Penn National (PENN) Misses Q3 Earnings & Revenue Estimates

Penn National Gaming, Inc. PENN reported results for the third quarter of 2018, with earnings and revenues missing the Zacks Consensus Estimate.

Adjusted earnings of 38 cents per share missed the Zacks Consensus Estimate of 43 cents by 11.6%. In fact, earnings decreased a significant 95.5% year over year owing to weakness in Illinois and Mississippi jurisdictions.

Net revenues of $789.7 million lagged the consensus mark of $807.9 million by 2.2% and also declined 2% from the year-ago quarter.

Shares of Penn National lost 1.7% following the results. In the past year, the company’s shares have declined 8.4%, outperforming the industry’s fall of 21.4%.

Let us take a closer look at the numbers.

Inside the Headlines

Penn National’s income from operations in the reported quarter totaled $155.8 million, up 8.4% from the prior-year quarter. Adjusted EBITDA increased 2% from the year-ago quarter to $229.7 million. Adjusted EBITDA margin increased 115 basis points to 29.1%, with 17 of the 23 gaming operations recording improved margins.

Traditional net debt ratio declined to 1.77x while gross and net leverage — including master lease obligations — declined to 5.17x and 4.90x, respectively.

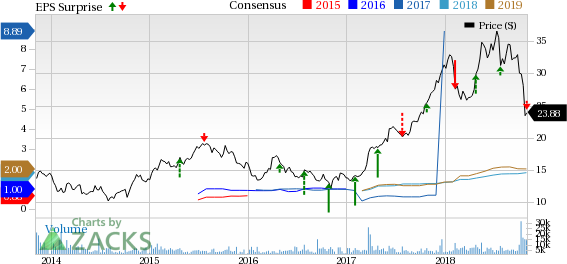

Penn National Gaming, Inc. Price, Consensus and EPS Surprise

Penn National Gaming, Inc. Price, Consensus and EPS Surprise | Penn National Gaming, Inc. Quote

Fourth-Quarter and Full-Year Guidance

For the fourth quarter, net revenues are expected at $1.14 billion, reflecting a 49.4% rise from the year-ago quarter. Full-year revenues are expected at $3.58 billion, up from the previously anticipated $3.21 billion. Revenues are projected to rise 13.8% year over year.

Adjusted loss for the fourth quarter is predicted at 40 cents, showing an improvement from loss of $3.72 in the fourth quarter of 2017. Meanwhile, earnings for 2018 are anticipated at 90 cents, down from the previous guidance of $1.75. Moreover, earnings are projected to fall 82.2% year over year.

Other Developments

As of Oct 15, the company completed the acquisition of Pinnacle Entertainment which helped it expand its diverse portfolio to 40 gaming, entertainment and racing properties across 18 jurisdictions.

Meanwhile, the company expects the acquisition of the Margaritaville Resort Casino in Louisiana to close by the end of this year.

Zacks Rank & Stocks to Consider

Penn National carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Consumer-Discretionary sector are Rocky Brands, Inc. RCKY, sporting a Zacks Rank #1 (Strong Buy), while DISH Network Corporation DISH and Peak Resorts, Inc. SKIS have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Rocky Brands has a projected current-year earnings growth rate of 57.8%.

DISH Network has an expected current-year earnings growth rate of 9.8%.

Peak Resorts has an expected current-year earnings growth rate of 342.9%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Penn National Gaming, Inc. (PENN) : Free Stock Analysis Report

DISH Network Corporation (DISH) : Free Stock Analysis Report

Peak Resorts, Inc. (SKIS) : Free Stock Analysis Report

Rocky Brands, Inc. (RCKY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance