Paychex (NASDAQ:PAYX) Posts Q2 Sales In Line With Estimates But Gross Margin Drops

Payroll and human resources software provider, Paychex (NASDAQ:PAYX) reported results in line with analysts' expectations in Q2 CY2024, with revenue up 5.3% year on year to $1.30 billion. It made a non-GAAP profit of $1.12 per share, improving from its profit of $0.97 per share in the same quarter last year.

Is now the time to buy Paychex? Find out in our full research report.

Paychex (PAYX) Q2 CY2024 Highlights:

Revenue: $1.30 billion vs analyst estimates of $1.29 billion (small beat)

EPS (non-GAAP): $1.12 vs analyst estimates of $1.10 (1.8% beat)

Full year guidance calls for 4.8% year-on-year revenue growth (slightly below analyst estimates) and 6.0% year-on-year EPS (non-GAAP) growth (slightly above)

Gross Margin (GAAP): 71%, up from 69.9% in the same quarter last year

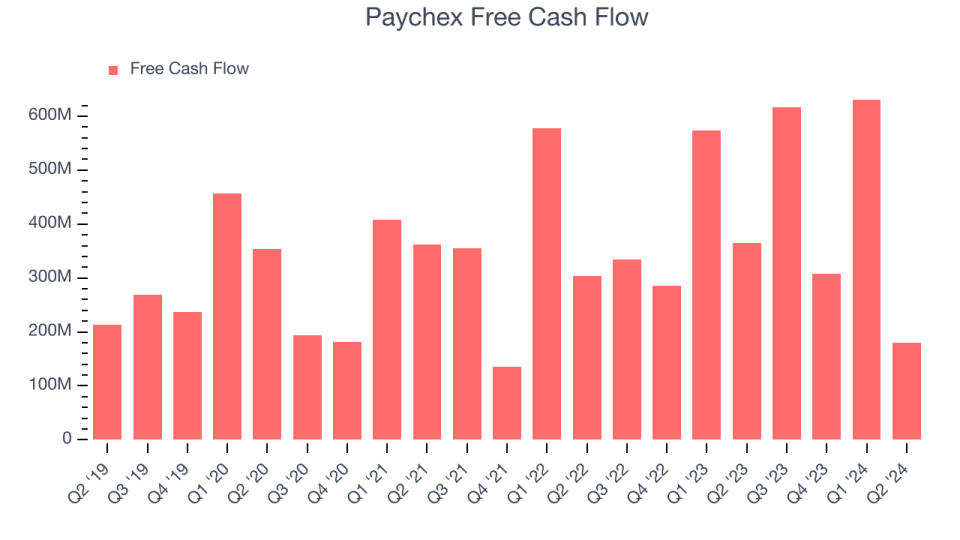

Free Cash Flow of $180.4 million, down 71.4% from the previous quarter

Market Capitalization: $45.01 billion

President and Chief Executive Officer , John Gibson commented, “As we close out the fiscal year, I am pleased to report that Paychex delivered solid financial results, reflecting our ability to navigate changing market conditions by providing innovative HR technology and advisory solutions that deliver value for our clients and their employees and continually finding ways to operate more efficiently as a company. In fiscal 2024, we achieved 5% growth in total revenue, 9% growth in diluted earnings per share and 11% growth in adjusted diluted earnings per share. These results are a testament to the hard work and dedication of our more than 16,000 employees and the investments we have made in our technology and advisory solutions. "

One of the oldest service providers in the industry, Paychex (NASDAQ:PAYX) offers its customers payroll and HR software solutions.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Sales Growth

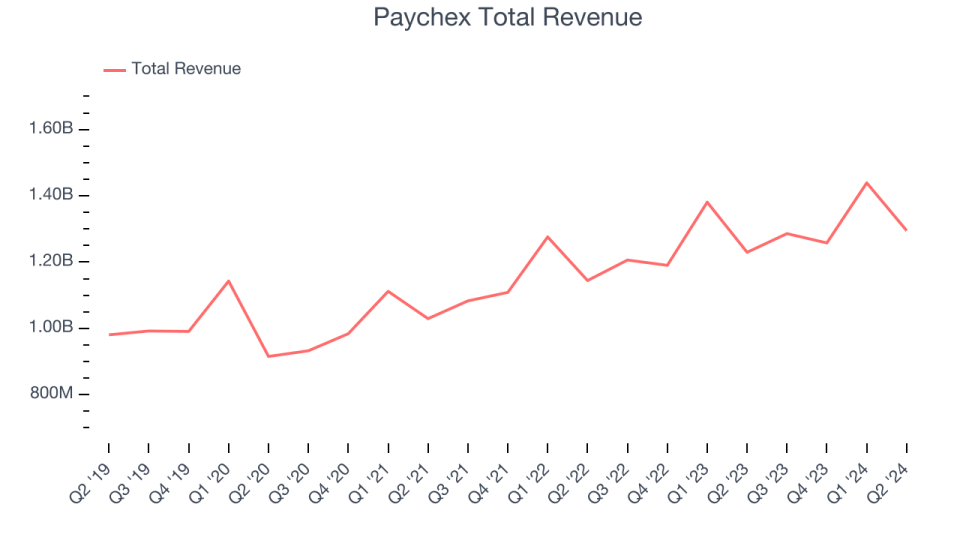

As you can see below, Paychex's revenue growth has been unremarkable over the last three years, growing from $1.03 billion in Q4 2021 to $1.30 billion this quarter.

Paychex's quarterly revenue was only up 5.3% year on year, which might disappoint some shareholders. On top of that, the company's revenue actually decreased by $144.2 million in Q2 compared to the $181.4 million increase in Q1 CY2024. This situation is worth monitoring as Paychex's sales have historically followed a seasonal pattern but management is guiding for a further revenue drop in the next quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Paychex's free cash flow came in at $180.4 million in Q2, down 50.5% year on year.

Paychex has generated $1.74 billion in free cash flow over the last 12 months, an eye-popping 32.9% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Paychex's Q2 Results

Revenue and EPS beat by small amounts. Looking ahead to the full year, revenue guidance was slightly below expectations but EPS guidance was slightly above. Overall, this was a solid quarter for Paychex with no major surprises. The stock traded up 2% to $127.38 immediately following the results.

So should you invest in Paychex right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance