Paylocity (PCTY) Q3 Earnings and Revenues Surpass Estimates

Paylocity Holding Corporation PCTY reported third-quarter fiscal 2024 non-GAAP earnings of $2.21 per share, beating the Zacks Consensus Estimate by 13.92%. The bottom line improved 27% year over year, driven by higher revenues and an increase in the operating and EBITDA margins.

Paylocity’s revenues climbed 18% year over year to $401.3 million and surpassed the Zacks Consensus Estimate by 1.1%. The robust increase in the top line was mainly driven by a continued focus on scaling operational costs while maintaining industry-leading service levels.

The top-line growth can be attributed to a 17% increase in Recurring revenues (91.4% of the total revenues), which totaled $366.8 million. Moreover, the Interest Income on Funds Held for Clients (8.6% of total revenues) jumped 34% year over year to $34.4 million.

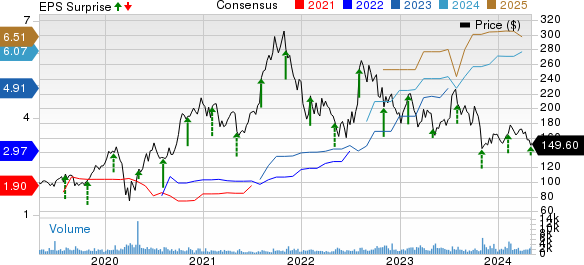

Paylocity Holding Corporation Price, Consensus and EPS Surprise

Paylocity Holding Corporation price-consensus-eps-surprise-chart | Paylocity Holding Corporation Quote

Quarterly Details

Paylocity’s adjusted gross profit was $304.65 million, up 17.9% year over year. The adjusted gross margin remained unchanged year over year at 75.9%.

The non-GAAP operating income rose 25% year over year to $145.9 million. The non-GAAP operating margin expanded 200 basis points (bps) to 36.3%.

Adjusted EBITDA jumped 28.5% from the year-ago quarter to $167.9 million. The adjusted EBITDA margin of 41.8% expanded 340 bps.

Balance Sheet & Other Details

Paylocity exited the fiscal third quarter with cash and cash equivalents of $492.7 million compared with the previous quarter’s $366.9 million. As of Mar 31, 2024, the company had no long-term debt and it had not drawn on its credit facility.

During the reported quarter, PCTY generated an operating cash flow of $304.7 million and a free cash flow of $248.5 million.

Fourth-Quarter and Fiscal 2024 Guidance

For the fourth quarter of fiscal 2024, the company expects revenues in the band of $347.8-$351.8 million, indicating approximately 13% growth from the year-ago period. Adjusted EBITDA is projected in the range of $104.1-$107.1 million.

For fiscal 2024, Paylocity projects revenues between $1.393 billion and $1.397 billion, suggesting approximately 19% growth from the year-ago quarter. Adjusted EBITDA is expected in the band of $489.5-$492.5 million.

Zacks Rank & Stocks to Consider

Currently, Paylocity carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader Computer and Technology sector are Arista Networks ANET, NVIDIA NVDA and Dell Technologies DELL, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Arista Networks have risen 11.6% year to date. ANET is set to report first-quarter 2024 results on May 7.

Shares of NVIDIA have surged 74.5% year to date. NVDA is slated to report first-quarter 2024 results on May 22.

Shares of Dell Technologies have rallied 62.1% year to date. DELL is set to report first-quarter fiscal 2025 results on May 30.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Paylocity Holding Corporation (PCTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance