Pharma Stock Roundup: MRK, SNY, AZN, NVS' Q1 Results, Pipeline & Regulatory Updates

The first-quarter 2024 earnings season picked up pace this week, with Merck MRK, Sanofi SNY, Novartis NVS and AstraZeneca AZN announcing their first-quarter results. Three of the four companies beat estimates for both earnings and sales in the first quarter. The European Commission (“EC”) approved J&J’s JNJ Carvykti for earlier lines of treatment in relapsed/refractory multiple myeloma (RR MM).

Recap of the Week’s Most Important Stories

Earnings Update: AstraZeneca beat estimates for both earnings and sales. Its earnings and sales rose at a double-digit rate on a constant currency basis due to strong demand for its blockbuster medicines and higher alliance revenues from partnered medicines. Among the key drugs, sales of cancer drugs, Tagrisso and Imfinzi rose 15% and 33%, respectively. Diabetes drug Farxiga rose 45%. AstraZeneca reiterated its financial guidance for 2024. It expects total revenues to increase in the low double-digit to low teens percentage in 2024 at CER. Core earnings per share are also expected to increase in the low double-digit to low teens percentage range.

Merck’s first-quarter results were better than expected as it beat estimates for earnings as well as sales. Keytruda continued its growth trajectory and was the key driver of the top line in the quarter. Keytruda sales rose 24% in the quarter. Sales of the HPV vaccine, Gardasil, rose 17%. The company also raised its earnings range despite a steeper impact from currency. Adjusted earnings per share are expected to be between $8.53 and $8.65 versus the prior expectation of $8.44 to $8.59. Merck slightly raised the upper end of its 2024 revenue guidance range from $62.7-$64.2 billion to $63.1 to $64.3 billion.

Sanofi’s quarterly results were mixed as it missed estimates for sales while earnings were in line. Higher sales of Dupixent and contributions from new products like Altuviiio and Nexviazyme were partially offset by the impact of generic competition on Aubagio sales in all key markets and the soft sales performance of the Vaccine segment. Dupixent’s sales rose 24.9% on a constant currency rate (“CER”) basis, while Vaccines rose 5.6%. The company maintained its 2024 earnings growth expectations at CER. Adjusted earnings are expected to decline in the low single-digit range at CER in 2024 due to higher R&D costs and taxes.

Novartis’ first-quarter results were better than expected as it beat estimates for both earnings as well as sales. It also raised its growth expectations for sales and profit in 2024. Its sales rose 11% at constant currency (“cc”) in the quarter, driven by the continued strong performance of Entresto, Pluvicto, Kesimpta, Cosentyx and Kisqali. Core operating income rose 22% at cc. Novartis expects 2024 net sales to grow in the high single to low double-digits range, up from the prior expectation of mid-single-digit growth. Core operating income is projected to grow in the low double digits to mid-teens range, up from the prior expectation of a high single-digit range.

Sanofi’s Rilzabrutinib Meets Goal in Immune Thrombocytopenia Study: Sanofi’s phase III study evaluating its BTK inhibitor, rilzabrutinib, to treat immune thrombocytopenia (ITP), an autoimmune blood disorder that causes high risk for bleeding events, met its primary endpoint. In the LUNA 3 phase III study, a significantly higher proportion of patients treated with oral rilzabrutinib (400 mg twice daily) achieved the primary endpoint of durable platelet response versus placebo in adult patients with persistent or chronic ITP. Based on data from the LUNA 3 study, Sanofi plans to file regulatory applications for rilzabrutinib in ITP in the United States and the European Union by 2024-end.

Rilzabrutinib was added to Sanofi’s pipeline with last year’s acquisition of Principia Biopharma. The candidate is being developed for some immune-mediated diseases like asthma, chronic spontaneous urticaria, prurigo nodularis, IgG4- related disease and warm autoimmune hemolytic anemia.

AstraZeneca’s Voydeya Gets Approval in Europe: The EC approved AstraZeneca’s first-in-class, oral, Factor D inhibitor Voydeya (danicopan) to treat extravascular hemolysis in adults with the rare disease paroxysmal nocturnal hemoglobinuria (PNH). Voydeya has been approved as an add-on therapy to AstraZeneca’s other C5 inhibitors, Ultomiris (ravulizumab) or Soliris (eculizumab), for the treatment of PNH in adults who have residual hemolytic anemia. Voydeya is approved for 10-20% of PNH patients who experience “hemolysis” or destruction of red blood cells despite treatment with other C5 inhibitors. Voydeya’s approval is based on data from the pivotal ALPHA phase III study. The drug was approved in Japan in January and in the United States earlier this month.

EU Expands J&J’s Carvykti Label in Multiple Myeloma: The EC granted label expansion to J&J’s Carvykti for early-stage use in RR MM. Carvykti is now approved in the EU to treat adult patients with RR MM who have received at least one prior line of therapy, including a proteasome inhibitor (PI) and an immunomodulatory agent (IMiD) and who are refractory to Revlimid. Carvykti was initially approved in the EU in 2022 to treat adult patients with r/r MM who have received at least three prior therapies, including a PI, an IMiD agent and an anti-CD38 monoclonal antibody.

The label expansion approval was based on survival and safety data from the late-stage CARTITUDE-4 study. Carvykti was approved for similar earlier-line use by the FDA earlier this month.

Novartis’ Lutathera Gets FDA Nod for Rare Cancer in Kids: The FDA granted approval to Novartis’ radioligand therapy, Lutathera, for treating pediatric patients (ages 12-17) with somatostatin receptor-positive (SSTR+) gastroenteropancreatic neuroendocrine tumors (GEP-NETs), a rare cancer. The drug is already approved for treating SSTR+ GEP-NETs in adults. The approval for use in children and adolescents was based on data from the NETTER-P study.

The NYSE ARCA Pharmaceutical Index rose 1.7% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

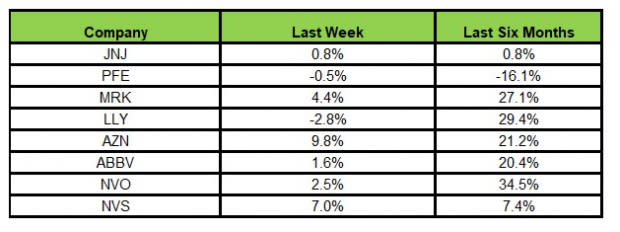

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

In the last five trading sessions, AstraZeneca rose the most (9.8%), while Lilly declined the most (2.8%).

In the past six months, Novo Nordisk has risen the highest (34.5%), while Pfizer has declined the most (16.2%).

(See the last pharma stock roundup here: JNJ’s Q1 Results, LLY, ABBV, RHHBY’s Successful Study Data)

What's Next in the Pharma World?

Watch this space for first-quarter earnings of Novo Nordisk, Pfizer and Lilly alongside regular pipeline and regulatory updates next week.

Merck, Novartis, AstraZeneca and J&J have a Zacks Rank #3 (Hold) each, while Sanofi has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Novartis AG (NVS) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance