Pharma Stock Roundup: BAYRY's Q1 Earnings, JNJ's New Buyout, Pipeline Updates

This week, Bayer BAYRY released its first-quarter results. J&J JNJ announced that it will acquire a private biotech, Proteologix, which will add the latter’s pipeline candidates in atopic dermatitis, also called eczema. Merck MRK will discontinue the Keytruda plus vibostolimab co-formulation arm of a phase III melanoma study. Eli Lilly’s LLY two phase III studies on its once-weekly insulin efsitora alfa met their primary endpoint of non-inferior reduction in blood sugar levels compared to daily basal insulins. Novo Nordisk’s NVO hemophilia A candidate met the primary endpoints in a pivotal phase III study.

Recap of the Week’s Most Important Stories

Bayer Releases Q1 Results: Bayer’s first-quarter core earnings per share declined 4.4%, while total revenues declined 4.3% on a reported basis. On a currency and portfolio-adjusted basis, sales declined 0.6% year over year. Sales in the Crop Science segment declined 3%. Pharmaceuticals segment sales increased 3.9%, driven by growth in sales of new products, cancer drug, Nubeqa and chronic kidney disease drug, Kerendia. Among the best-selling products, Xarelto sales rose 1.7% while Eylea was up 3.4%. Consumer Health sales declined 1.8%.

Bayer reiterated its previously provided currency-adjusted total revenue guidance of €47-€49 billion for the full year. Core earnings per share range was lowered to €4.80-€5.20 from the previous guidance of €4.95-€5.35.

J&J to Acquire Proteologix for $850M: J&J announced a definitive agreement to acquire Proteologix, a private biotech making bispecific antibodies for immune-mediated diseases. For the deal, J&J will pay $850 million in cash while being entitled to make a future milestone payment.

Proteologix’s lead pipeline candidate is its phase-I-ready asset PX128, a bispecific antibody targeting IL-13 plus TSLP. It is being developed for treating moderate-to-severe atopic dermatitis (AD) and moderate-to-severe asthma. Proteologix also has some other bispecific antibodies in its pre-clinical pipeline, including PX130, an inhibitor of IL-13 plus IL-22, also being developed for moderate-to-severe AD

Merck Ends Keytruda+Vibostolimab Combo Cohort of Melanoma Study: Merck announced that it is discontinuing the Keytruda plus vibostolimab co-formulation arm of a phase III study called KeyVibe-010 due to a higher rate of patient discontinuation. The cohort of the KeyVibe-010 study was evaluating a co-formulation of Keytruda plus vibostolimab, Merck’s investigational anti-TIGIT antibody, as an adjuvant treatment for patients with resected high-risk melanoma.

Data from a pre-planned analysis of the KeyVibe-010 study showed that the primary endpoint of recurrence-free survival (RFS) met the pre-specified futility criteria. A higher rate of patients discontinued all adjuvant therapy in the coformulation arm versus the Keytruda-only arm, primarily due to immune-mediated adverse experiences. Due to this, it seemed unlikely that the study could achieve a statistically significant improvement in RFS. Accordingly, an independent Data Monitoring Committee recommended unblinding the study.

Lilly’s Weekly Insulin Matches Daily Insulin in Blood-Sugar Control: Lilly announced top-line results from the QWINT-2 and QWINT-4 phase 3 studies, evaluating once-weekly insulin efsitora alfa compared to daily basal insulins in adults with type II diabetes. In the studies, efsitora alfa led to non-inferior reductions in A1C compared to the most commonly used daily basal insulins globally. A1C is a test that measures the average blood sugar levels over the past three months. In the QWINT-2 study, efsitora reduced A1C by 1.34% compared to 1.26% for insulin degludec, resulting in an A1C of 6.87% and 6.95%, respectively. In the second study, QWINT-4, both efsitora and insulin glargine reduced A1C by 1.07%, resulting in an A1C of 7.12% and 7.11%, respectively. Overall, the data shows that efsitora as a weekly insulin provides the same blood sugar control as daily basal insulin.

Lilly reached a settlement with a medical spa, Totality Medispa, selling compounded products in the name of its popular tirzepatide drugs, Mounjaro and Zepbound. Per the settlement deal, Totality Medispa will have to make a monetary payment to Lilly. It will also have to refrain from using Lilly’s branding to promote its compounded tirzepatide products.

Lilly has sued several pharmacies, weight loss clinics and medical spas selling/making compounded versions of Mounjaro and Zepbound. Lilly has time and again warned against the use of custom-made products claiming to contain tirzepatide that are made or distributed by compounding pharmacies. These products are not approved by the FDA and can pose serious health risks to users.

Novo Nordisk’s Hemophilia A Candidate Meets Goal in Pivotal Study: Novo Nordisk’s pivotal phase III study (FRONTIER 2) evaluating its pipeline candidate, Mim8, in hemophilia A patients, met its co-primary endpoints. Mim8 is NVO’s next-generation FVIIIa mimetic bispecific antibody.

The study evaluated the safety and efficacy of its once-weekly and once-monthly subcutaneous Mim8 versus no prophylaxis treatment and prior coagulation factor prophylaxis treatment in people aged 12 years or older with hemophilia A with or without inhibitors.

In the study, once-weekly and once-monthly subcutaneous Mim8 demonstrated statistically significant and superior reduction of treated bleeding episodes versus no prophylaxis treatment and prior coagulation factor prophylaxis treatment. The data clearly highlights the potential of Mim8 to prevent bleeding episodes effectively and safely in hemophilia A patients, regardless of their dosing frequency. Based on this positive data, Novo Nordisk plans to file regulatory applications for Mim8 by the end of this year.

The NYSE ARCA Pharmaceutical Index rose 1.54% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

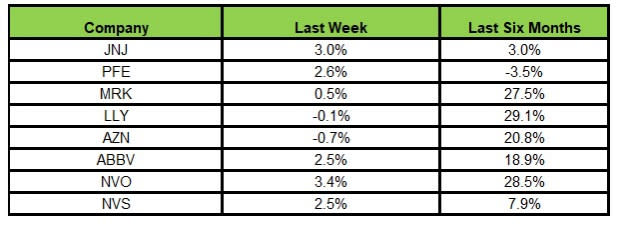

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

In the last five trading sessions, Novo Nordisk rose the most (3.4%), while AstraZeneca declined the most (0.7%).

In the past six months, Lilly has risen the highest (29.1%), while Pfizer has declined the most (3.5%).

(See the last pharma stock roundup here: PFE DMD Study Patient Death, FDA Panel Meet for LLY’s Donanemab)

What's Next in the Pharma World?

Watch this space for regular pipeline and regulatory updates next week.

J&J, Lilly, Novo Nordisk and Merck have a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance