Pick These 3 Bargain Tech Stocks to Boost Portfolio Returns

Making a remarkable rally in 2023, tech stocks have shown no signs of slowing this year. With a year-to-date (YTD) rise of 21.2%, the tech-laden Nasdaq Composite has outperformed The Dow Jones Industrial Average and the S&P 500 index’s increase of 4.3% and 16.1%, respectively.

Technology stocks have more than 50% weightage in the Nasdaq Composite index. The Technology Select Sector SPDR Fund XLK ETF, the most important component of the broad technology market index, has returned 20.6% YTD. The Zacks Computer and Technology sector has registered a YTD gain of 26.6%

The rally has been primarily driven by cooling inflationary pressure and stable gasoline prices, which have subsided the fears of a recession. A resurgence in global semiconductor sales and a potential benchmark interest rate cut this year are expected to continue driving the momentum for tech stocks for the remainder of 2024.

The tech sector's rally has catapulted several stocks to new heights but also created disparities. Amid the fervor, many fundamentally strong tech companies didn't witness the same elevation in their stock prices, making them potentially lucrative but often overlooked opportunities. This post-rally evaluation in 2024 is a chance for investors to unearth undervalued tech gems that might have been sidelined during the fervent market activity.

In our opinion, Zscaler, Inc. ZS, Dropbox, Inc. DBX and Paycom Software, Inc. PAYC are among the stocks that were left behind last year’s tech rally. Given the strength of their fundamentals and solid prospects, it seems wise to add these stocks to your portfolio. These are among the bargain stocks that are poised for robust gains in 2024.

Moreover, these stocks have a favorable combination of a Growth Score of A or B and a Zacks Rank #1 (Strong Buy) or #2 (Buy). The Growth Style Score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth. Additionally, per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 or #2 and a Growth Score of A or B offer solid investment opportunities.

Our Picks

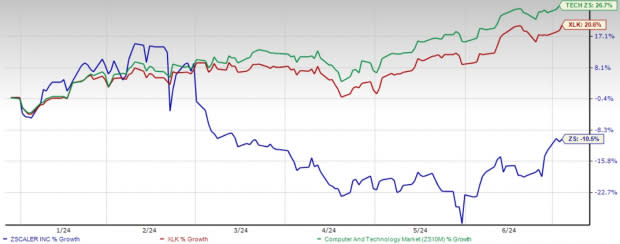

Zscaler is one of the world’s leading providers of cloud-based security solutions. ZS stock has declined 10.5% YTD. With a closing price of $198.40 on Jul 3, the stock trades 23.6% lower than the 52-week high of $259.61.

Zscaler is benefiting from the rising demand for cyber-security solutions due to the slew of data breaches. The increasing demand for privileged access security on digital transformation and cloud-migration strategies is a key growth driver. A strong presence across verticals, such as banking, insurance, healthcare, public sector, pharmaceuticals, telecommunications services and education, safeguards it from the negative impacts of ongoing macroeconomic headwinds. Portfolio expansion through acquisitions with the likes of Avalor, Canonic Security and ShiftRight is praiseworthy.

The Zacks Consensus Estimate for Zscaler’s fiscal 2024 earnings has been revised upward by 2 cents to $2.99 per share over the past 30 days. The long-term estimated earnings growth rate for the stock stands at 26.5%. The stock currently sports a Zacks Rank #1 and has a Growth Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zscaler YTD Price Performance

Image Source: Zacks Investment Research

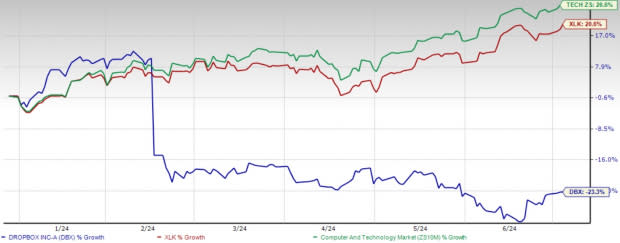

Dropbox offers a cloud-based platform that facilitates businesses and individuals to create, access and share digital content globally. YTD, the stock has plunged 23.3%. With a closing price of $22.63 on Jul 3, the stock trades 32.3% lower to the 52-week high of $33.43.

Dropbox has been benefiting from an expanding user base and strong average revenue per paying user (ARPU) growth. The company exited the first quarter of 2024 with 18.16 million paying users, while the ARPU was $139.59 compared with $138.97 in the year-ago quarter, driven by the pricing increase. As of Mar 31, 2024, Dropbox had roughly 575K business teams, and 34% of paying users were business teams. Expanding product capabilities and a strong partner base are driving Dropbox’s prospects. It has a strong balance sheet and generates solid free cash flow.

The Zacks Consensus Estimate for DBX’s 2024 earnings has been revised upward by 11 cents to $2.12 per share over the past 60 days. The long-term estimated earnings growth rate for the stock stands at 10.4%. DBX stock currently sports a Zacks Rank #1 and has a Growth Score of A.

Dropbox YTD Price Performance

Image Source: Zacks Investment Research

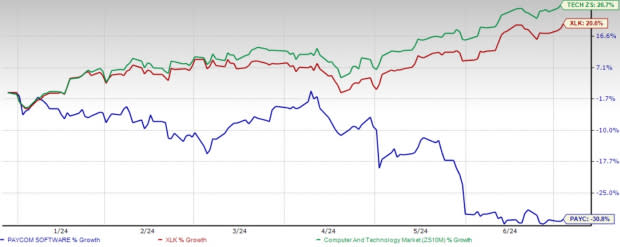

Paycom Software is a provider of cloud-based human capital management (HCM) software-as-a-service solutions for integrated software for both employee records and talent management processes. The stock has plunged 30.8% YTD. With a closing price of $143.11 on Jul 3, 2024, the stock trades 61.7% lower than the 52-week high of $374.04.

Paycom Software’s back-to-back quarters of strong financial performance reflect continued growth despite disruptions caused by macroeconomic headwinds. In the last reported first-quarter 2024 results, its revenues increased due to new client additions and a continued focus on cross-selling to existing clients. Paycom Software’s differentiated employee strategy, measurement capabilities and comprehensive product offerings are helping it win new customers. Its solutions, like Ask Here and Manager on-the-Go, focusing on employee usage and efficiency, are tailwinds.

The Zacks Consensus Estimate for 2024 earnings has been revised upward by 2 cents to $7.71 per share in the past 30 days. The long-term estimated earnings growth rate for the stock stands at 10.4%. The stock sports a Zacks Rank #1 at present and has a Growth Score of B.

Paycom Software YTD Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

Paycom Software, Inc. (PAYC): Free Stock Analysis Report

Dropbox, Inc. (DBX): Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance