Pennant Group Inc (PNTG) Reports Strong Earnings Growth in Q4 and Fiscal Year 2023

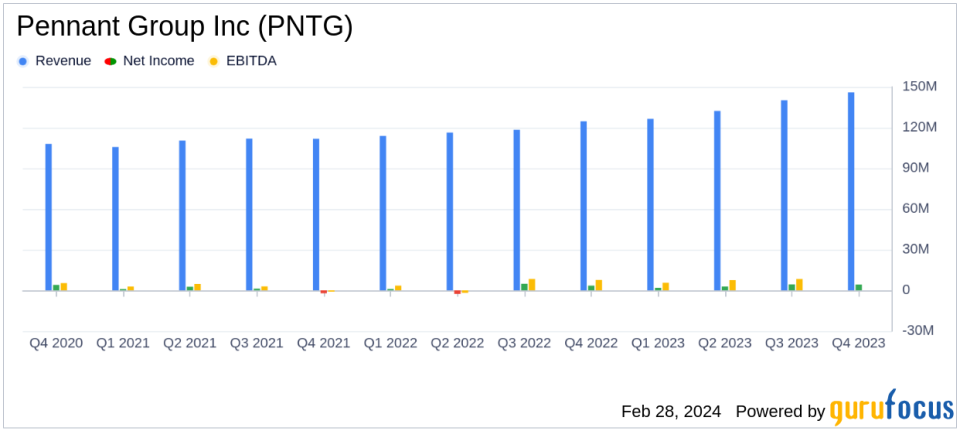

Revenue: Full year revenue increased by 15.1% to $544.9 million, and Q4 revenue grew by 17.1% to $146.0 million.

Net Income: Annual net income soared by 101.4% to $13.4 million, with Q4 net income up by 25.2% to $4.3 million.

Adjusted EBITDA: Adjusted EBITDA for the year rose by 29.1% to $40.7 million, with Q4 seeing a 19.8% increase to $11.9 million.

Home Health and Hospice Services: Segment revenue for the year was $394.5 million, a 15.3% increase, with Q4 revenue up by 17.9%.

Senior Living Services: Segment revenue for the year was $150.4 million, a 14.8% increase, with Q4 revenue also up by 14.8%.

2024 Guidance: Revenue is anticipated to be between $596.8 million and $633.7 million, with adjusted EPS between $0.82 and $0.91.

On February 28, 2024, Pennant Group Inc (NASDAQ:PNTG) released its 8-K filing, detailing a robust performance for both the fourth quarter and the fiscal year ended December 31, 2023. The company, a provider of healthcare services including home health, hospice, and senior living services across multiple states, has demonstrated significant growth in key financial metrics, underscoring its operational success and strategic focus.

Financial Performance and Strategic Execution

Pennant Group Inc (NASDAQ:PNTG) reported a substantial increase in revenue and net income, with total revenue for the year reaching $544.9 million, marking a 15.1% increase over the previous year. The fourth quarter contributed to this growth with a revenue of $146.0 million, a 17.1% increase over the same quarter of the prior year. Net income for the full year was $13.4 million, more than doubling with a 101.4% increase over the prior year, while the fourth quarter net income rose by 25.2% to $4.3 million.

The company's adjusted net income also reflected positive trends, with a 28.3% increase to $21.9 million for the year and a 22.2% increase to $6.6 million for the fourth quarter. Adjusted EBITDA followed suit, with a 29.1% increase to $40.7 million for the year and a 19.8% increase to $11.9 million for the quarter.

These financial achievements are particularly important for a company in the Healthcare Providers & Services industry, as they indicate Pennant Group's ability to grow its operations while maintaining profitability and managing costs effectively. The company's focus on leadership development, clinical excellence, employee engagement, margin improvement, and growth has been central to its strong performance.

Segment Performance and Future Outlook

The Home Health and Hospice Services segment, which constitutes the majority of the company's revenue, saw a 15.3% increase in revenue to $394.5 million for the year, with the fourth quarter revenue up by 17.9%. The Senior Living Services segment also experienced growth, with a 14.8% increase in revenue to $150.4 million for the year and a similar increase for the fourth quarter.

Looking ahead, Pennant Group's management has provided guidance for 2024, anticipating total revenue to be between $596.8 million and $633.7 million, with adjusted earnings per diluted share expected to be between $0.82 and $0.91. Adjusted EBITDA is projected to be between $46.2 million and $49.7 million. This guidance reflects the company's expectations based on the strong performance in 2023 and current operating conditions.

CEO Brent Guerisoli expressed confidence in the company's trajectory, stating, "Our earnings guidance midpoint of $0.87 represents 19.2% growth on our 2023 adjusted earnings per share and 52.6% growth over our 2022 results." CFO Lynette Walbom highlighted the company's strong cash flow, which positions it well to respond to growth opportunities.

For a detailed analysis of Pennant Group Inc (NASDAQ:PNTG)'s financials, including income statements, balance sheets, and cash flow statements, investors are encouraged to review the company's Form 10-K filed with the SEC, which can be accessed on Pennant Group's website.

Value investors and potential GuruFocus.com members seeking comprehensive insights into Pennant Group Inc (NASDAQ:PNTG)'s financial health and future prospects will find the full earnings report and management's commentary on the company's 8-K filing and investor relations website.

Explore the complete 8-K earnings release (here) from Pennant Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance