Parsley (PE) Q2 Earnings and Sales Beat on Output Gains

Parsley Energy, Inc. PE reported second-quarter 2019 results on Aug 6, wherein earnings and sales topped the respective Zacks Consensus Estimate.

The company posted adjusted net earnings per share of 32 cents, beating the Zacks Consensus Estimate by a penny. Higher-than-expected production led to the outperformance. Precisely, average output came in at 140.1 thousand barrels of oil equivalent per day (Mboe/d), surpassing the Zacks Consensus Estimate of 131 Mboe/d. However, the bottom line declined from 39 cents per share recorded in second-quarter 2018 amid weaker y/y commodity price realizations.

Parsley’s total revenues in the quarter under review amounted to $498.5 million, increasing from $467.8 million a year ago. Further, the top line surpassed the Zacks Consensus Estimate of $468 million.

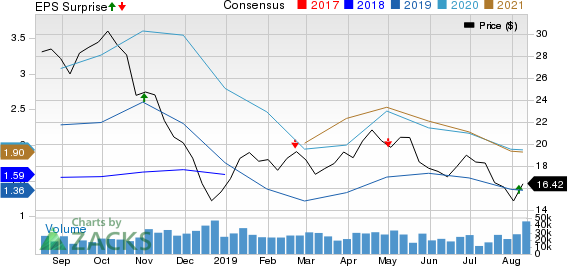

Parsley Energy, Inc. Price, Consensus and EPS Surprise

Parsley Energy, Inc. price-consensus-eps-surprise-chart | Parsley Energy, Inc. Quote

Production Stats and Realized Prices (Excluding Derivatives Impact)

Parsley's average quarterly volume increased 11.6% year over year to 140.1 thousand barrels of oil equivalent per day — comprising 83% liquids — on the back of rising production of oil, natural gas and natural gas liquids (NGLs). In the quarter under review, the company placed 39 gross horizontal wells on production.

Average realized oil price declined 9.4% from the year-ago quarter to $58.23 per barrel and natural gas price realization decreased 99.2% to $0.01 per thousand cubic feet. Realized price for NGLs in the quarter was $14.18 per barrel, lower than the year-ago level of $27.20. Overall, the company fetched $39.01 per barrel compared with $47.48 a year ago.

Total Expenses

Total operating expenses rose to $317.7 million from the year-ago figure of $252.3 million. Lease operating costs rose to $42.7 million in the quarter under review from the year-ago period’s $36 million. Depreciation costs also increased to $198.6 million in second-quarter 2019 from $145.5 million in the corresponding quarter of last year. Transportation, production and restructuring expenses drove total costs in the quarter.

Capex & Balance Sheet

During the quarter under review, capital expenditure totaled $372 million, of which 78% was allotted to drilling and completion activities, and the remaining was spent on facilities and infrastructure.

As of Jun 30, Parsley had cash and cash equivalents of $64 million. Its long-term debt totaled around $2,221.4 million, representing a debt-to-capitalization ratio of 26%.

Guidance

On a positive note, Parsley has tightened capital budget, while increasing its output guidance. The company expects 2019 capital expenditure in the range of $1,400-$1,490 million versus prior forecast of $1,350-$1,550 million. Full-year 2019 lease operating expenses per Boe has been revised from $3.50-$4.50 to $3.40-$3.90. Parsley has also lowered full-year forecast of general and administrative costs per Boe.

Total production is now expected in the band of 134,000-139,000 Boe/d versus prior forecast of 124,000-134,000 Boe/d. Full-year oil production is anticipated in the band of 85-86.5 thousand barrels per day versus earlier estimate of 80-85 thousand barrels. The company expects second-quarter oil output to average 87-90 thousand barrels per day.

Zacks Rank & Key Picks

Parsley currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the energy space include Delek Logistics Partners, L.P. DKL, BP Midstream Partners LP BPMP and TC PipeLines, LP TCP, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delek Logistics Partners, L.P. (DKL) : Free Stock Analysis Report

TC PipeLines, LP (TCP) : Free Stock Analysis Report

Parsley Energy, Inc. (PE) : Free Stock Analysis Report

BP Midstream Partners LP (BPMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance