Lawyers go part-time to avoid City jobs bloodbath

As the UK went into Covid lockdown, City law firms slashed salaries and asked staff to drop one day of their working week, a drastic cost-cutting move not seen since the financial crisis.

Today, the reduced working week has returned as overstaffed City firms seek to avoid making sweeping redundancies amid a deep deal-making slump.

Fladgate, a City law firm, last month asked associates in its real estate team to switch to a shorter working week and reduced pay.

As part of the firm’s cost-saving initiative, a group of around 30 lawyers can choose to work four-day weeks starting this month until March, as first reported by legal news website Roll on Friday.

The voluntary scheme is expected to reduce the pressure on the firm as it grapples with a major slowdown in the commercial real estate sector, which has been hit by higher borrowing costs, inflationary pressures and hybrid working.

Daniel Norris, global head of real estate at international law firm Hogan Lovells, says: “It has caused investors to slow down or pause decisions to buy and/or sell; and tenants have thought twice about taking on new leases.”

Large asset managers which previously invested in commercial real estate have instead looked for greater returns elsewhere, including bonds and equities.

Fladgate’s reduced part time week comes as professional services firms that overhired during the post-pandemic flood of M&A deals spent last year cutting costs amid slowing revenue growth and declining profits.

City workers heading back to the office after the Christmas break now face a reckoning with Fiona Czerniawska, chief executive of Source Global Research, a consulting sector research firm, expecting cost cutting to continue into 2024.

“We don’t see any signs at the moment of a sudden change in the market that would mean that they didn’t need to be thinking about profitability,” she says.

The Big Four accountants – EY, Deloitte, PwC and KPMG – all announced hundreds of layoffs across advisory and consulting divisions last year after a sharp drop in attrition rates – the number of people leaving the firm each year – left overstaffed firms facing high expenses.

However, Czerniawska expects accountancy firms will want to avoid further sweeping redundancies in their deals team this year. Drastic layoffs are not only reputationally damaging, but also leave firms without the manpower if deals return sooner than expected.

“Every single time there’s been a downturn – if you go back to the financial crisis and if you think about Covid – the recovery for professional services was just incredibly fast.

“Nobody wants to find themselves without enough staff at the point when the market recovers,” she says.

Czerniawska instead expects professional services firms to adopt temporary measures to save cash, including deferring start dates for graduates and apprenticeships, reducing working hours or quietly managing out underperforming staff who don’t meet billable hours targets.

Advisory firms are more likely to consider more discrete and flexible measures especially as the private equity industry enters 2024 flushed with trillions of pounds in unspent investor cash.

Alex Hamilton-Baily, partner and head of legal and professional services at headhunter Odgers Berndtson, says: “There’s plenty of cautious optimism because of the continuing build up of private capital waiting to be unleashed.

“This surely must lead to increased deal flow at some point, so all sorts of advisory firms aren’t cutting as hard as they might.”

While investors are poised for a rebound in private markets, bankers and money managers are still reeling from last year’s cull, which saw Goldman Sachs, Citi and BlackRock joining the firms which eliminated thousands of jobs from the global financial sector.

While investment firms’ wealth management and commodity divisions more or less took inflationary pressures on the chin, equity financing teams were among the hardest hit by job cuts.

“Share prices, generally speaking, dropped across the board last year, meaning that there was less money to be made in equity markets,” says Tom Andrew, senior manager at professional services recruiter Robert Walters.

More junior investment bankers are now more likely to secure new jobs than their more senior colleagues because of fewer job opportunities and a preference of firms to promote from within.

“If you’re at the early stage of your career, you’ll probably find it easier to get back into the market versus if you have 15 to 20 years of experience,” according to Michael Henning, head of investment at recruiter Mason Blake.

Size matters when it comes to cost-cutting, with commentators arguing that the size of Fladgate, a mid-market firm which employs nearly 200 people including 93 partners, means it lacks the scale of larger full-service competitors that are better hedged against market downturns.

Christopher Clark, director at legal recruiter Definitum Search, says: “Any firm offering a four day week or reduced hours is clearly experiencing some financial pressure.

“You’re not going to offer a reduced working week if everyone is above capacity. If everyone is above capacity, you’d be hiring.”

While some law firms are offering part-time working hours in response to the deal slump, others have reduced hours as means of retaining talent.

Slaughter and May, one of the City’s most conservative law firms, also announced last month that it will permanently allow associates to work reduced hours for lower pay. Associates at the blue-blooded institution, where wearing brown shoes was once frowned upon, can reduce their total working hours by as much as 20pc.

These lawyers continue to work five days per week as usual, but will accrue non-working days in addition to their holiday entitlement which they can take in up to two pre-agreed blocks during the year.

The prestigious firm began trialling the so-called “Switch On/Off” scheme in 2021, along with separate schemes involving associate job sharing and unpaid leave for project-based lawyers that were not taken forward.

The pilots were introduced amid concerns of rising burnout among remote-working junior lawyers who were struggling to cope with soaring workloads fuelled by the post-pandemic M&A boom.

It is understood that Slaughter and May’s reduced hours scheme is not aimed at reducing costs nor launched in response to short term market conditions, even as the M&A specialist is likely to have been hit by the ongoing global deals drought.

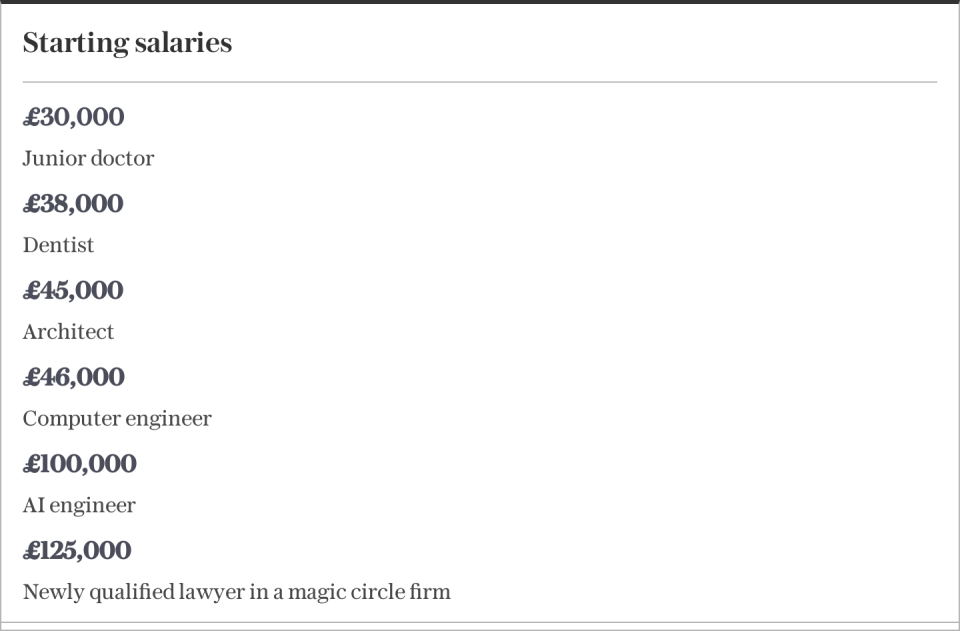

The scheme will instead help distinguish Slaughter and May, which typically expects lawyers to record about 1,800 billable hours each year, against deep-pocketed US rivals, which typically demand longer working hours for much higher six-figure salaries and bonuses.

Jonathan Clarke, Slaughter and May’s chief people officer said at the time: “The new working arrangement provides our lawyers with a different approach, which enables them to develop their careers and deliver value for our clients, whilst simultaneously having the time to pursue other interests and maintain a greater work-life balance.”

However, critics have raised concerns about whether volunteering for such schemes could hamper future career prospects.

One former Slaughter and May lawyer says: “The question most associates will have is, am I marking myself out in a negative way? Am I blotting my copy by going and saying I want to reduce my workload by 20pc?”

The elite firm, founded in 1883, recruits about 95 trainee lawyers each year, according to legal news website Legal Cheek.

However, only a fraction have a chance of eventually joining its partnership. Another former Slaughter and May lawyer says: “I don’t think anyone who signs up to the reduced hours scheme is going to become a partner, which is probably what [Slaughter and May] is not saying.

“They will pretend that it doesn’t affect your career prospects, but it will affect your career prospects because that’s just how these firms are. It’s brutally competitive.”

Fladgate declined to comment. Slaughter and May was approached for comment.

Yahoo Finance

Yahoo Finance