PayPal: Navigating Challenges Amidst a Slowing Growth Trajectory

With trailing 12-month revenue of $30.43 billion, PayPal Holdings Inc. (NASDAQ:PYPL) stands as the second-largest company in the Transaction & Payment Processing industry, only behind Visa (NYSE:V). Despite its significant e-commerce-driven surge during the Covid-19 pandemic, the stock has faced a massive correction. Over the past three years, the company's growth engine has significantly slowed, facing mounting competitive pressures, decelerating growth and uncertainty regarding its turnaround.

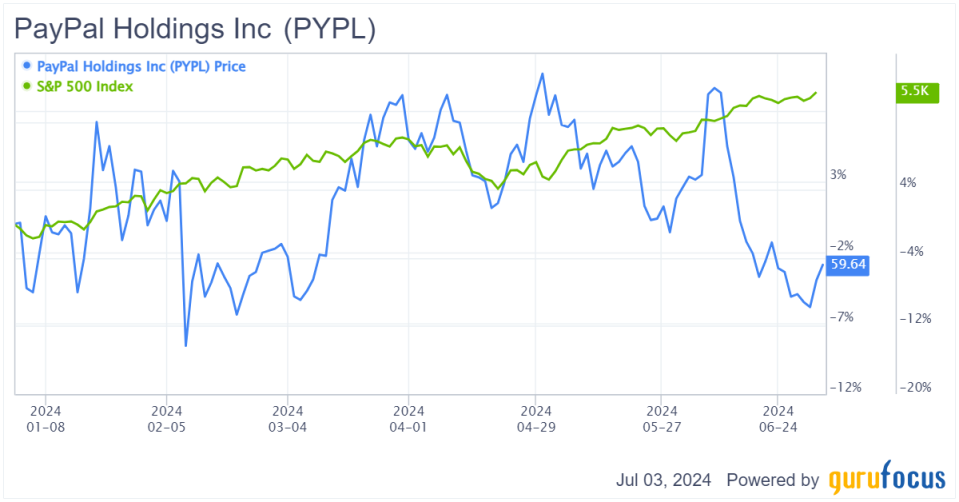

PayPal's stock has underperformed so far in 2024, down nearly 3% year to date while the broader market (S&P 500) saw a 15.50% increase. PayPal investors have missed out on much of the broader market gains this year. The stock's muted price action reflects a lack of growth catalysts and a decline in active customer accounts. In response, the board has brought in new management to rejuvenate the company. Recent quarterly performance suggests PayPal may be approaching an inflection point, regaining some of its disruptive edge in digital payments.

Despite this, the company's earnings per share are expected to lag in 2024. However, product innovations and a renewed focus on unbranded checkout have driven solid total payment volume growth, which is encouraging. While these factors alone do not warrant a buy rating, the stock's discounted valuation suggests it may have reached a bottom. Although the upside potential remains unclear, further downside also seems unlikely at this point. As such, investors should remain patient and consider the long-term turnaround potential. I understand the frustration of many investors who are watching artificial intelligence names rush forward while PayPal struggles.

Despite the bullish outlook from analysts, maintaining an investment in a floundering stock can be difficult. However, I believe patient investors will be rewarded well in the coming years. Given the overall lofty market valuation, PayPal is trading at a significant discount compared to its historical levels. While the stock is currently fairly valued and will likely continue trading on the sidelines, I remain optimistic about its long-term prospects.

Promising early results with new CEO

PayPal's new CEO, Alex Chriss, has been tasked with revitalizing the company's growth and enforcing cost discipline. Since taking over, he has made strides in improving pricing in unbranded services, reducing frictions in branded services to combat market share loss and revitalizing Venmo. During a recent conference, Chriss expressed satisfaction with the newly restructured management team, emphasizing their shared strategic vision. This cohesive leadership is crucial for steering PayPal's transformation. He also underscored the importance of focusing on impactful initiatives and accelerating innovation to better serve the company's ecosystem.

Challenges from Apple's Tap to Cash

Apple's (NASDAQ:AAPL) introduction of "Tap to Cash" at its Worldwide Developers Conference keynote poses a significant threat to PayPal's efforts to monetize Venmo. This new peer-to-peer payment feature, set to roll out with iOS 18, leverages Apple's vast device base, directly competing with Venmo's user demographics. Similar to how Meta Platforms (NASDAQ:META) faced challenges post-ATT, PayPal now faces a substantial risk from Apple's entry into the peer-to-peer payment market. More than half of global iPhone users have activated Apple Pay, highlighting the competitive pressure on Venmo.

Despite these challenges, PayPal is expanding Venmo's reach. For instance, since April, PayPal and Venmo have collaborated with Visa+ peer-to-peer payment system, enabling cross-platform money transfers. This enhancement is expected to bolster PayPal's ecosystem and attract more users.

Expanding partnerships and functionality

PayPal's strategy under Chriss includes expanding partnerships and enhancing functionality for cryptocurrency adopters. This move is aligned with the company's broader goal of improving the customer experience. The company has recently expanded into the digital advertising business, leveraging vast amounts of customer behavior data from billions of transactions processed each quarter. This venture has the potential to generate significant additional revenue.

Additionally, PayPal has shown strong momentum in digital assets by launching its stablecoin, PayPal USD, on the Solana blockchain. Collaborating with cryptocurrency company MoonPay, PayPal now offers its 426 million users access to over 100 digital assets. The company's growing interest in cryptocurrencies is a promising venture, especially as cryptocurrency payments are expected to grow at a compound annual rate of nearly 17% between 2023 and 2030, according to Statista.

Financials overview

Source: Paypal

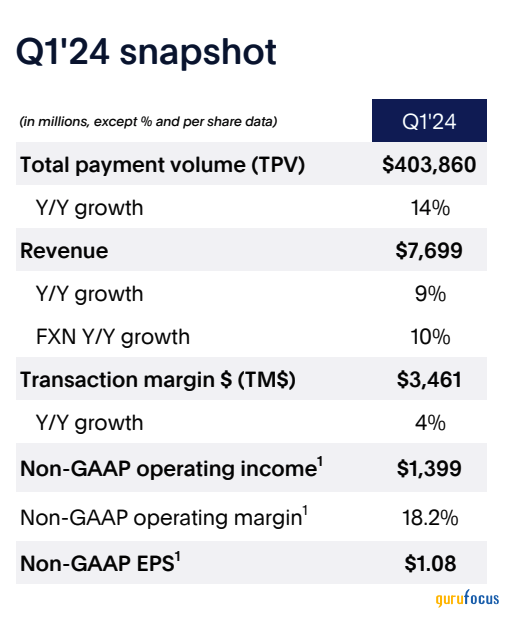

In the latest quarterly earnings release on April 30, PayPal exceeded revenue and earnings per share consensus estimates, signaling positive momentum for the company. Revenue grew by 9% year over year, driven primarily by increasing transaction revenue. Despite a slight decrease in the number of active accounts, the number of payment transactions per active account grew by 13%, mitigating any negative impact on the top line.

PayPal's focus on cost discipline is evident as profitability outpaced revenue growth. Operating income increased by 17% year over year, significantly outpacing revenue growth, which allowed the company to boost non-GAAP earnings per share by 27%. The operating margin also improved, expanding from 16.50% to almost 18%.

As a result of strong revenue and operating margin performance, PayPal generated $2.10 billion in levered free cash flow, 3 times higher compared to the first quarter of 2023. This robust FCF allowed PayPal to enhance its financial position, with the net cash balance improving from $2.20 billion at the end of the previous quarter to $2.70 billion as of March 31. This improvement in the balance sheet increases the company's financial flexibility to support further growth initiatives.

Revenue growth and outlook

Source: Paypal

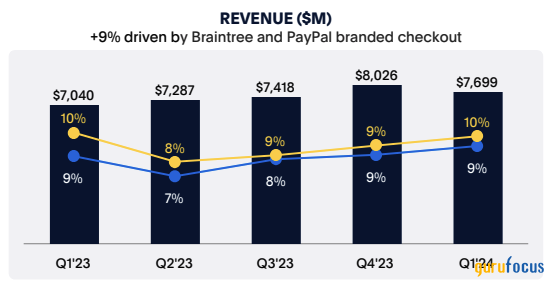

While PayPal has continued to grow, the revenue growth rate has significantly deteriorated since 2021. Over the past three years, the company's year-over-year growth rate has steadily declined, dropping by 66.90% from the pandemic-fueled growth levels. However, the first-quarter revenue growth and growth in unbranded checkout, improved international payments and conversion technology should drive better results for merchants. Consequently, PayPal should continue to grow revenue meaningfully.

Looking forward, PayPal projects only 6.50% year-over-year growth in net revenue for the second quarter, below market consensus. This single-digit growth trajectory contrasts sharply with the 20%-plus top-line growth experienced during the pandemic. The slower growth remains a major concern for investors. If PayPal can maintain mid-to-high single-digit revenue growth, it may still present a chance for re-rating higher as investor perception of risk decreases.

Margin analysis

Source: Paypal

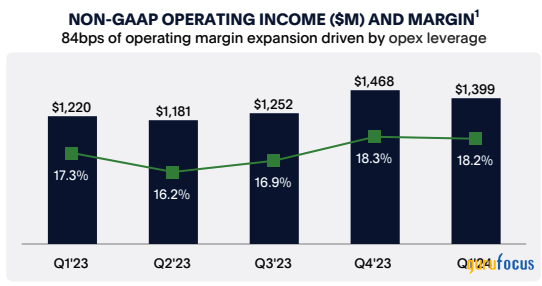

PayPal's operating and net income margins have declined from over 20% post-pandemic to mid-teen ranges in recent quarters. This decline is partly due to the slowdown in net revenue growth. The lack of margin expansion is another factor preventing bullish sentiment on the stock in the near term.

However, PayPal is addressing cost efficiencies, including laying off 7% of its total headcount and conducting a comprehensive review of current operations to find more savings. By stabilizing or moderately growing the operating margin, PayPal aims to offset any gross margin declines. Given that both growth outlook and margins are below pandemic-era levels, a major comeback to previous highs seems unlikely.

Share buybacks

Although share buybacks are not a direct financial fundamental, they significantly impact stock performance. PayPal has maintained an elevated level of share repurchases, averaging over $5 billion per year for the last four years. During 2020 and 2021, when the stock traded around $200 per share, the effect of buybacks was potentially minimal. However, as the market cap has been trimmed and the buyback amount remains constant, the impact of these buybacks could become more significant, potentially driving further price appreciation.

Valuation perspective: A cautious approach

When evaluating PayPal's valuation, it is apparent the stock is trading at a relative discount compared to a year ago. At the time of writing, PayPal is trading at 14.70 times non-GAAP 2024 earnings, which is significantly below the price-earnings ratio of over 20 for the S&P 500 index. This lower multiple suggests a subpar growth outlook for the company. Notably, PayPal's GAAP price-earnings ratio of 15.48 is near its 10-year low, indicating potential undervaluation. However, I believe PayPal represents a value trap at current levels due to a lack of growth catalysts.

Investors should exercise patience when holding this stock. According to FactSet, the 10-year average price-earnings ratio for the S&P 500 is around 18. Given PayPal's single-digit growth and flat margins, I consider this average multiple to be a fair benchmark for the company. Based on PayPal's GAAP earnings guidance of $3.65 per share for 2024, the implied fair value is approximately $65. This suggests that while the stock is undervalued, the lack of significant growth drivers limits the upside potential.

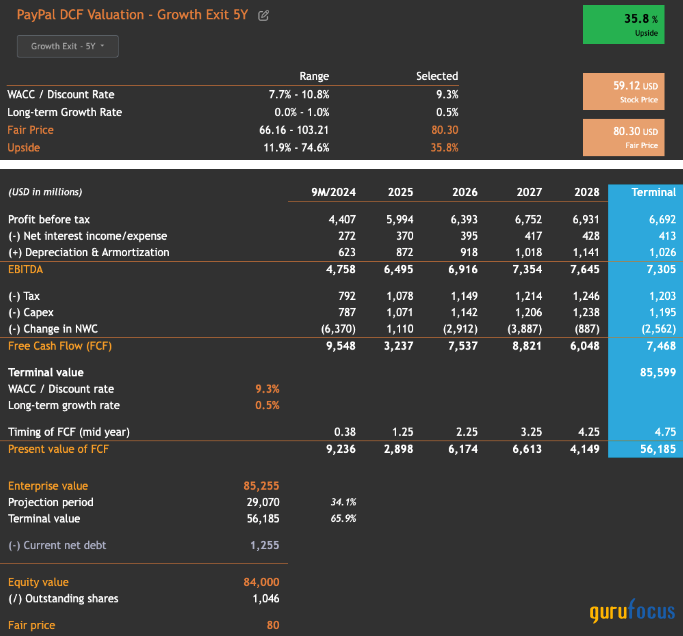

Source: valueinvesting.io

Even when applying a discounted cash flow valuation, the stock appears to present a buying opportunity at current levels. A DCF analysis with a 5-year growth exit model indicates an upside of about 36% under a base case projection, assuming a weighted average cost of capital of 9.30% and a long-term growth rate of 0.50% following the five-year growth stage. Despite this optimistic projection, the absence of strong growth drivers is concerning for investors considering entering at current levels.

While PayPal may offer significant upside opportunities for long-term investors willing to wait for a potential turnaround, the current outlook suggests a longer road to recovery than previously anticipated. The current valuation reflects a single-digit growth trajectory and potentially flat margins in the near term. Thus, investors should approach with caution, balancing the potential for future gains against the present uncertainties.

A cautious hold with long-term potential

In conclusion, PayPal remains a pivotal player in the Transaction & Payment Processing industry, but its recent performance highlights significant challenges. Despite promising early results under Chriss, competitive pressures, particularly from Apple's new payment features, present substantial risks. The company's strategic focus on cost discipline and expanding partnerships shows potential, yet the lack of clear growth catalysts tempers enthusiasm.

Financially, PayPal has demonstrated solid revenue and earnings growth, but this has slowed significantly from its pandemic-era highs. The company's efforts to streamline operations and focus on impactful initiatives are positive steps, but investors need to be cautious given the current valuation and growth outlook.

While PayPal is undervalued relative to historical levels, I believe the stock is a value trap at current levels due to the absence of significant growth drivers. Long-term investors willing to wait for a potential turnaround might find the stock appealing, but the road to recovery appears longer than anticipated. Therefore, I maintain a cautious hold rating, suggesting that patience and careful consideration of future developments are essential for investors.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance