PDL BioPharma (PDLI) Q2 Earnings Top, Revenues Slump Y/Y

PDL BioPharma, Inc. PDLI delivered earnings of 10 cents per share in the second quarter of 2018, beating the Zacks Consensus Estimate of 6 cents. However, the company’s bottom line was higher at 26 cents in the year-ago period.

The company reported total revenues of $46.6 million in the reported quarter, a substantial plunge of 67.6% from the year-earlier figure of $143.8 million. This decrease is mainly attributable to the change in PDL’s strategy to a pharmaceutical business model and a sharp decline in royalties.

Last week, the company paid $20 million to buy Depomed's remaining 50% interest in royalties payable on sales of the type II diabetes products licensed by Depomed. Products covered by the royalty agreement and amendment include Glumetza and its authorized generic Jentadueto XR as well as Invokamet XR and Synjardy XR. Following the amendment, PDL will now receive 100% royalties rather than a 50/50 share with Depomed.

PDL BioPharma sees this transaction as a shift away to focus on strategic equity and product investments.

Shares of PDL BioPharma are marginally up in after-hours trading on Aug 8 owing to higher earnings. However, the same has underperformed the industry so far this year. While the stock has lost 7.7%, the industry has decreased 3.6%.

Quarter in Detail

Product revenues for the quarter under review were $31.9 million, up 69% year over year. The same included $25.9 million from the sales of Noden products — Tekturna and Tekturna HCT — and $5.9 million from the sale of LENSAR laser system in the United States.

PDL recognized $12.8 million in revenues from royalty rights, $1.2 million of royalties from PDL's licensees to the Queen et al. patents and $0.8 million of interest revenues.

Royalty revenues from the Queen et al. licenses were lower than the year-ago period’s yield, mainly due to the extinguishment of Biogen’s BIIB U.S. product supply of its multiple sclerosis drug Tysabri. The drug was manufactured before the patent expiry with ex U.S. product supplies, which is rapidly depleting.

Research and development (R&D) expenses for the second quarter summed $0.7 million, down 84.2% from the prior-year level. This upside was on the completion of the pediatric study for Tekturna.

General and administrative expenses escalated 28.7% to nearly $14.5 million from the level registered in comparable quarter last year. This downside was due to a quarterly expense from LENSAR in 2018 and other costs related to business development.

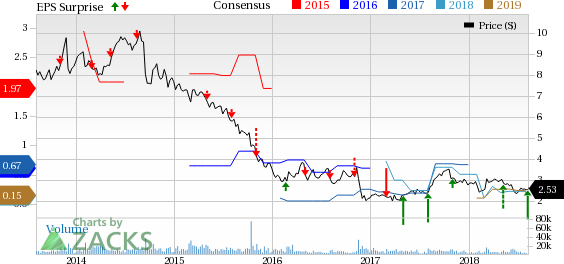

PDL BioPharma, Inc. Price, Consensus and EPS Surprise

PDL BioPharma, Inc. Price, Consensus and EPS Surprise | PDL BioPharma, Inc. Quote

Zacks Rank

PDL BioPharma carries a Zacks Rank #4 (Sell).

Two better-ranked stocks in the healthcare sector are Gilead Sciences, Inc. GILD and Illumina, Inc. ILMN, both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Gilead Sciences’ earnings estimates have been moved 7.7% north for 2018 and 2.2% for 2019 over the past 60 days. The stock has gained 7.3% year to date.

Illumina’s earnings estimates have been revised 11% upward for 2018 and 8% for 2019 over the past 60 days. The stock has soared 54.7% so far this year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

PDL BioPharma, Inc. (PDLI) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance