The Pieris Pharmaceuticals (NASDAQ:PIRS) Share Price Is Up 95% And Shareholders Are Holding On

One simple way to benefit from the stock market is to buy an index fund. But if you pick the right individual stocks, you could make more than that. Just take a look at Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS), which is up 95%, over three years, soundly beating the market return of 43% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 25% in the last year.

See our latest analysis for Pieris Pharmaceuticals

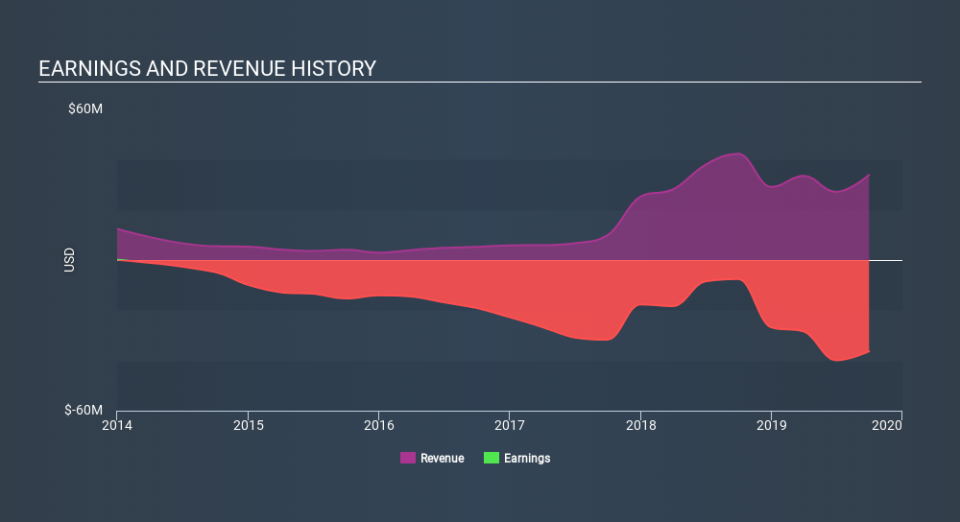

Pieris Pharmaceuticals isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years Pieris Pharmaceuticals has grown its revenue at 52% annually. That's well above most pre-profit companies. The share price rise of 25% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. If that's the case, now might be the time to take a close look at Pieris Pharmaceuticals. If the company is trending towards profitability then it could be very interesting.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Pieris Pharmaceuticals's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pieris Pharmaceuticals's TSR for the year was broadly in line with the market average, at 25%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 3.7% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Pieris Pharmaceuticals you should be aware of, and 1 of them is a bit concerning.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance