Pimco Warns Credit Market Returns Fail to Compensate for Risks

(Bloomberg) -- Investors are being insufficiently compensated for the risks of lending in the credit market as more capital chasing too few opportunities curbs returns, according to Pacific Investment Management Co.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

NATO Singles Out China Over Its Support for Russia in Ukraine

Kevin Costner, Warner Bros. Cancel ‘Horizon: Chapter 2’ Release

The excess premium for less-liquid investments has dropped below 100 basis points, less than half the return it should offer, Mohit Mittal, chief investment officer of core strategies at Pimco, wrote in report released Wednesday. Covenants that traditionally protected lenders in private credit markets have also deteriorated.

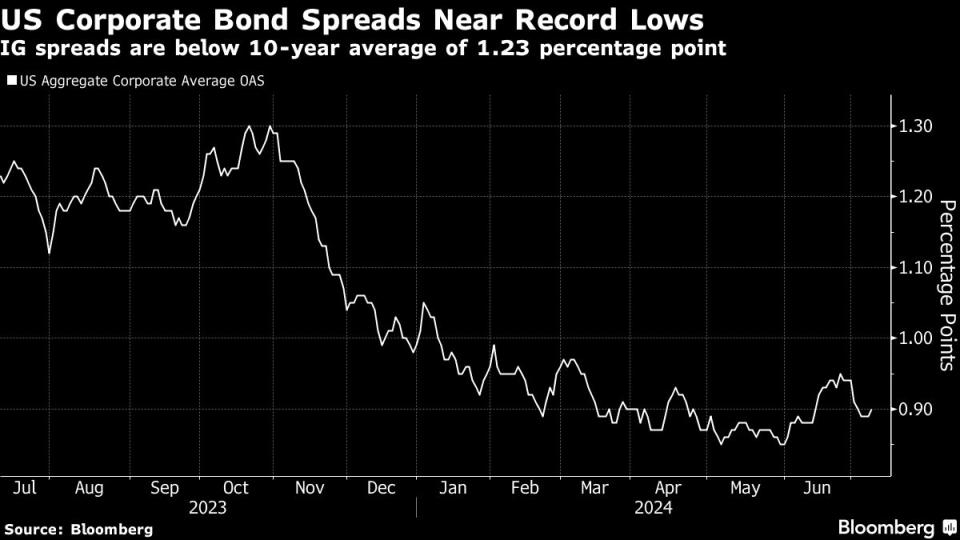

“Liquidity premiums have compressed in both public and private credit markets, with lower-quality segments of each facing elevated vulnerability to economic slowdowns and higher interest rates,” Mittal said. “New investments are entering at potentially unattractive valuations, with corporate spreads across public and private credit markets near record lows.”

Pimco has shifted its public credit exposure “to areas that we believe offer healthy liquidity and risk premiums, such as agency mortgages and senior structured products,” according to Mittal.

Meanwhile, a sharp rise in global market interest rates since 2022 favors “high quality, liquid public fixed income,” and these more mainstream starting yields look “very attractive” compared with most alternatives across the risk and liquidity spectrum, Mittal said.

Other key points on credit market liquidity, risks and return potential include:

Low liquidity and risk premia from private credit “is insufficient relative to the opportunity costs associated with rebalancing, lost alpha from public fixed income, and potential costs of cash shortfalls.”

Some “40% of private credit borrowers (size weighted and up from 15.9% two years ago) are not producing enough cash flow to service all debt, taxes, and capital spending needs.”

If rates stay elevated longer and growth slows such borrowers would be “more vulnerable to further increases in leverage, declining credit quality, and higher expected losses.”

The role of the primary dealer in making prices and supplying market liquidity “has become less essential” and “public fixed income liquidity remains robust, aided by innovations like ETFs and portfolio trading.”

--With assistance from Maria Clara Cobo.

(Updates to add chart.)

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance