Paycom (PAYC) Surpasses on Q3 Earnings, Lifts '19 Guidance

Paycom Software’s PAYC third-quarter 2019 non-GAAP earnings per share came in at 70 cents, which surpassed the Zacks Consensus Estimate of 69 cents and also grew 34% year over year.

Further, the company generated revenues of $175 million, surging 31% from the year-earlier period and also outpaced the Zacks Consensus Estimate of $172 million.

Robust new business wins and the company’s high-margin recurring revenue business drove results.

Strong sales growth can be attributed to its employee usage strategy, sales efforts and investments. The first-quarter launch of differentiated product offering, Direct Data Exchange, for all Paycom Software clients is boosting customer additions.

Moreover, the company’s top line received a 31% year-over-year positive impact in recurring revenues, which comprises 98% of the total revenue base.

The better-than-expected earnings coupled with management’s bullish guidance for the full year are expected to buoy investor confidence in the stock.

Notably, shares of Paycom Software have soared 70.8% year to date, substantially outperforming the industry’s growth of 14.5%.

Margins

Adjusted gross profit jumped 33.7% from the year-ago period to $148.6 million. The company’s adjusted gross margin expanded 170 basis points (bps) on a year-over-year basis to 85.3%.

As a percentage of revenues, total adjusted sales and marketing expenses, administrative expenses, and research and development expenses increased 30 bps to 26.7%, 80 bps to 53.9% and 180 bps to 10.3%, respectively.

Paycom Software’s adjusted EBITDA rose 35.3% year over year to $66.6 million. Adjusted EBITDA margin of 38% expanded 110 bps year over year.

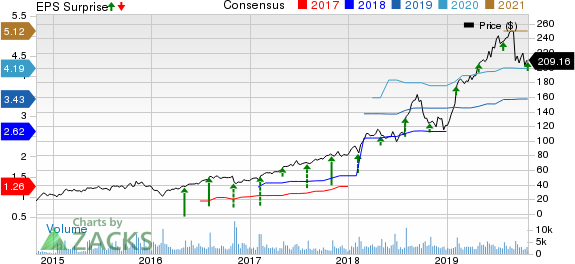

Paycom Software, Inc. Price, Consensus and EPS Surprise

Paycom Software, Inc. price-consensus-eps-surprise-chart | Paycom Software, Inc. Quote

Balance Sheet & Cash Flow

Paycom Software exited the third quarter with cash and cash equivalents of $108.1 million compared with $94.8 million in the sequential quarter.

The company’s balance sheet comprises long-term debt of $33.1 million compared with $33.5 million sequentially.

Net cash provided by operating activities in the nine months ending Sep 30, 2019 was $176.4 million compared with $145.8 million in the year-ago period.

Guidance

For fourth-quarter 2019, Paycom Software expects revenues in the range of $188.5-$190.5 million. The mid-point of $189.5 million is higher than the current Zacks Consensus Estimate of $188.68 million.

Adjusted EBITDA is estimated in the band of $72-$74 million.

Paycom Software raised forecasts for the full year. The company envisions revenues within $733-$735 million, up from $728-$730 million predicted earlier. The mid-point of the guided range implies 30% improvement from the year-ago reported figure. The Zacks Consensus Estimate is pegged at $729.46 million.

Adjusted EBITDA is anticipated in the bracket of $311-$313 million, up from the earlier guidance of $306-$308 million.

The company projects adjusted gross margin within 84-85% compared with 83-85% envisioned earlier.

Zacks Rank and Stocks to Consider

Paycom Software currently carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are Benefitfocus BNFT, Five9, Inc. FIVN and NIC EGOV, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Benefitfocus, Five9 and NIC is currently estimated at 20%, 10% and 18%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIC Inc. (EGOV) : Free Stock Analysis Report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

Five9, Inc. (FIVN) : Free Stock Analysis Report

Benefitfocus, Inc. (BNFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance