Payday lending regulation is on the ballot in Nebraska amid sky-high interest rates

An unexpected cash crunch forced Richard Blocker to take out a payday loan in 2014.

To get his epilepsy under control, he needed medication — but the prices had been increased. Even though he was working in the banking industry and had good insurance, the cost was still burdensome.

“I was having trouble keeping up with my meds and paying my other bills,” he recalled in an interview with Yahoo Finance. “So I went to a payday lender thinking, well, it’s just gonna be one quick loan and I’ll get it paid off, and I’ll be good. That’s not what happened.”

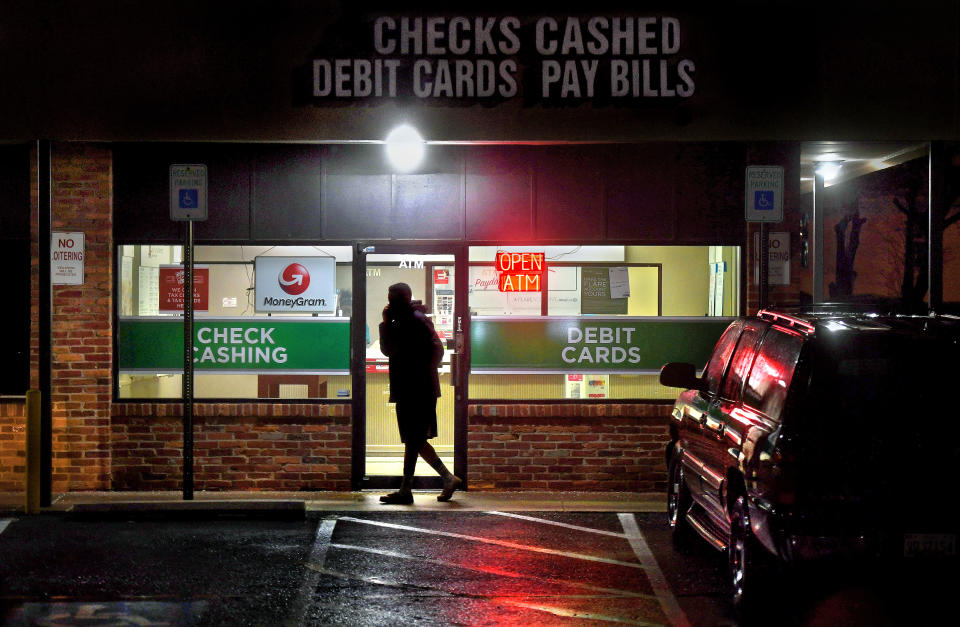

Blocker knew the risks of payday lending, but the bank wasn’t going to give him a small loan to tide him over. So he went to the EZ Money branch in his neighborhood near Omaha, Nebraska, and took out a $500 loan with a $15 fee every two weeks.

Then things began to spiral out of control. Blocker ended up renewing the loan eight times. That $15 fee ballooned to become $600. By the time he got rid of the debt, he had paid the lender back $1,100 at an annual percentage rate of almost 400%.

“I wound up having to pick up a part-time job to get out of that issue,” he recalled, “and to continue to pay for my medication and other bills.”

Nebraska as a microcosm

In Nebraska, payday lending has been legal in Nebraska since 1994. The law didn’t put a cap on rates and fees at that point. Payday lenders can charge more than 400% in interest.

In 2019, according to the state’s Banking and Finance Department, about 50,000 Nebraskans took out 500,000 payday loans. The average loan was $362. The average interest rate was 405%.

“There's about $30 million in fees alone that payday lenders charge and over the course of a year,” Ken Smith, economic justice program director at the Nebraska Appleseed Center for Law in the Public Interest, told Yahoo Finance. “The problem has been very, very clear.”

Smith’s group — along with several others — are pushing for an initiative that hopes to introduce a cap on rates at 36%, which is a “level that many other states in the country have.”

He added that there was a “long string” of attacks that the group had to endure from payday lenders who wanted to prevent the question from appearing on the ballot. One lawsuit said they did not want to be identified as payday lenders, as it may carry a negative connotation. (That has since been resolved.)

The proposal to cap APR at 36% will now appear on the ballot on Election Day.

“This is the same common-sense measure that voters recently approved in South Dakota and Colorado,” said former Consumer Financial Protection Bureau (CFPB) Director Richard Cordray. “We want companies to be able to make small-dollar loans, but they should be loans that help people, not hurt them.”

Jennifer Bellamy, legislative counsel with the American Civil Liberties Union (ACLU), told Yahoo Finance that “if Nebraskans were to vote and support this initiative, this would be a huge step in the right direction.”

The payday lending industry, meanwhile, considers the initiative to be aimed at “eliminating regulated small-dollar credit in the state while doing nothing to meet Nebraskans’ very real financial needs,” stated Ed D’Alessio, executive director of INFiN, a national trade organization which represents the industry.

‘An immoral rate of interest has been around for thousands of years’

Over the years, millions of Americans have gone to payday lenders and ended up in situations where their initial two-week loan rolls over into months and even years.

In some extreme cases, as Yahoo Finance previously reported, researchers uncovered a “debt-to-jail” pipeline involving lenders suing debtors in small claims court and getting them arrested when they don’t show up. ProPublica also uncovered specific cases.

“The question about what is an immoral rate of interest has been around for thousands of years, and is even addressed in the Bible,” Aaron Klein, an economic studies fellow at the nonprofit think tank Brookings, told Yahoo Finance.

In response to predatory lenders, “many state governments have passed interest rate caps, or usury caps,” he added, regardless of their political orientation, such as in South Dakota, or in California. (U.S. lawmakers banned debtors prisons in 1833.)

The CFPB, which is tasked with supervising predatory lenders, has largely been defanged by the Trump administration. The agency had actually moved to protect consumers in 2017, by issuing a rule to condemn the way these lenders made loans without regard for borrowers’ ability to repay. But in July this year, the CFPB rescinded that rule.

That fight is ongoing: On Thursday, Public Citizen and the Center for Responsible Lending sued the CFPB to bring back measures the agency adopted in 2017 to protect American consumers from both payday loans as well as auto-title loans.

With the elections looming, a Biden administration could “restore the CFPB, put back common sense rules, like only lend to people you think have a chance to pay you back,” added Klein.

A 2019 bill proposed by Rhode Island Senator Sheldon Whitehouse and Senate Democratic Whip Dick Durbin called the Protecting Consumers from Unreasonable Credit Rates Act of 2019 would limit rates also to 36%. Others have introduced the Veterans and Consumers Fair Credit Act, which would extend the 36% rate cap protection in place for veterans and their families to all consumers.

‘The rich get richer, and the poor get poorer’

For 43-year-old Nebraskan Phil Davis, a payday loan seemed like the best option when his car broke down and he was short of cash to celebrate Christmas with his family a decade ago.

“They’re just in a strip mall, and you walk in the front door, you go to the desk, and they take a check, write down the information, give you the cash… and you go about your business,” recalled Davis, who works in the restaurant industry.

What Davis didn’t expect was to be stuck with those loans for more than just a two-week period: His initial $500 loan, with its $75 fees due every two weeks, ballooned to more than $5,800 by the time he eventually paid it off three years later with a tax refund.

“It’s the mounting of the fees that really gets to people,” Davis said.

Davis has since become an advocate for the 36% cap, stressing that payday lending practices are perpetuating income inequality.

“I feel like the rich get richer, and the poor get poorer,” Davis said. “It upsets me more now, and to think about how much money I gave to these people… to think of how many other people who are taking that money and don’t have $150 a month.”

And with a reasonable cap on interest rates, he added, the option remained available to those in need of short-term cash while making it “a little easier for people to crawl out of the hole they are in.”

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

New Jersey AG files suit accusing student loan giant Navient of 'unconscionable' practices

'Educational Redlining': New report alleges discrimination against certain student loan borrowers

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance