The past year for Vontier (NYSE:VNT) investors has not been profitable

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Vontier Corporation (NYSE:VNT) share price is down 11% in the last year. That falls noticeably short of the market return of around 21%. Because Vontier hasn't been listed for many years, the market is still learning about how the business performs. In the last ninety days we've seen the share price slide 13%.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Vontier

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Vontier share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

With a low yield of 0.3% we doubt that the dividend influences the share price much. Vontier's revenue is actually up 14% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

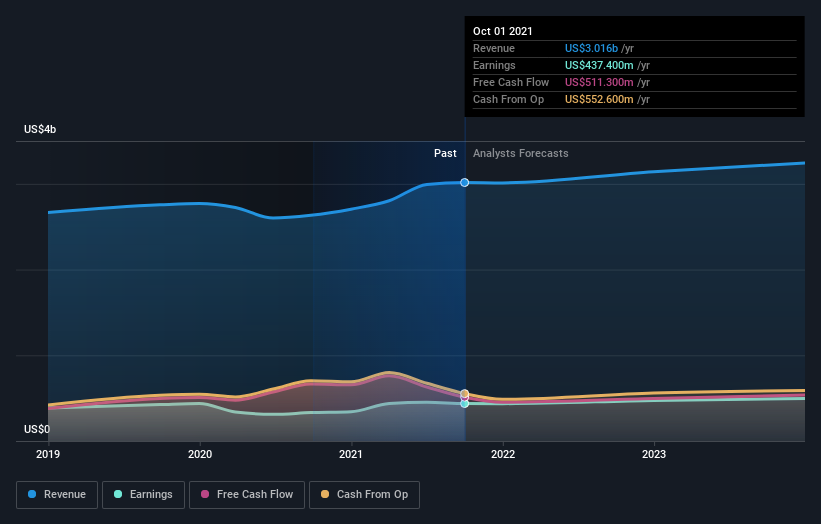

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Vontier has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Vontier in this interactive graph of future profit estimates.

A Different Perspective

While Vontier shareholders are down 10% for the year (even including dividends), the market itself is up 21%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's worth noting that the last three months did the real damage, with a 13% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Vontier that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance