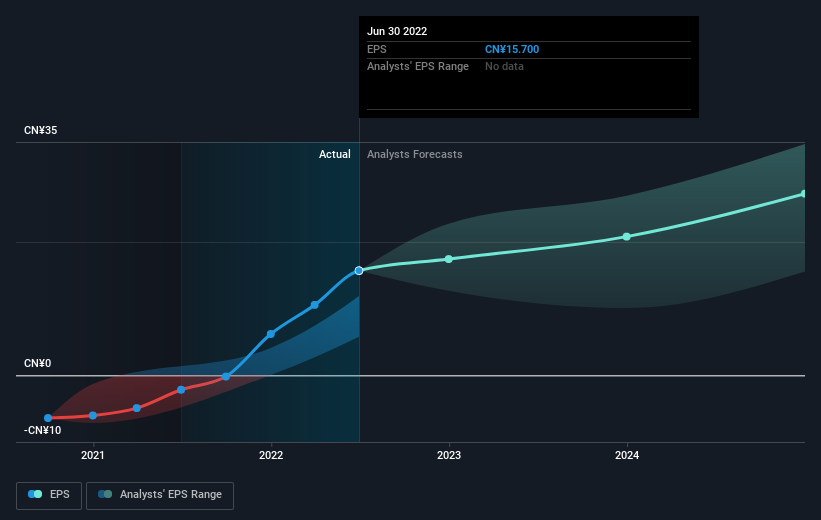

Pinduoduo managed to increase earnings per share from a loss to a profit, over the last 12 months.

We're surprised that the share price is lower given that improvement. If the improved profitability is a sign of things to come, then right now may prove the perfect time to pop this stock on your watchlist.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Pinduoduo has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

The last twelve months weren't great for Pinduoduo shares, which performed worse than the market, costing holders 49%. Meanwhile, the broader market slid about 21%, likely weighing on the stock. Investors are up over three years, booking 5% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand Pinduoduo better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Pinduoduo you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance