I would pay $1,500 more under the Senate tax plan

The House and Senate have now both introduced tax legislation, which means it’s game-on for tax cuts. The House bill would cut my tax burden by roughly $5,000, according to calculations I made after that plan came out in early November. I’d fare much worse under the Senate plan, which would raise my tax bill by about $1,500.

As I explained in the prior analysis, I’m not a representative taxpayer. I’m a resident of high-income, high-tax New York, so my income and tax bill are both higher than the national median. I use an accountant and claim itemized deductions, since I sometimes have freelance income that can make my taxes a bit complicated. Under the current tax code, I benefit more than most from the state-and-local tax deduction, otherwise known as the SALT provision.

But I’m willing to reveal my tax calculations (while keeping my income private) as an exercise in understanding how major changes to the tax code might affect ordinary people. Under the House plan, I would lose thousands of dollars’ worth of deductions, due to a new limit of $10,000 on state-and-local deductions. But I’d benefit from the elimination of the alternative minimum tax, and from lower overall rates, which is why my total tax bill would go down.

My tax bill under the Senate plan

The Senate plan would leave me with even fewer deductions than the House version, while taxing me at a higher rate. The Senate plan completely eliminates the SALT deduction, which was the single-biggest way of reducing taxable income deduction on my 2016 return. So that would leave me with taxable income that’s considerably higher than under current law, and also higher than it would be under the House plan.

Like the House plan, the Senate legislation would eliminate the alternative minimum tax and all personal exemptions. Both plans would nearly double the standard deduction, to $12,000 for an individual, $18,000 for a head of household and $24,000 for a married couple. The House plan would cap the deductibility of mortgage interest at a total loan value of $500,000, while the Senate plan would leave in place the $1 million limit. I have a mortgage, but it’s less than $500,000, so nothing would change for me.

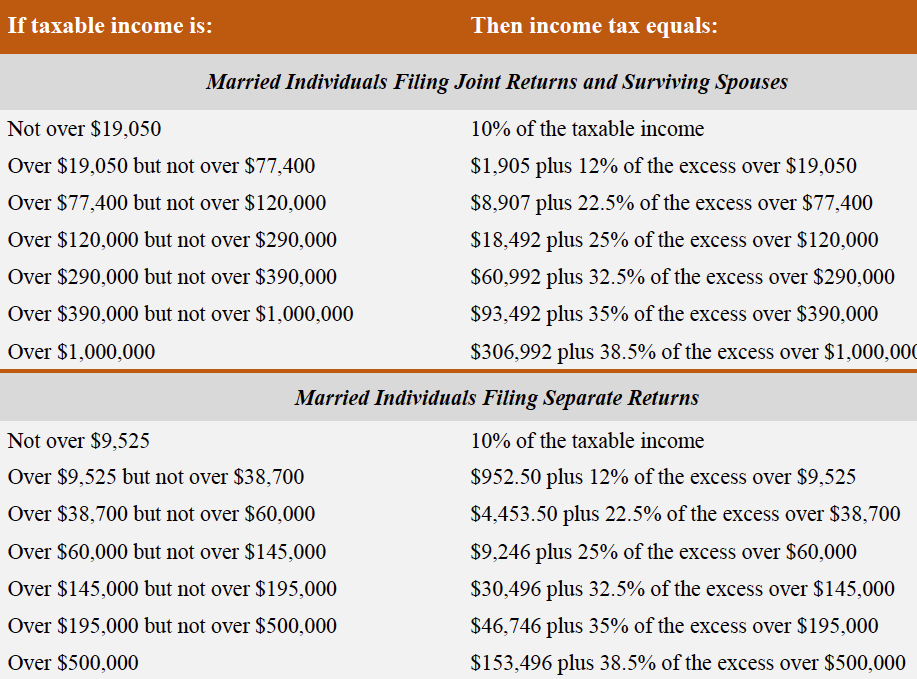

Under the Senate plan, I’d probably choose the new standard deduction instead of itemizing, since my deductions, without the SALT write-off, would be less than the standard deduction. In a way, that would make filing simpler. But my taxable income would be 21% higher under the Senate plan than it was in reality in 2016. I calculated my total tax using these tables published by the Senate Finance Committee, showing the proposed new tax brackets:

Overall, I’d pay $1,552 more under the Senate plan than I paid in reality last year. Compared with the House plan, my tax bill would be about $6,500 higher. I’m just one taxpayer, and I don’t expect Congress to draft legislation specifically with me in mind. But I’m also fairly similar to a lot of professional taxpayers trying to cover college expenses, keep up with mortgage payments and save for retirement. Harming some people to make others better off is risky politics, especially if families end up paying more to finance large tax cuts for businesses. And the centerpiece of the Senate bill, like the House version, is a big cut in the corporate tax rate, from 35% to 20%. Some of the changes on the individual side are meant to offset revenue lost to the lower corporate rate.

Tax legislation could undergo significant change before Congress is ready to pass a final bill. The real-estate industry in particular is strongly opposed to killing the SALT deduction, since it will make itemizing in general less appealing, and reduce the value of the mortgage-interest deduction. That could depress real-estate values and demand for purchased homes. As for me, I’d be happy if Congress did no harm and my taxes stayed the same. That might be too much to hope for.

Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available.

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman

Yahoo Finance

Yahoo Finance